In today’s Money Morning…even the kitchen sink…regulators prepare for next bull run…will you miss out?…and more…

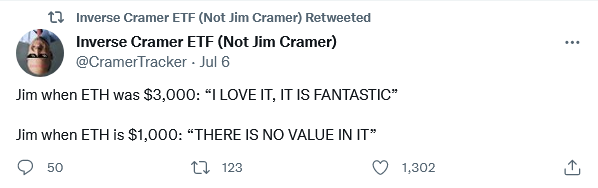

I came across a funny Twitter profile the other day…

It’s called the Inverse Cramer ETF (Not Jim Cramer).

In case you don’t know, Jim Cramer is the very popular, long-time host of CNBC’s Mad Money show.

On the segment, he basically ‘shoots from the hip’ on what’s happening in stocks and markets.

He can get quite emotional and is very entertaining.

But what the enterprising soul who started up the Inverse Jim Cramer ETF realised was that he got an awful lot of calls wrong too.

So he started tracking them and creating a pretend ETF of all Jim’s predictions, but doing the opposite!

Here’s a good example:

|

|

|

Source: Twitter |

The author claims — and I’ve not checked this — that the Inverse Cramer ETF is significantly beating the market this year, writing on their website:

‘If you’ve been inversing Jimmy, congratulations on a spectacular month and year.

‘You are significantly beating the market!’

Look, it wouldn’t surprise me if it were true.

The unspoken truth about financial media is that it’s all about eyeballs, not about ‘being right’ per se.

And, of course, ‘being right’ consistently in investment markets is a very hard thing to do.

I make plenty of bad calls myself!

But there’s a subtle difference between how we think about a given subject and how the mainstream does.

The mainstream makes money by stating the obvious and not going too far outside the accepted wisdom.

It’s a comfortable space for investors to live.

But as Jim Cramer’s performance suggests, probably not that profitable!

The truth of the matter is, if you want to give yourself an edge in investment markets, you have to think the opposite of what others are thinking.

Or explore places no one is thinking about at all!

That’s our niche in the investing industry.

So with that said, here’s one sector I think represents a huge contrarian opportunity for you right now.

If you’ve the courage to go against the grain…

Even the kitchen sink

You’ve just seen what a good, old-fashioned ‘bank run’ looks like in the digital asset world.

US$2 trillion vaporised from the crypto system in six months. For many of the 19,000 altcoins…an utter bloodbath.

Some say this is the end for crypto…

Including our friend Jim.

Here’s what he has to say about cryptocurrencies like Ethereum [ETH] right now:

|

|

|

Source: Twitter |

I just noticed Ethereum popped 30% higher since Cramer said this!

But do you see how the mainstream operates?

When there’s a bull market, they jump aboard. Then when things crash, they pile on the fear.

They’re taking the easy route by appealing to your immediate emotional responses. They’re certainly not getting you to challenge your thinking.

And Cramer’s not alone in this regard when it comes specifically to crypto.

Nearly every day for the past few months, I’ve been reading stories from mainstream outlets about how ‘bad’ crypto is and how bad it’s going to do in the future.

Meanwhile, quietly in the background, big players are hoovering up quality crypto assets (not the dodgy stuff) on the sly.

As reported in DeCrypt:

‘Earlier this week, blockchain analytics Glassnode also said that whales are adding to their balance aggressively, acquiring 140,000 Bitcoin per month directly from exchanges.

‘Currently, whales own as much as 8.69 million BTC, or 45.6% of Bitcoin’s total supply of 21 million, according to Glassnode.’

It was also revealed in the first week of July that the world’s richest Bitcoin [BTC] wallet…a ‘giga-whale’…is now officially on a ‘massive shopping spree’.

Splurging more than US$102 million so far.

That’s a lot of money to risk if you thought it had even a snowball’s chance in hell of ‘going to zero’, as the critics claim.

So why are these big hands so confident in the face of all this negativity?

Well, they’re probably seeing the same subtle shifts I’m seeing…

Regulators prepare for next bull run

As I wrote to subscribers of my new Crypto Capital project on Thursday:

‘It appears those “crypto bros” over at the Bank of International Settlements (BIS) didn’t get the memo about bitcoin being “dead”.

‘Despite its public scepticism on cryptocurrencies, the BIS Basel Committee on Banking Supervision quietly issued a very interesting proposal.

‘In it they recommended that banks be allowed to hold up to 1% of their total reserves in cryptocurrencies such as bitcoin.

‘The document stated:

“Banks’ exposures to Group 2 cryptoassets will be subject to an exposure limit. Banks must apply the exposure limit to their aggregate exposures to Group 2 cryptoassets, including both direct holdings (cash and derivatives) and indirect holding (i.e. those via investment funds, ETF/ETN, special purpose vehicles).”

‘Make no mistake, this is a very big deal.

‘While the 1% limit is still fairly strict, the fact they’re moving in this direction at all is a huge sign of progress.

‘The BIS is a global supervisory body for central banks — so a sort of bank for central banks — which means this proposal has global implications.

‘And they weren’t the only committee subtly shifting their stance on bitcoin…

‘There was also this new report issued by The Federal Reserve Bank of Cleveland recently:

|

|

|

Source: Cleveland Fed |

‘The paper discusses how the Lightning Network is turning bitcoin into a more viable currency.

‘Here’s a good one-liner from the mostly technical paper:

“If the scalability problem can be successfully addressed, it may be possible for a currency based on a permissionless blockchain to obtain wide acceptance.”

‘Haters, be in disbelief!’

It’s certainly a lot of time and administrative effort for bureaucrats to waste on a ‘dead’ asset class…

Will you miss out?

Big hands buying…

Regulators subtly changing their tone…

Mainstream screeching at you to sell…

To me, that’s a very interesting combination of factors in play.

At the very least, I think it should pique your interest; especially if like me you’re a contrarian investor interested in potential exponential opportunities.

If you are, look out as I’ll have more to say on this over the coming week or two…

Good investing,

|

Ryan Dinse,

Editor, Money Morning