As antitrust storm clouds gather in Washington, some think the big US tech stocks are cruising for a bruising.

I’m talking about the NASDAQ giants, like Facebook Inc [NASDAQ:FB], Apple Inc [NASDAQ:AAPL], Amazon.com, Inc [NASDAQ:AMZN], Microsoft Corp [NASDAQ:MSFT], and Alphabet (Google) Inc [NASDAQ:GOOGL].

But there’s a case to be made that any regulatory issues can be avoided, and the run can go on for at least another few years.

In the EU for instance, Apple recently beat a $15 billion tax bill related to its business in Ireland.

And $8 billion in fines is doing little to stop Google’s dominance in the European market.

Amazon CEO Jeff Bezos recently indicated a willingness to appear before a US House of Representatives committee in their ongoing antitrust probe of Big Tech.

I expect this hearing will result in much grandstanding, little action and at most, a slap on the wrist for these NASDAQ-listed companies.

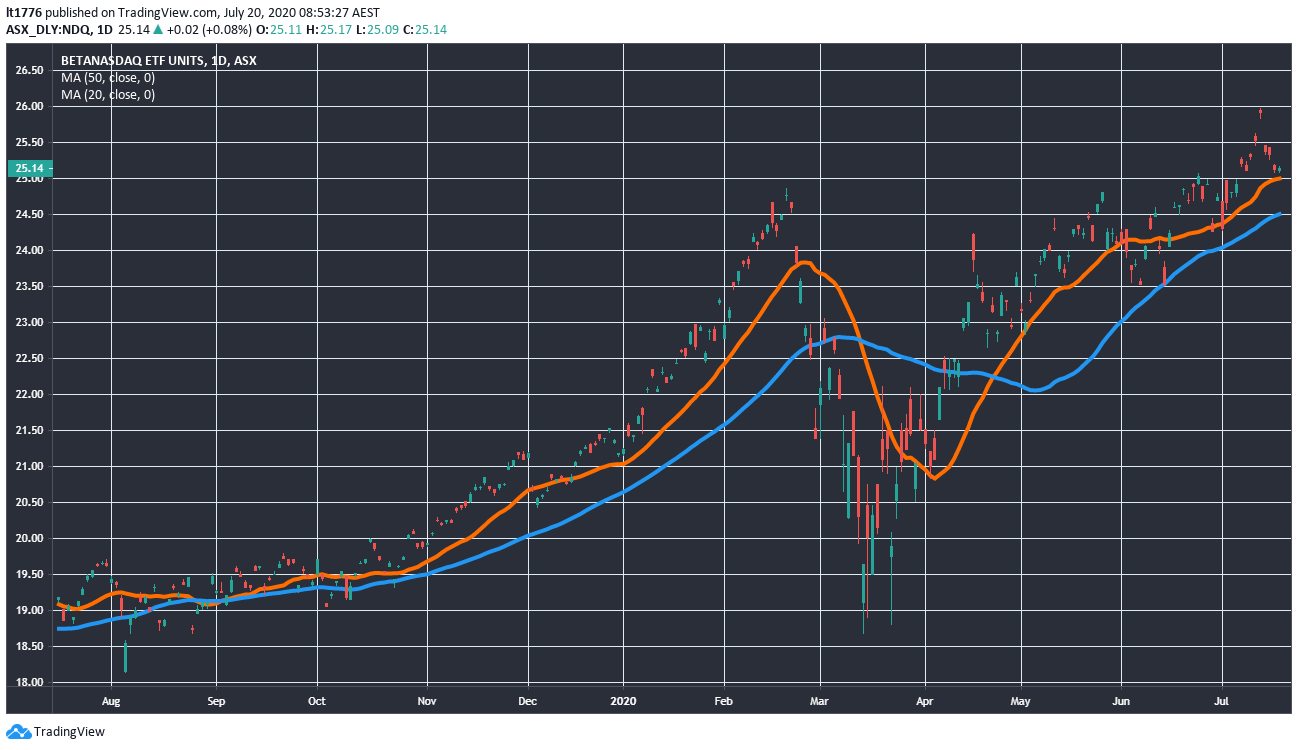

Let’s take a quick look at what’s happening with BetaShares NASDAQ 100 ETF [ASX:NDQ], for context.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

A quick look at the NDQ chart

|

|

|

Source: tradingview.com |

Its top three holdings are AAPL, MSFT, and AMZN.

As you can see it had a small pullback recently, after it surged past its mid-February peak from the March market lows.

Its upward momentum is yet to properly stall however.

I think in the medium term you may see NDQ squeeze another 10–15% out of the run.

Such is the prominence of these companies in our lockdown lives.

They are fast becoming utilities — essential parts of how businesses and households operate.

And funds betting on growth over value are increasingly successful.

This fund bet on NASDAQ growth and topped the rankings — what can you learn from it?

A recent profile in the Australian Financial Review of Hyperion Asset Management’s Australian Growth Companies Fund details its success navigating the recent market panic.

They were recently named second in Mercer’s long-only Australian equities fund rankings.

The fund delivered a 19% return while the ASX shed 7.7%.

How did they do it?

Nothing too amazing or left field, they just stuck to their convictions about the resilience of tech stocks in the new market environment.

Big bets on AMZN, MSFT, and Tesla Inc [NASDAQ:TSLA] all paid off.

Unlike the dotcom bust in 2000, things are very different this time.

These businesses are fully integrated into our lives and produce serious earnings.

Those who were bearish on big US tech stocks after the market panic clearly underestimated these companies.

What can you gather from this?

Well, for starters, a single-minded focus on P/E ratios and dividend yield might not get you anywhere.

Secondly, the ability to stick to your convictions when investing is really important.

You don’t need to be a genius to know that even when the global economy starts to buckle, people will still be using the big tech companies’ products.

The trick though, is spotting the next big trend, not capitalising on what I would call a ‘mature megatrend’ — the world is going online for work and pleasure via these NASDAQ giants.

If it’s not growing is it even value?

With all this focus on growth versus value and how growth is the only way forward, the contrarian in me wants to say that there will eventually be a shift back to value.

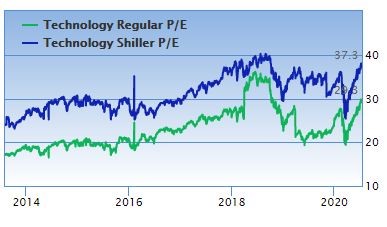

So let’s use a tool that value investors like, the Shiller P/E ratio.

The Shiller P/E is designed to eliminate ‘fluctuation of the ratio caused by the variation of profit margins during business cycles.’

Check out the regular and Shiller P/E ratios of the technology sector of S&P 500 below:

|

|

|

Source: gurufocus.com |

This is in stark contrast to both P/E ratios in the financial services sector:

|

|

|

Source: gurufocus.com |

By both metrics, financial services could be deemed ‘cheap’ and tech stocks could be deemed ‘expensive’.

Does this mean banks are sure-fire winners in the years ahead?

Not at all.

Does this also mean that tech stocks are bound to pullback soon?

Again, not necessarily.

The point I am trying to make is that growth versus value is a bit of false dichotomy.

With certain small-caps, I’ve found you can sometimes get both.

And if the company isn’t going to grow profits, or at least revenue, is it any value at all?

Finally, where to look for neither growth nor value…

AFR with rare bit of insight

The article profiling Hyperion’s success finished with an interesting, and rare insight…

The author said:

‘If economic growth is depressed amid the pandemic and tepid after it, do you really want to be weighed down by the large industrial companies, established financial services players and big resources houses that still dominate indices around the world?’

For once, I agree with the AFR, somewhat.

Banks are definitely out, large industrial companies could be weighed down by sluggish global growth, but commodities are looking appealing.

You can read what my colleague Ryan Dinse thinks about commodities here.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.