The Tyro Payments Ltd [ASX:TYR] share price is up more than 7%, to trade at $4.21.

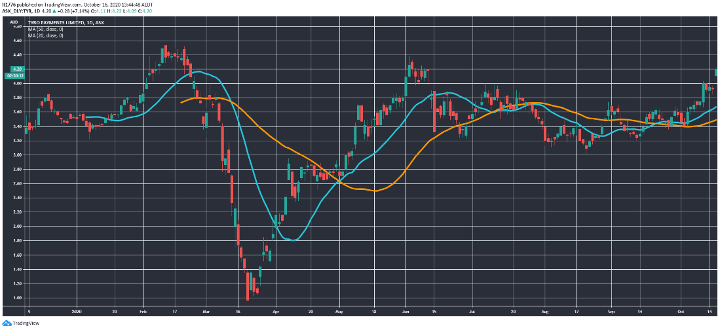

The TYR share price bounced strongly off the March market lows and is now registering some positive upwards momentum:

Source: Tradingview.com

Tyro Payments recently announced a partnership with Bendigo and Adelaide Bank Ltd [ASX:BEN]. We look at the terms and the TYR share price outlook.

TYR share price jumps on partnership

Tyro shares jumped to $4.20 at the start of trading, with the announcement released in the morning.

Here are the key terms of the partnership taken from the announcement that triggered the move:

- ‘Tyro will exclusively provide merchant acquiring services to Bendigo Bank’s existing merchant acquiring customers and Bendigo Bank will exclusively refer new merchant opportunities from its business customer base to Tyro, all under a co-brand.

- ‘Economic benefits of Bendigo Bank’s existing merchant service contracts will move to Tyro on completion (expected to occur in the first half of calendar 2021):

- ‘Tyro is purchasing Bendigo Bank’s existing merchant acquiring arrangements (essentially its merchant service contracts and associated goodwill);

- ‘Bendigo Bank will receive upfront consideration of $9 million and an on-going gross profit share from existing and newly referred Bendigo Bank business customers who use Tyro’s merchant acquiring services; and — the alliance has an initial 10-year term with provision for extension by agreement for additional five-year terms.’

It seems the market thinks this is a good deal for Bendigo and Adelaide Bank as well, with the BEN share price up more than 3% at time of writing, despite the difficulties faced by major bank stocks recently.

Outlook for TYR share price

Having previously highlighted that Tyro’s main growth opportunity may lie in converting existing payments customers into lending customers, i.e. the growth of its fintech arm of the business is what could drive the share price over the next few years.

As retail opens back up, and the prospect of a macro boost from eased Victorian restrictions, TYR looks to be well placed at the moment.

They release a steady stream of updates, which is pleasing.

Transparency builds trust.

As at 30 June, they had $188.3 million in cash which gives it a decent amount of wiggle room.

EBITDA loss of $4.4 million in FY2020 is not ideal, but a capital raise seems unlikely for at least a long time into the future.

However, I think out-and-out fintechs may be more exciting than a company that is more geared towards physical payment processing.

Check out three of our favoured fintechs in this brand-new report. It profiles three companies that are currently flying under the radar.

Regards,

Lachlann Tierney,

For Money Morning