Editor’s note: In today’s video update I discuss a handful of small-cap miners that have taken off recently. Click here or the thumbnail below to view.

Our editors don’t always agree.

In fact, if we did, we wouldn’t be doing our job properly.

We aren’t a hivemind, I can assure you.

But one of the luxuries I am afforded, is that I get to hear a range of viewpoints on the market and make my own conclusions.

And today, I’m going to run you through movements in the prices of two metals.

You should be watching them closely.

If I’m right, then everything you read in the major outlets could be wrong (it so often is).

Before I dive in though, I’ll give you some crucial background…

Bearish on big miners, bullish on small-caps

In recent weeks, you’ve likely heard a lot about the China–Australia relationship breakdown.

You can find out what exactly triggered it right here.

So on Wednesday, I outlined what the risk was for the big Aussie miners.

This doesn’t mean that some carefully selected Aussie small-cap miners can’t succeed though.

If anything, my colleague Ryan Dinse’s ‘mini-boom’ thesis could be playing out before our eyes.

That is, while the macro picture could be swinging against iron ore — you may see pockets of the Aussie mining world return to prominence.

Ryan’s always drilled into me the idea of ‘strong convictions, loosely held.’

Which means you need to believe in what you are investing in but be flexible enough to quickly adjust if the narrative changes.

Ryan and I bounce ideas off each other and the combined reasoning produces better recommendations for Exponential Stock Investor.

Anyway, here are two metals to keep your eyes peeled for.

Last month we flagged this resource boom

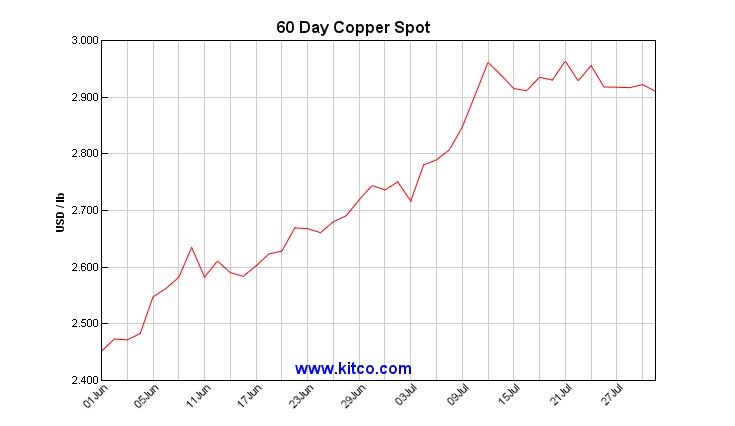

The copper price is levelling off at the moment, since we last talked about it in June.

You can see the 60-day chart below:

|

|

|

Source: Kitco |

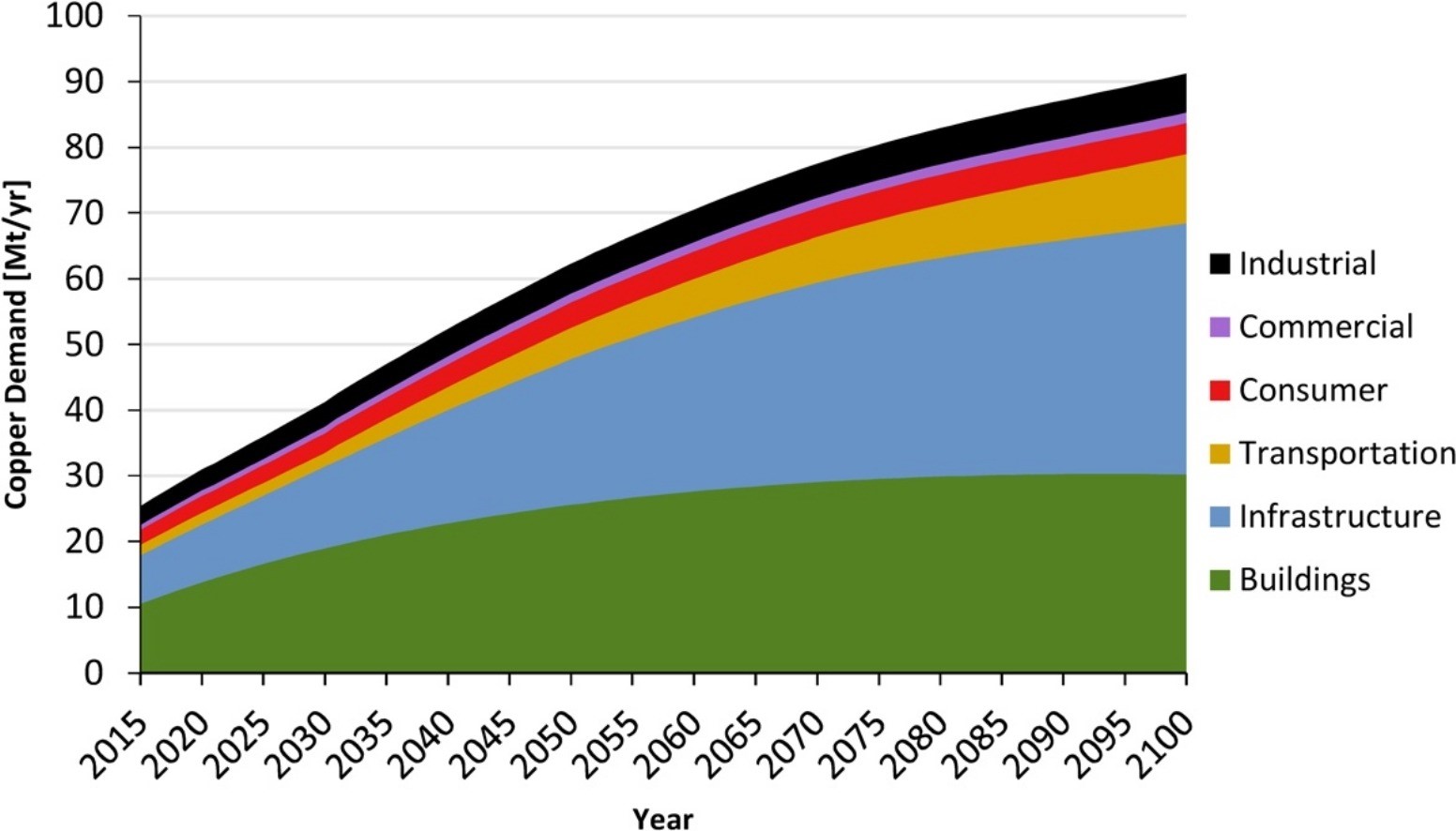

You can see buildings and infrastructure make up a huge chunk of the current and future demand for copper below:

|

|

|

Source: Schipper et. al. (2018) |

Everyone thinks of copper as the ultimate boom-time resource.

New home builds are a big part of this.

For those who thought the sky was falling, the recent 13-year high for sales of US new homes may have caused consternation.

But why wouldn’t US residential real estate hold up?

The Fed pushed interest rates to just above zero, and the flight to the ‘burbs is on as people move away from high density areas.

But there is more to the copper story than simply huge infrastructure spending and the race to snap up a McMansion on the outskirts of the city.

You see, it’s a future tech metal as well.

Mandatory EV charging stations being pushed by the German government are the beginning.

These charging stations use up an immense amount of copper — up to 25kgs in fact.

Let’s pivot to the second metal on today’s agenda though…

The second mini-boom resource is a bit similar

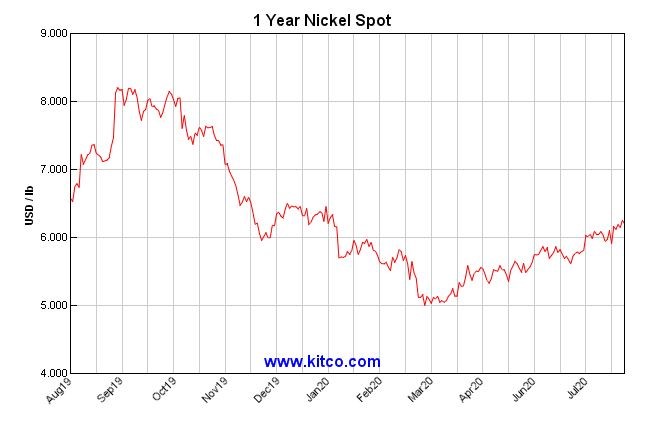

Nickel garnered a lot of hype about a year ago, but it’s worth a second look.

You can see the one-year nickel price below:

|

|

|

Source: Kitco |

Nickel is similar to copper.

Much of its current demand comes from boom-time sources like stainless steel.

But it is also a future tech metal as well, with the advent of NCM 811 batteries for EVs.

Indeed, Tesla CEO Elon Musk was quoted in a recent call as saying:

‘Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.’

Here’s how you could trade mini-booms

The point I’m trying to make is that you need to be nimble in this chaotic market.

When someone says resources are across the board doomed, take it with a grain of salt.

Adjust your perspective based on facts.

The sky is falling (i.e. the macro-bear position) is a very constraining outlook.

Find niches and pockets of movement in the market and you could be a major winner compared to say, sticking only in cash.

To trade a mini-boom effectively though, you need to have a signal.

Ryan’s come up a with an incredible indicator that helps him track the movement of cash into specific small-caps.

You can learn all about how it works here.

Regards,

|

Lachlann Tierney,

For Money Weekend

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.