Uh-oh, Australia’s regulators now know that they have released the familiar demon of housing speculation…and they have no way of putting him back in the box.

All the statistics point the same way: the market is hot, hot, hot.

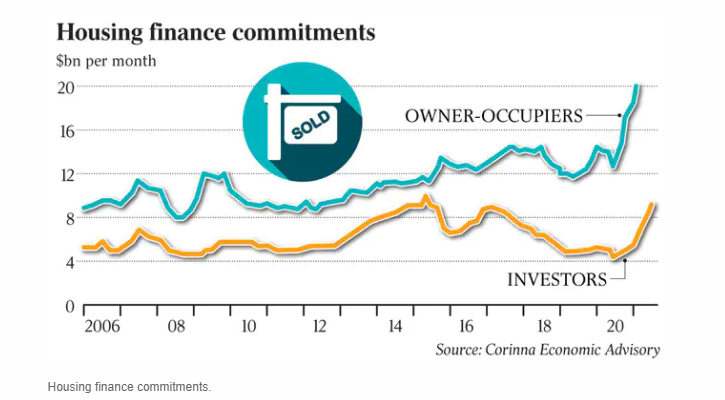

Clearance rates are at 75%, mortgage rates are low, and financing commitments are surging. They are up 83% on the last year.

You can see that here:

|

|

|

Source: The Australian |

And, as forecast here in your Daily Reckoning, investors are coming back into the market in a big way. Investor lending is up 40% since January.

The Australian reports this morning:

‘The banking regulator became increasing worried about the frenzied pace of mortgage lending in April and put the nation’s banks on notice not to relax standards and to ensure borrowers weren’t taking on excessive debt in the face of ultra-low interest rates, according to new internal documents.’

APRA can huff and puff all it wants, but the only way to halt this train is to make the banks stop lending with caps and restrictions.

That would be a gutsy move when the economic recovery is fragile and the outlook so uncertain…not to mention a grave risk to the baby boomer voter base who own the banks and live off the dividends.

And would that even stop the market anyway? There is so much cash swishing around the world looking for a home — literally!

I saw a report last week that Aussie consumers have ‘squirrelled’ away more than $140 billion since the pandemic began.

Not only that, but the current surge in house prices is driving up the level of equity the home-owning Aussie has.

The Australian reports that:

‘The equity in a typical Australian home has jumped more than $100,000 in four capital cities in the past 12 months, and more than $74,000 in the other four capitals, CoreLogic data shows. And that’s before calculating the extra equity created by people paying more off their loan principal during the pandemic.’

This is giving the propertied class additional firepower to leverage further into the housing market.

And then there is the other wild card mostly forgotten since the boom years before 2008: the ‘non-banks’.

These are mortgage lending firms that operate differently to the big banks.

The main difference: non-banks don’t accept deposits. APRA does not regulate them in the same way.

You can see where I’m going with this, right?

The non-banks can service the borrowers that the big banks will be reluctant to go after with the regulator watching them. They can clean up while the going is good.

Aussie Property Expert’s Bold Prediction for 2026. Discover More.

I was researching this sector last week.

The non-banks are getting funding at the best prices since the GFC. There’s global appetite for the bonds from all over the place.

Again, we find the low interest rate policy of the global central banks driving the markets toward a frenzy of asset speculation and a careening boom-bust cycle.

It is vital you understand this dynamic at work. There is likely to be huge asset inflation across Australian property for the next four years or so.

But these booms are by their nature dated: they cannot last forever because it is not productive behaviour driving them.

When’s the boom going to end? And how do you take advantage of it in the meantime?

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.