In the last three years, several commodity bull markets in lithium, oil, copper, nickel, iron ore, uranium, and rare earths have come and gone.

Investors who jumped into these mining stocks at the right time enjoyed massive gains during the boom.

However, be warned, many overstayed their welcome as they tumbled.

Oil is down. Iron ore is down. Nickel and lithium collapsed. Timing is important in commodity cycles.

The fact that all these commodities are trading much lower than their peaks together points to a potential recession worldwide, maybe worse.

But two metals are going against this trend.

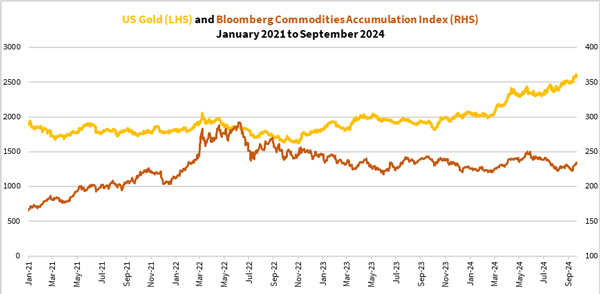

Let me show you gold’s performance relative to other commodities:

| |

| Source: Refinitiv Eikon |

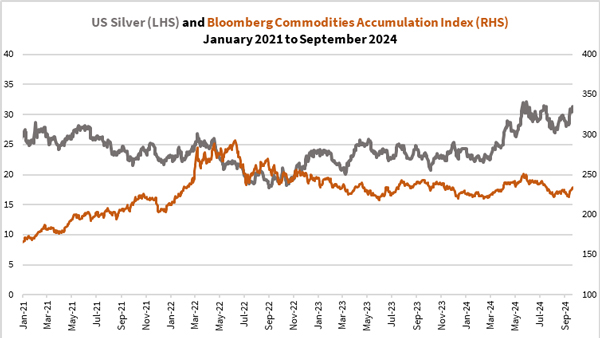

And here’s silver:

| |

| Source: Refinitiv Eikon |

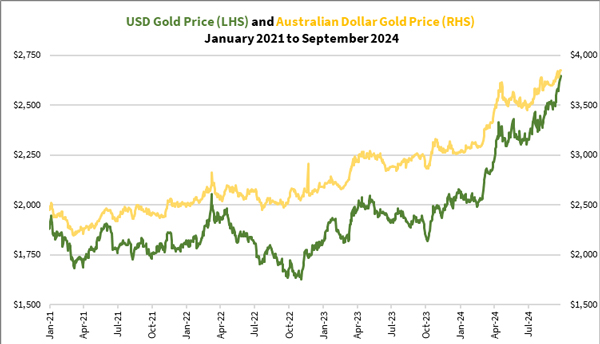

Shortly after the Australian market closed last Friday, gold shot past US$2,600 an ounce.

By the time the US markets closed, gold finished at US$2,660 or AU$3,865. Since the start of the year, it has rallied 27-28%.

| |

| Source: GoldHub Australia |

Silver regained US$30 an ounce on Friday 13th September, looking poised to hold these levels given the rate cut cycle has started:

| |

| Source: Refinitiv Eikon |

Smart money investors are likely to positioning for inflation to reaccelerate. A so-called ‘soft landing’ seems less likely, at least for me.

Therefore, I see resources investors could pursue precious metals going forward.

Record profitability for gold miners to

spur more interest

Investors could pour funds into precious metals mining stocks in the coming months.

Unlike metals, mining stocks are businesses. Their potential to generate future cashflows and investor returns drive their prices.

Here’s how the ASX Gold Index [ASX:XGD] performed in the past four years:

| |

| Source: Refinitiv Eikon |

The index is trading just over 10% below its all-time highs in August 2020. Meanwhile, gold is now worth almost 30% more. At one stage, the index fell by as much as 55%, making a cyclical low in September 2022.

What’s the missing link for the performance of gold, silver and the established gold producers to diverge so much?

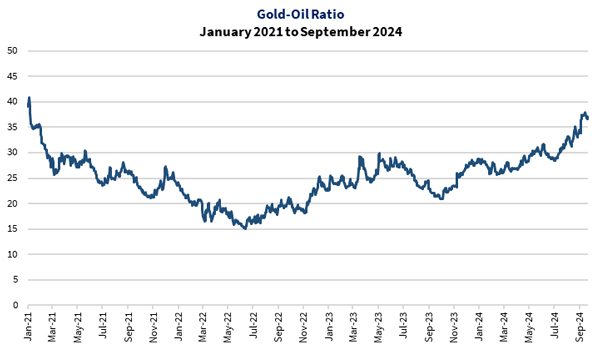

It’s oil and operating margins.

Gold is just one factor driving the profitability of gold mining companies. Oil is a major input as energy products like diesel are used to power machinery. Furthermore, the price of oil affects economic inflation, which in turn drives the cost of goods and services and wages/salaries.

Since 2015, I’ve used the gold-oil ratio to help me anticipate the operating margins of gold producers and how gold stocks would perform in the coming quarter. It’s served me well.

Since June 2022, the gold-oil ratio increased by 150%:

| |

| Source: GoldHub Australia |

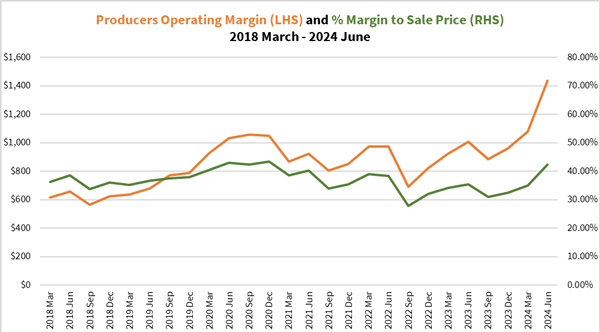

That’s helped boost the operating margins of ASX-listed gold producers. As you can see below, gold producers have recently generated margins rivalling that seen in 2020:

| |

| Source: GoldHub Australia |

I expect the 2024 September and December quarter operating margins to be as good as the last quarter, if not better. There’s fundamental support for gold stocks to have a higher value.

Should that be the case, not only will gold producers enjoy further buying interest. Funds could flow into the smaller companies, which are still priced like they’re in a bear market.

Significant opportunities remain…

don’t miss out!

Just in case you think you missed the boat, know that the two largest Australian gold producers, Northern Star Resources [ASX:NST] and Evolution Mining [ASX:EVN], are still yet to break their all-time record highs.

Only a handful of gold producers, Capricorn Metals [ASX:CMM], Emerald Resources [ASX:EMR], Ora Banda Mining [ASX:OBM] and Spartan Resources [ASX:SPR], have broken out like gold.

And while I don’t know what will happen in the coming months, I’d go as far to say you may’ve missed one major buying wave that started in October 2022, gaining momentum in March this year after the US Federal Reserve announced it would likely cut rates three times this year. I believe there’s still another one coming.

How far could it go?

Let me tell you this: I’ve recently prepared plans for members of my gold stocks investment services, The Australian Gold Report and Gold Stock Pro, outlining what they can do with their gold stocks as the ASX Gold Index rallies further.

This includes taking profits and selling out when prices get into bubble territory.

To find out what companies I’ve recommended them and to access my detailed analyses and plans, sign up to The Australian Gold.

Once you do, I’ll send you a report on how to get started on your precious metals portfolio and you can catch up with my recent updates.

For those who are particularly adventurous and want to speculate in early-stage gold stocks, check out Gold Stock Pro. I’ve five companies you can consider adding to your portfolio for the potential of exciting opportunities in the coming bull market for gold stocks.

That’s it from me, enjoy the rest of your week!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments