We are officially in the best and longest bull market in American stock market history. Depending on how you measure it…

In fact, there are so many different conclusions on just how long the bull market has continued for, and how much it has gone up by, that I got dizzy looking at the distinctions between them.

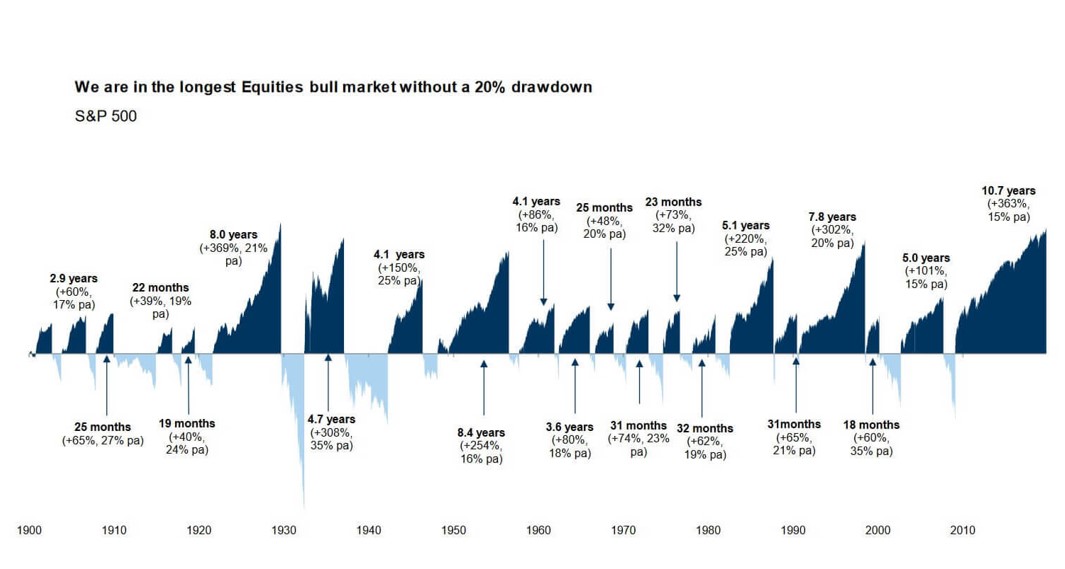

Here’s one version of events from Deutsche Bank.

Bull and bear markets

|

|

| Source: Deutsche Bank |

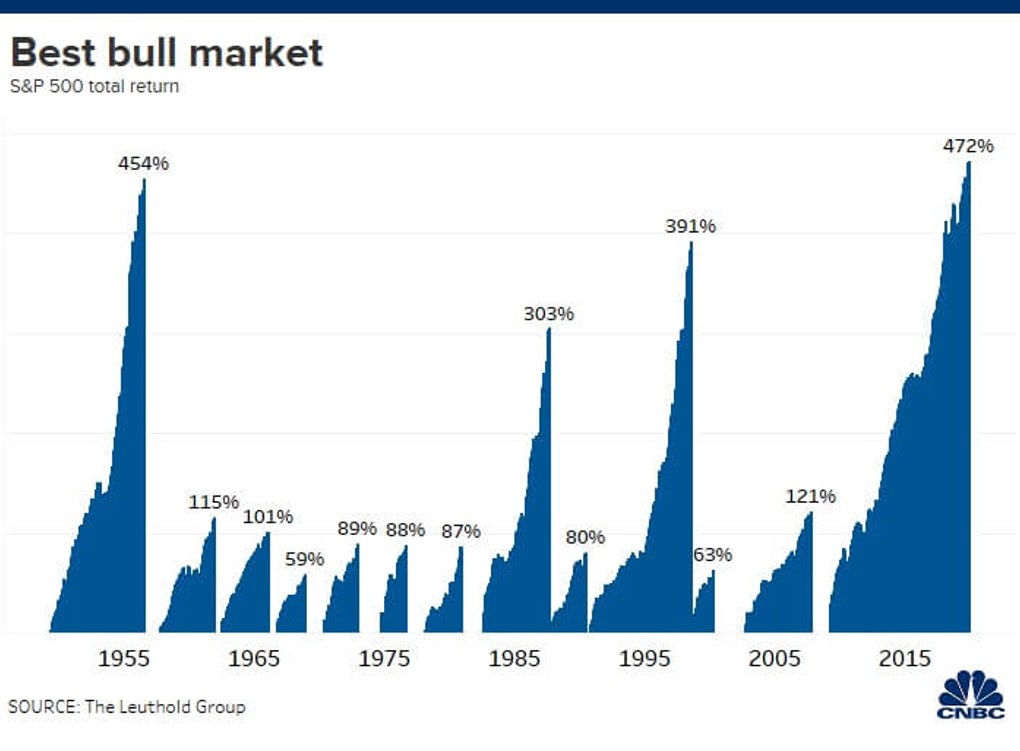

CNBC has a completely different version of events for the boom since 2009, and those which came before:

|

|

| Source: Deutsche Bank |

Given the wild variety of analyses, even climate scientists would be embarrassed by the claims that finance researchers are making about exactly what the US stock market has achieved since 2009. Nobody can agree.

But, for the sake of examining what happens next, let’s assume this really is the best and longest bull market in US stocks, however you choose to measure it.

Because after the biggest and longest boom you get what?

A quick glance at the first chart above and you’ll notice that longer and larger booms are usually followed by worse and longer lasting busts. It’s a bit like a hangover, really.

We missed out on the boom — unlikely to dodge the bust

Today, we dig into what this suggests will happen next. But first, why does it matter to Australians?

So far, we’ve missed out on much of the US’ stock market boom. But would we miss out on the US’ bust too? Unlikely…

That’s the biggest lesson Aussies should learn from 2008. The world is now so interconnected that our asset prices can’t escape.

Which means it’s worth paying attention to what’s going on in the US.

So, will the biggest bust follow on from the biggest boom?

What bothers me about the proportional boom and bust narrative is just how bad things would get. After the biggest ever boom comes what exactly? What exactly is the biggest ever bust?

Or has the world changed, as I’ve opined in the past? Are central bankers now omnipotent, omnipresent, and omniscient enough to save us?

Well, they’re certainly very powerful. Recently, the largest three central banks began printing money in concert. A Deutsche Bank tracking list revealed literally every asset class they tracked rose in price year to date…

So, what I wanted to discuss in today’s Daily Reckoning is what the world would look like without a crash. What if booms don’t bust anymore? What happens instead?

I’m struggling to describe what that world would look like. Economic doldrums, financial sclerosis, and malaise just don’t seem to do the trick. So, I’ll have to explain it the long way.

Booms are times when there’s overinvestment, too much borrowing, and a lot of suspicious success which wouldn’t happen outside of a boom. The point being that an end and a reversal is built into the boom. For a reason. Just as you get a hangover for a reason.

But what if you don’t get the reversal? What if those investments stick around, the debt isn’t written off and corporations with iffy financials turn into the undead — zombies?

Actually, they’d be more like vampires — living off the lifeblood of the living. They soak up the resources which would’ve been used to generate the next boom. Hence the prolonged malaise and doldrums I mentioned.

An economy requiring life support won’t jump out of bed and head off on its next adventure. Keeping the zombies alive prevents a recovery.

The zombie economy

The textbook case of all this was Japan. Now it’s Italy too. The economy can’t grow because there are too many vampires keeping their hands on the resources needed.

But the economy and asset prices are two different things. That’s what the current boom taught us. And investors are interested in the latter — asset prices.

The US has had a very poor economic recovery compared to the past. While also delivering the biggest stock market boom…

This either suggests that the coming stock market bust will be even more severe because it’s based on boom time bubbles instead of real growth, or it suggests that asset prices and the economy have diverged.

In Japan, deflation in asset and consumer prices was part of the lost decades that followed the end of their epic boom. Asset prices reflected the economy. But allowing this would be sacrilege to central bankers today.

The American central bankers are even toying with running inflation above their legal mandate to keep up appearances.

The point is, it’s tough to be a pessimist on asset prices these days. Even if you are sceptical on the economy, or if you’re expecting doldrums, that still doesn’t mean the stock market will go down.

Not that it’s a good idea to punt your life savings on the assumption central bankers can keep the stock market going up. Just that it could continue to pay to play.

The question becomes how.

| Until next time, |

|

| Nick Hubble, PS: Exclusive interview from The Daily Reckoning Australia: ‘The New Case for Gold: An interview with bestselling author and Wall Street insider, Jim Rickards’. Click here to learn more. |