Feel that rush like you’re in the subway as the train passes through?

Well, there are freight trains, and then there’s the price of iron ore. It just keeps hurtling along.

It broke into a record high last night. It’s now over US$200 a tonne.

My goodness. This is showering money all over the producers and miners like they have never seen.

I had a mate tell me the other day he used to know a bunch of BHP types that had their chest out when iron ore was US$80 a tonne. It’s not far off triple that now for the highest grade.

That’s not all…

The profits are much higher this time around because the costs for the big boys — BHP, Rio Tinto, Fortescue — are so much lower.

Iron Ore Breaks US$200

Your editor has been rumbling that iron ore might hit US$200 in recent weeks.

But Mr Market wouldn’t be himself if he didn’t put a worry or two in to go along with the party.

One of those worries is political. The other is practical.

You don’t need me to tell you that Australia’s relationship with China is reaching new lows.

This raises the idea that Beijing will do something to block or rein in the iron ore market.

On numbers alone, you would think that China cannot block Australia’s iron ore without crashing their steelmakers and construction industry. Australian supply is too dominant in the market.

But hey, maybe they decide to kamikaze the issue. I suppose we can’t rule it out completely.

It’s certain, however, that China will funnel money into Africa and South America to establish new supply.

Here is the basic dynamic at work…

|

|

| Source: Twitter |

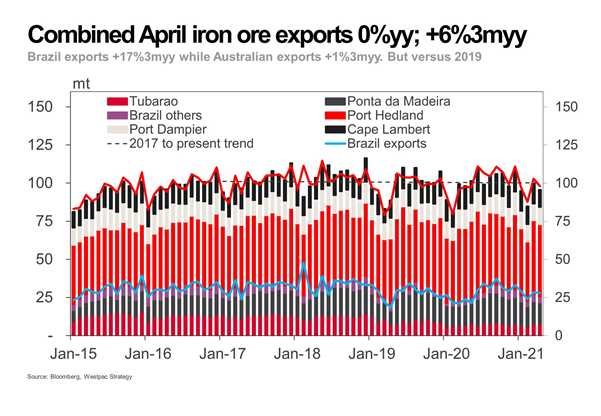

What does it show? It shows iron ore exports flat for a long time. This includes Australia and Brazil.

Both are shipping out slightly less than they were in 2017. But China’s demand has grown 5% per year in the same time frame.

Even if they have the deposit and the permits, can they get the trucks, drivers, and port access? The cost of shipping is also skyrocketing.

What a dynamic. Your guess is as good as mine as to where we go from here. But I’m on the freight train for now.

Certainly, any company with established production and delivery is in a fantastic position.

Of course, the astonishing levels of dividends that could gush from the big iron ore miners is going to show up in consumer spending for some.

Crypto Market and the Dogecoin Surge

But if you think that iron ore is hot, it’s nothing compared to what’s going on in the crypto market.

I saw a Tweet on the returns in this market. Dogecoin, the joke coin that began in 2013, is up 26,000% in a year.

Dogecoin is completely useless as far as I know. And it’s returns like this that lead people to dismiss crypto as a ridiculous bubble.

However, we’ve already seen the equivalent of this roadshow. It was the Nasdaq boom of 2000.

Back then lots of companies skyrocketed with no revenue but big dreams of conquering this new thing called the ‘internet’.

Many failed. The Nasdaq lost 80% of its value at one point. Many people made (and lost) a fortune.

But out of those ashes came the titans of today: Amazon being the most famous.

There’s no doubt in my mind that the titans of tomorrow will come from the crypto world.

That’s the easy part. The question is how do you find and monetise it?

A venture capitalist, for example, would perhaps buy the top 20 projects under the assumption 15 will go to zero, two or three muddle through — but one goes to the Moon.

A conviction investor might stake their fortune on one or two and live with the consequences.

You might just want to trade momentum.

There’s no right or wrong way here. Only hindsight can show that.

But you do need to start learning about what’s happening here. And so do I. I’ve lost a bit of ground here in recent times.

That’s why I’m thrilled my friends Ryan and Greg have launched their New Money Investor service.

They take us inside the crypto world to show us what’s happening.

I’ll be learning as much as you. Come join me and be a part of it here.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.

Comments