A recent tweet from Fred Harrison caught my attention the other day:

|

|

| Source: Twitter |

Fred Harrison is a British economist — famous for bringing knowledge of the 18-year property cycle to the fore through his many publications.

He predicted the crash of 2008 with this knowledge…in 1997! That was 11 years before it happened.

Fred also predicted the recession of 1991 — eight years before it happened.

His track record for forecasting cycles is remarkable.

More so is his ability to highlight the cause, and therefore the ultimate cure to the boom/bust real estate cycle.

It’s this information you need to master if you really want to take advantage of the knowledge we share in Cycles, Trends & Forecasts. (You can listen to a recent interview I conducted with Fred here.)

Fred’s tweet sums up an underlying truth behind the COVID-panic rhetoric.

Governments are not concerned with the health of their citizens.

We’d live in a very different economic system if they were.

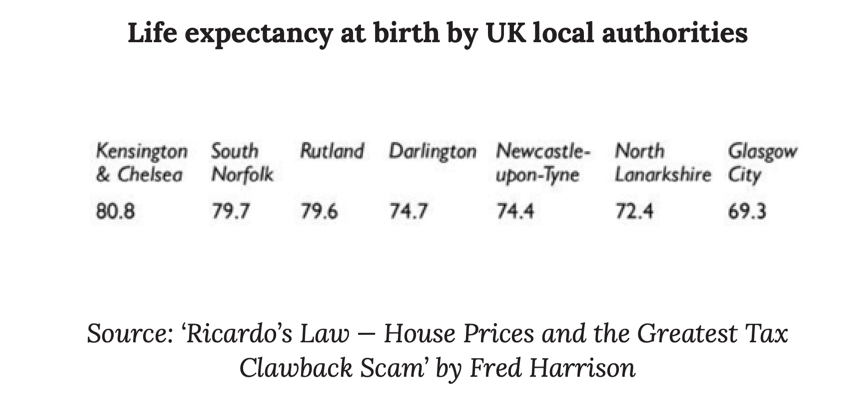

As Fred shows in his book, those that monopolise the best locations secure the difference between a long, healthy life or early death.

In other words, the price gap between rich and poor locations determines the length of a person’s lifespan.

‘People who live in the locations of deprivation are systematically deprived of up to 20 years of life on earth.

‘The deaths can be predicted with precision, because they conform to an economic process that has divided the nation for centuries (Harrison 2006a, 2015).’

Harrison shows that if you live in London, for example, surrounded by the best amenities, with housing equity some four times that of the UK’s northern regions, you can expect to live an average of 80 years.

The further away from London you progress, however, into the poorer northern regions, the worse your chances of a long, healthy life become.

|

|

Similar studies are evidenced by Michael Marmot (president of the World Medical Association).

‘I had been studying health inequalities in Baltimore.

‘In the poor part life expectancy for men was 63 years.

‘In the richest part it was 83 years.

‘A twenty-year gap in one city.

‘If you live in the richest part of Baltimore and want to see what it is like to live in a place with male life expectancy 63, you could fly to Ethiopia…or you could travel just a few miles.

‘Life expectancy for men in the poorest part of Baltimore is the same as Ethiopia, two years shorter than the Indian average.’

Under our current regime, speculators are encouraged to purchase the best locations for tomorrow’s capital gains.

Rents and company profits are used to service the debt rather than expand business and enterprise.

‘Once upon a time, tenants paid rent for the use of land to landlords. Today, the bulk of those rents are disguised as interest and paid to the financial sector to fund mortgages.’

Fred Harrison

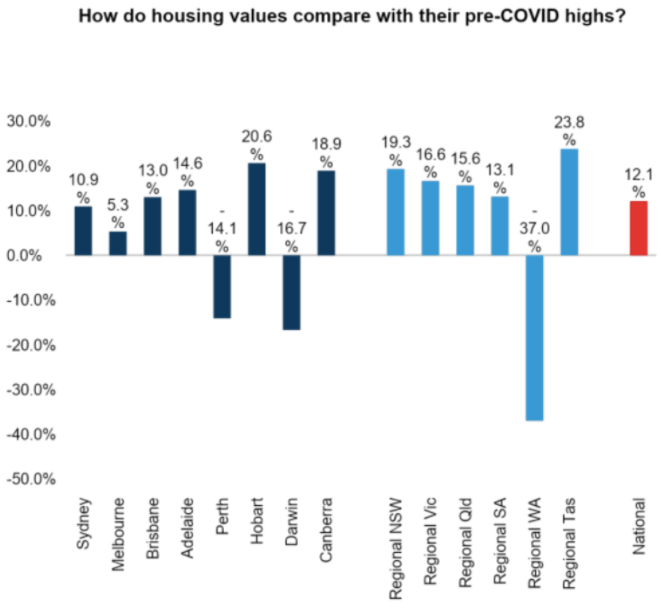

No surprise then that according to the latest CoreLogic data, 10 of 14 property markets across the country have experienced double-digit price growth throughout the pandemic.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Land values nationally have increased by a whopping 12.1%. Soaring above their pre-COVID peaks.

|

|

| Source: CoreLogic |

That’s all whilst wage growth sits at the lowest on records going back to the late 1990s.

No doubt, land monopolists are the winners of this pandemic.

It’s why we have a property cycle.

One that booms, and will eventually bust.

The higher property prices go, the more buyers need to borrow.

The more buyers borrow, the more bank-created credit is lent into existence against land — encouraging vendors to hold out for ever-increasing returns.

The result erodes the productive sectors of the economy.

The trends we see today of double-digit price growth cannot be sustained long term.

In a few years, what happened to property prices in the US and Europe in 2008, will happen here.

You need to understand this if you want to protect both your health and wealth.

Until then, money will continue to flow into the property sector.

Most real estate markets will continue to benefit, but Sydney investors should heed a warning.

Last week, the NSW government’s economic outlook forecast Sydney’s annual house price growth ‘to peak around late-2021.’

I don’t usually pay much attention to these publications, but this statement isn’t too far away from reality.

Sydney has commonly reached its peak ahead of other cities.

It did so in 2004, for example — whilst the peak in other areas pushed into early 2008 (just before the GFC).

Investors should target other states and territories if they want to advantage from continued price growth.

Sincerely,

|

Catherine Cashmore,

For The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.