The share price of 3D software company Vection Technologies Ltd [ASX:VR1] is up big today, with news it will join Facebook in its push to advance VR.

VR1 specialises in virtual and augmented reality solutions.

And as working from home now looks to be a permanent fixture for many, VR1’s products could be seeing an increase in demand.

Just last week VR1 received $6 million from a share placement open exclusively to sophisticated investors.

Which included the Italian government.

At the time of writing, the VR1 share price is up 34.62%, or 4.5 cents, to trade at 17.5 cents per share.

Source: Tradingview.com

Growth promised, growth delivered

In last week’s capital raising, Vection’s Managing Director Gianmarco Biagi said:

‘The placement represents a strong platform to pursue Vection Technologies’ global growth strategy, aligned with the 6-months objectives.’

It didn’t take long for VR1 to get stuck in.

Today, the company announced it would join the Facebook Independent Software Vendors (ISV) program to accelerate customer adoption of VR solutions built for Oculus enterprise products.

The Oculus is Facebook’s VR headset technology.

Though VR headsets are usually associated with video games, Facebook also markets the Oculus as an enterprise tool.

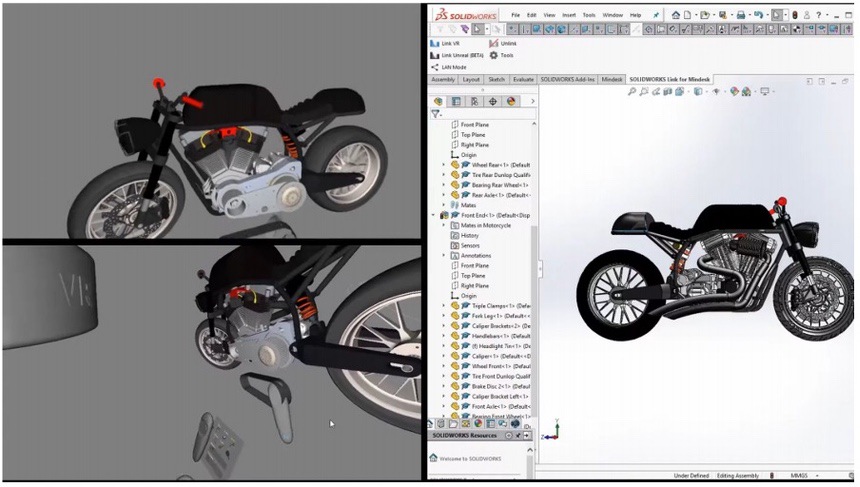

VR1’s software, Mindesk 2020.3, essentially allows users to collaborate on 3D designs virtually through the Oculus headset.

For example, Mindesk would allow a team of engineers based across different geographies to collaboratively work on the same 3D design for a new motorcycle.

Source: Vection Technologies

Pretty cool.

As part of admission into the program, Facebook will provide VR1 with a host of resources that will help develop and market its technology.

Speaking on the partnership, VR1 director Gabriele Sorrento said:

‘After following the developments of Facebook Business platform since its announcement during Oculus Connect 6 in 2019, we can finally certify its full maturity. This technical and commercial platform is ready to support Vection’s enterprise solution growth.’

What impacts will this have on VR1 financially?

VR1 said that the financial impact of the Facebook Oculus ISV program is not determinable at this time.

Although they anticipate this announcement to have a material effect on the company.

Mr Biagi seems confident the partnership will strengthen the company’s annual recurring revenue — a key financial metric used by software-as-a-service companies.

‘…Vection Technologies has established a long-term strategy to support its continued Year on Year growth during FY21, with strong initiatives to pursue long-term revenue generation, aligned with its commitment to reach 50% ARR by June 2022, coming to fruition during the second half of the current financial year.’

However, be mindful that VR1 is very much so a start-up company, generating just $3.1 million in revenues FY20.

Not great for a company with a market cap of ~$110 million.

If you’re looking for an innovative small-cap play, then check out these four Aussie stocks that are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Regards,

Lachlann Tierney,

For Money Morning

Comments