The Vulcan Energy Resources Ltd [ASX:VUL] share price is rising after successful production of its first battery-quality lithium hydroxide monohydrate (LHM) from pilot operations.

VUL share price are currently trading at $13.54 apiece, an increase of 1.7%.

VUL’s 12-month chart highlights Vulcan’s significant rerating as the ASX sees a resurgence in the lithium sector.

In the last 12 months, the VUL share price has gained over 1,050%. The stock was trading for as low as $1.22 in September 2020.

Vulcan announces first battery-quality lithium hydroxide production

Vulcan Energy was happy to report today that its chemical engineering team successfully produced its first battery-quality lithium hydroxide monohydrate (LHM) from piloting operations.

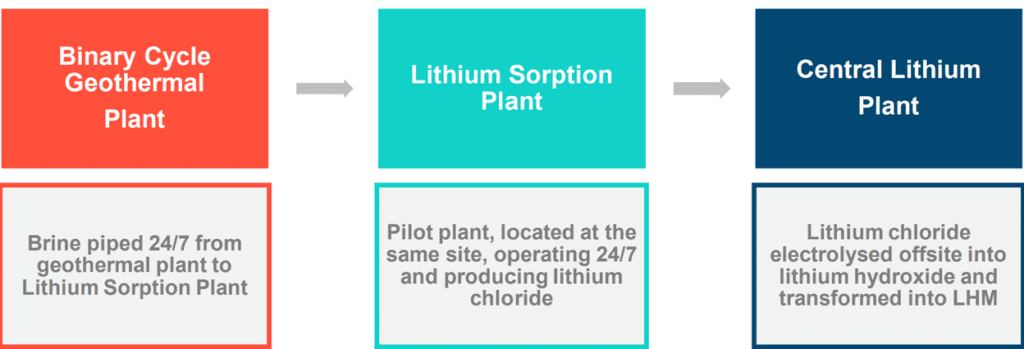

The LHM was produced from Vulcan’s sorption pilot plant in the Upper Rhine Valley, with downstream electrolysis processing offsite.

At >56.5% LiOH.H2O with ‘very low impurities’, VUL said the sample exceeded traditional battery-grade LHM product.

Vulcan added the sample exceeded even the best on the market battery-grade specifications required from offtake customers.

Data generated during the sample production will inform Vulcan’s ongoing Definitive Feasibility Study.

That DFS is currently being conducted by Hatch and Vulcan’s engineering teams.

The process consisted of three main stages.

Future production of battery-quality material will continue to ramp up to supply Vulcan’s offtake partners with samples.

Vulcan Managing Director Dr Francis Wedin commented:

‘I would like to congratulate our chemical engineering and chemistry teams on this important milestone as we develop the Zero Carbon Lithium Project.

‘We will continue to methodically progress, de-risk and execute on our plan to build a fully integrated renewable energy and battery-quality lithium chemicals project in Europe to service the battery and electric vehicle industry.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

What’s the outlook for VUL share price?

The lack of movement in VUL’s shares suggests the market has already factored news of the sort announced today into the share price.

Unsurprisingly, of course.

A stock doesn’t gain over 1,000% in 12 months without absorbing plenty of market expectations.

In a way, it shows investors are buying Vulcan’s ambitions and goals for the Zero Carbon Lithium Project in Germany.

Today’s news wasn’t a happy surprise but a confirmation of what the market has already priced in.

From a business operations standpoint, the successful production of VUL’s first battery-quality lithium hydroxide is an important milestone.

Vulcan’s pilot has been operating successfully since April 2021, using brine from a geothermal plant.

The pilot plant will be progressively scaled up in size during the coming year.

Moreover, VUL is targeting Phase 1 commercial production for CY2024.

Managing Director Dr Francis Wedin also said:

‘The team is working towards what is likely to be the first raw materials project with net zero greenhouse gas emissions in the world; an important statement of what can be achieved with the right scientific approach at this critical juncture of global climate change leading toward COP26.’

Vulcan also recently raised $200 million via an underwritten share placement.

The lithium stock looks like it has the funds to carry out its zero-carbon ambition.

Now, if you are interested in more stocks that have the potential to dominate the lithium sector, I suggest checking out this report.

The report takes you through the resurging Australian lithium industry as well three lithium stocks with exciting potential.

Governments and private interests alike are converging on electric vehicles and renewable energy.

So if you’re wondering exactly what this trend means for savvy private investors, I also recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you could capitalise on the US$95 trillion renewable energy boom.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here