The share price of Vection Technologies Ltd [ASX:VR1] is up again today after announcing a move into healthcare.

The VR1 share price is up 22%, trading at 8.3 cents.

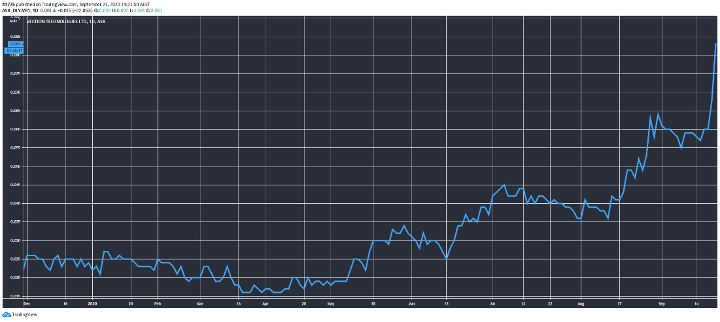

You can see the VR1 share price lighting up the charts after a long period of sideways trading prior to May:

Source: Tradingview.com

Here’s a quick look at their latest announcement.

Four Innovative Aussie Stocks that Could Shoot Up Further after Lockdown

VR/AR in Italian hospitals? The opportunity could be bigger than you think

Here’s a quick summary of VR1’s move into healthcare:

- Deal is with AORN SG Moscati hospital and the Libera Università Internazionale degli Studi Sociali Guido Carli (LUISS)

- Brings VR1’s Augmented Reality (AR) system to bear on endoscopic equipment and is integrated with electronic medical records

- Three-month trial

It’s certainly a futuristic idea.

In layman’s terms, you put on the AR goggles and you can see inside the human body and access health records at the same time.

And Italy has around 1,000 hospitals, so a significant addressable market.

The company said they cannot determine the amount of revenue to be derived from the deal but expect it to be material.

Outlook for VR1 share price

In an ideal world, you get in before a breakout.

That being said, I’ve noticed over the last few months an immense appetite for innovative small-caps on the ASX.

This while the market moves sideways, or edges down.

As such, the outlook for the VR1 share price is largely positive.

It’s a good environment out there for small-caps and the strong upwards momentum could be enough to keep it moving forward, even if there is limited positive news flow.

The company also announced $2.6 million in funding from Invitalia and a $1.1 million credit facility prior to today’s announcement.

This would bring the total cash available to around $3–4 million.

A bit light, given the current market cap after the rise in the VR1 share price.

It will be interesting to see whether VR1 goes for a capital raise in the next two quarters and on what terms.

They were cash flow positive last financial year — so there is potential for growth — it’s more a matter of how fast.

Regards,

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.