Vulcan Energy Resources Ltd’s [ASX:VUL] share price is surging 5.5% today after the lithium stock received a new exploration licence in the Upper Rhine Valley for three years.

VUL shares were up as much as 6.3% in early trade, exchanging hands for $8.73 at time of writing.

While trading largely sideways for the last month, the lithium explorer is still sitting on year to date gains of 215%.

Three Ways to Invest in the Renewable Energy Boom

Vulcan secures exploration licence

Investors are bidding up VUL shares today after the lithium explorer was granted a new exploration licence for geothermal energy, geothermal heat, brine, and lithium in the Upper Rhine Valley.

The licence runs for three years and covers 108 km2 of a region Vulcan considers ‘prospective’ for geothermal and lithium brine.

Vulcan has frequently stated that its Upper Rhine Valley geothermal and lithium brine resource is Europe’s largest lithium resource.

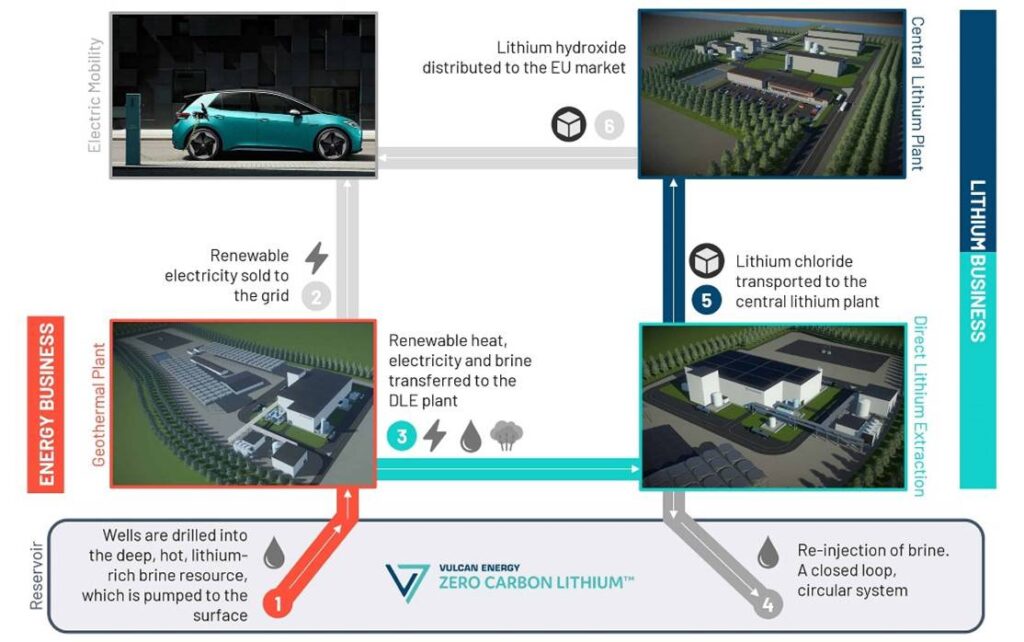

VUL’s lithium project in the Upper Rhine Valley — dubbed the Zero Carbon Lithium Project — uses renewable heat derived from geothermal brine to drive the lithium extraction process.

The explorer says this will involve no fossil fuel consumption.

What did VUL management have to say?

Commenting on today’s announcement, Vulcan Managing Director Dr Francis Wedin said:

‘The unique experience of the GeoT team, now part of Vulcan, has been instrumental in identifying areas such as this which are prospective for geothermal lithium mineralisation in the Upper Rhine Valley.

‘The newly granted exploration license will form part of our plans to grow our unique Zero Carbon Lithium™ Project, driven by high customer demand and an increasingly widely-held industry view that combined geothermal energy and sustainable lithium projects will be the preferred choice of lithium chemicals supply for the automotive industry in the years to come, due to their unique ability to produce lithium with no fossil fuels and net zero greenhouse gas emissions.’

VUL Share Price ASX outlook

Given today’s announcement, what are Vulcan’s next steps?

Well, Vulcan’s geological team will now review existing data over the area under licence, seeking a resource definition and addition to VUL’s total Mineral Resource of 15.85Mt LCE @ 181 mg/l Li.

However, today’s announcement did not pin down a date for the upcoming resource definition of its Upper Rhine Valley mineral resource.

What could today’s share price spike mean for Vulcan?

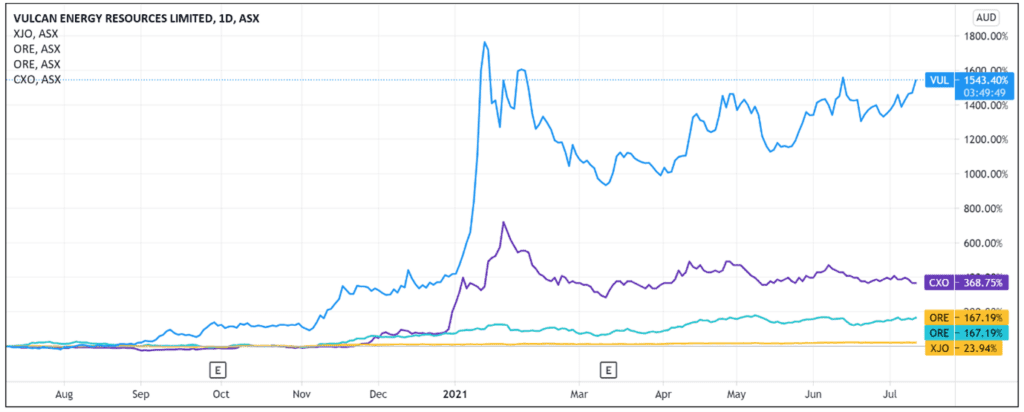

For one of the best-performing stocks — lithium or otherwise — on the ASX over the past year, Vulcan’s last few months have been marked by largely sideways price action.

Having gained more than 1,500% in the last 12 months, the lithium stock is slightly down 1% over the last month.

It is also trading 38% down from its 52-week peak.

The deceleration of VUL’s share price trajectory may be attributed to Vulcan’s meteoric rise that saw its shares jump from 21 cents in February 2020 to more than $9 in February 2021.

That’s a substantial rerating in the span of 12 months.

And could suggest that plenty of the market’s expectations for VUL are already priced in, limiting how much the stock could rise in the short term.

Today’s neat 5% gain could have something to do with Vulcan stating in today’s release that its pursuit of the new licence reflects ‘increasing customer demand.’

This may imply a potentially stronger market for VUL’s product than previously anticipated by investors.

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend reading Money Morning’s free 2021 lithium report.

If you’re keen for more reading, this report on energy disruption is also a great resource. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report