The Bitcoin [BTC] price hit new all-time highs across the world last week.

And no, I’m not talking just about developing nations here.

New highs were seen in the major currencies of the UK, Japan, South Korea, Norway, China, and India.

A new high of AU$98,000 was also seen here in Australia.

Anyone in any of these countries who bought Bitcoin at any time in its 15-year history is likely sitting in profit right now.

But before the sceptics’ cry ‘bubble’ check out this data point:

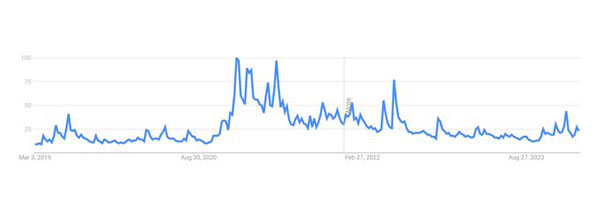

| |

| Source: Google Trends |

This is a chart of Google searches for the word ‘Bitcoin.’

As you can see, general interest in Bitcoin is barely above bear market levels, never mind the lofty highs of previous bull runs.

Nope, we’re nowhere near the irrational exuberance stage. In my opinion this trend has a lot further to run.

As I wrote to members of my Crypto Capital service on Thursday:

‘New all-time highs in US dollar terms — the last fiat standing — look inevitable any day now to me.

‘And then the FOMO (fear of missing out) party really begins!’

And yet I can all but guarantee the mainstream financial media will continue ignoring or attacking Bitcoin, even while the price soars ever higher.

Why do they hate it so much?

Well, as Upton Sinclair, the famous American novelist of the early 20th century once remarked:

‘It is difficult to get a man to understand something when his salary depends on his not understanding it.’

Most mainstream economists, analysts, and finance types are simply defending their own self-interest.

They’ve a big stake in the current fiat system, which Bitcoin threatens.

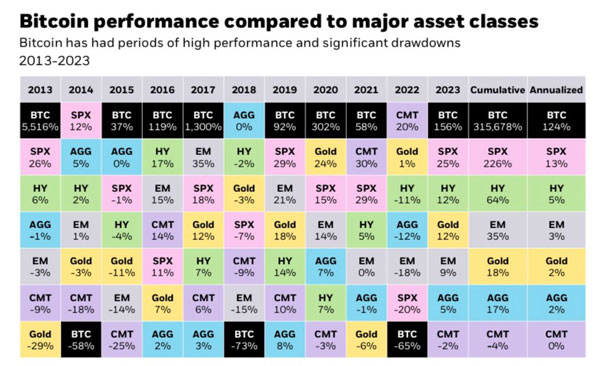

And if you listened to them, you’ve missed out on investing in one of the world’s best-performing asset over 1, 3, 5 and 10 years:

| |

| Source: x.com |

But here’s the thing…

This ‘incentive’ situation for Wall Street has changed in recent months.

For the first time in Bitcoin’s history, a growing bunch of powerful companies in mainstream finance are now ‘incentivised’ to understand Bitcoin.

Funnily enough, now they’re actively promoting it!

If history repeats, we’re about to see things get very interesting.

Let me explain…

Bitcoin claims its first victim

By now, you probably know that Bitcoin spot ETFs (exchange traded funds) went live on the 10th January.

Blackrock, Fidelity, and a host of other traditional money managers can now offer Bitcoin exposure to their clients.

And, more importantly (for them!), share in any upside gains.

What you mightn’t be aware of, is just how successful they’ve been so far.

Demand for the new Bitcoin investment vehicles has been off the chart.

As Bloomberg noted last week:

‘This is a wild stat: there were more individual trades yesterday in the bitcoin ETFs than there were in $SPY or $QQQ. And this is before they have options and/or are available on many advisory platforms.’

The SPY is an ETF that tracks the S&P 500 (the 500 largest stocks in the US), and the QQQ is an ETF that does the same for the technology-focused Nasdaq exchange.

Basically, the two biggest markets in the world.

And yet, here’s a single-asset ETF selling ‘magical internet money’ with more trading volume.

This demand has fed into the price, with Bitcoin making its largest one-month gain (+44%) on record in February:

| |

| Source: Trading View |

You can bet the bigwigs on Wall Street — even the sceptical ones — have started taking notice.

In fact, we know they are.

Exhibit ‘A’ comes from Morgan Stanley.

The firm has just fast-tracked a new fund to allow its investors some access to Bitcoin ETFs.

| |

| Source: X.com |

Direct access to the Bitcoin ETFs is rumoured to be coming soon.

As Kitco reported:

‘If Morgan Stanley is considering offering its clients access to spot BTC ETFs, other firms are likely doing so as well, and it may only be a matter of time until Wall Street initiates the next leg up in this bull market.

‘According to X user Andrew, founder of x3, along with Morgan Stanley, UBS is also considering moving up their timeline to list the products after receiving multiple inquiries from clients.’

Remember, as I said at the start, all these big banks have spent the best part of a decade attacking Bitcoin.

But now, one by one, they’re changing their tune.

And as Exhibit ‘B’ will show you, it’s fast becoming a major career risk to NOT back Bitcoin.

Get this…

The CEO of giant asset manager Vanguard unexpectedly resigned last week.

The firm had famously decided not to offer Bitcoin ETFs on their platform, which manages US$8.6 trillion.

As recently as 20thJanuary Vanguard was defending its decision, saying:

‘We won’t lose a single 401k (superannuation) plan over it.’

Fast forward one month, Bitcoin is up by 50%, and a loyal, 33-year CEO in the prime of his career has stepped down out of the blue.

It doesn’t take a genius to work out what’s happened here.

And the proof of that will be how fast Vanguard’s new CEO changes tack on Bitcoin.

Let’s see…

But my point is, the main incentive structure that drives Wall Street — profit — has just done a complete 180.

And now the race is on to accumulate Bitcoin as fast as possible.

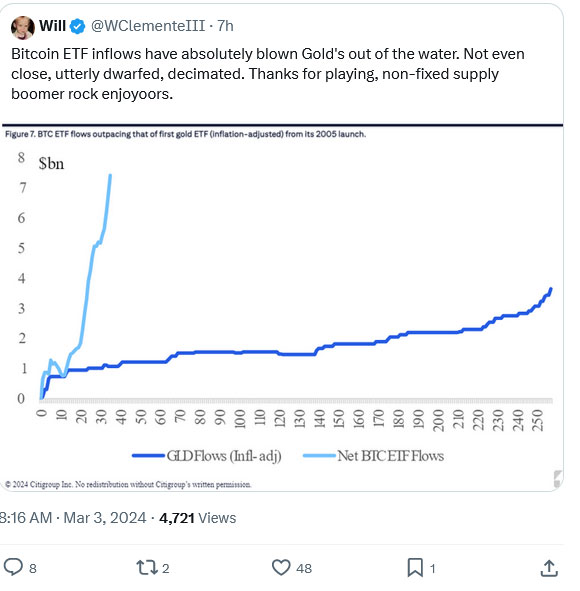

With that in mind, let’s finish with one last chart…

Insane Chart shows Strength of Demand

To get a feel of how insane demand for these new Bitcoin ETFs has been let’s compare it to the last big ‘hard money’ ETF launch.

In 2004, Gold ETFs launched for the first time.

It was an easy way for investors to add gold exposure to their portfolios.

This is what happened next:

| |

| Source: Trading View |

The gold price shot up 400% over a six-year bull run after ETFs launched in late 2004.

With that in mind, here’s how inflows into the Bitcoin ETFs compare to gold so far:

| |

| Source: x.com |

Interesting, no?

Make of this information what you will.

On slightly tangiential…but not unrelated…note.

There’s another pump in demand brewing. For Artificial Intelligence stocks. This from the Motley Fool yesterday…

| |

How much of this is unadulterated hype?

How much is genuine?

And what stocks should you consider?

We have our our Fat Tail Daily take on the matter coming next week.

It’s called Lock. Build. Explode.

If you’re interested in getting into AI stocks…but not the obvious ones…then make sure you read Fat Tail Daily over the next 14 days or so.

We’re going to give you our approach to AI investing, which centers on five specific stocks.

Keep reading over the coming days, you’ll get a lot out of it…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments