In today’s Money Morning…known knowns: we have effective vaccines…known unknowns: virus variants will emerge…unknown unknowns: social factors of ‘new money’…and more…

Follow The Money Morning Podcast on Spotify here and on Apple Podcasts here.

In today’s episode of The Money Morning Podcast I speak with Paul Hyslop of Zoono Group Ltd [ASX:ZNO] about their COVID-19-killing products, and the big partnerships they’ve struck up with major companies at home and abroad.

With two major vaccines threatening to go the way of the scrap heap due to blood clot concerns, various doom mongers would be licking their lips at the prospect of being right about the sky falling.

I’ll push back against that today and also give you a look at what I think comes next.

First though, a word about human perception of risk.

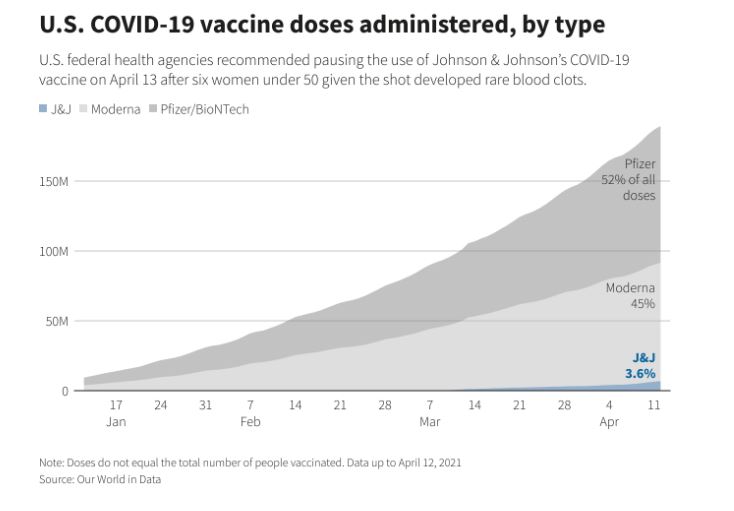

You see, the Johnson & Johnson vaccine rollout in the US was recently paused after six people under the age of 50 developed rare blood clot conditions after receiving the jab.

This out of seven million administered doses.

In Reuters’s coverage, experts likened the risk to being struck by lightning in the UK and the risk of oral contraceptives.

From a strictly consequentialist perspective then, one that seeks the best outcomes for the most people, this is an acceptable level of risk.

But from an individual’s perspective — the thought is, ‘what if it were to happen to me?’

The perception of risk and risk appetite go hand in hand for investors, one informs the other.

A large company haemorrhaging cash will usually slide down the charts, as investors can see the risk.

But what about risks we can’t see?

US Secretary of Defense Donald Rumsfeld once notoriously said in a press conference:

‘[T]here are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know.’

It’s the ‘unknown unknowns’ that really worry investors.

So, in three sections, I’ll break down my thesis that vaccine turmoil won’t derail the recovery.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Known knowns: we have effective vaccines

Not all vaccines are the same.

Some are more effective than others.

The two leading candidates going at the moment are the Moderna and Pfizer/BioNTech vaccines.

And these are the two the US is relying on the most as you can see below:

|

|

|

Source: Reuters |

I think the aggressive vaccine rollout in the US is tracking relatively well for a nation of its size.

Both the Moderna and Pfizer/BioNTech vaccines rely on the same technology.

As a result of this technology, they can be chopped and changed reasonably quickly to adapt to what I would call known unknowns — virus variants.

This is not blind cheerleading for mRNA-based vaccines — but more so restrained optimism that the synthetic biology approach to medicine will be a sustained part of our society in this century.

Known unknowns: virus variants will emerge

You’ve likely heard about the UK and South African variants.

And new, nastier variants are likely to emerge if past history is anything to go by.

My concern is that in rushing to secure the bulk of vaccines for their countries, developed countries could eventually shoot themselves in the foot.

Altruism dies in a crisis.

As in, the developing world will see one of these variants emerge, and in turn, emerging markets go down the drain.

Leading to increased risks to those financial institutions exposed to their growth.

You can see hints of the risk on the chart below:

|

|

|

Source: Financial Times |

Lazard Asset Management has this to say on how these countries are faring:

‘The vaccine rollout in developing countries should improve as these countries acquire more supply in the second half of this year. COVAX, a global initiative led by the World Health Organization (WHO) and the GAVI Alliance, has committed to distributing a group of vaccines equitably among developed and developing countries, with the goal of supplying 2 billion doses (vaccinating 1 billion people) by the end of 2021. It began distributing vaccines in late February in Africa and despite some delays in manufacturing and exports, delivered some 31 million doses by late March.’

But should those economies suffer from future variants, and their debt unwind — there could be some danger in this part of the market muddying the waters.

What about the ultimate question mark though?

Unknown unknowns: social factors of ‘new money’

This domain of our knowledge/ignorance is the specialty of Nassim Nicholas Taleb.

He said in Fooled by Randomness:

‘It was confidently believed that the scientific successes of the industrial revolution could be carried through into the social sciences, particularly with such movements as Marxism. Pseudoscience came with a collection of idealistic nerds who tried to create a tailor-made society, the epitome of which is the central planner. Economics was the most likely candidate for such use of science; you can disguise charlatanism under the weight of equations, and nobody can catch you since there is no such thing as a controlled experiment.’

And herein lies the problem.

We’ve printed a bucket load of money, inflated asset prices while turning people away from fiat and towards crypto in one fell swoop.

Where do we go from here? Does society answer the siren song of central bank backed digital currencies (CBDCs)?

I’m sure this ‘new money’ will come with assurances that it is worthy of confidence and designed by the brightest minds — economists no doubt.

But will it be trusted?

These are just some of the impossible question marks hovering over the current vaccine driven recovery.

For now, don’t panic, I’d say.

Just because J&J and AstraZeneca are being shown the door doesn’t mean all is lost.

It’s what comes next that you should really be watching out for.

The re-remaking of what money is.

Regards,

|

Lachlann Tierney,

For Money Morning

P.S: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.