I’m writing this piece shortly before the Christmas break.

As you may know, we have something called the Fat Tail New Years’ Countdown on right now.

It’s where you can join my Crypto Capital Foundation service at 70% off the regular price.

But only for the next few days.

You rarely see me try and actively pitch my own service. (I leave that to the marketing team!)

I figure you either get the value of what I do…and the crypto project in general…or you don’t.

I will make a bit of an exception today.

I do think if you’ve toyed with joining my crypto advisory, but put it off, now is the time to jump onboard while there’s such a massive discount.

So why do I think this is an opportune time to join?

As I type, Bitcoin [BTC] is surging higher.

It’s very likely to finish 2023 as the world’s best performing asset class by far; up over 130%.

And yet, the haters are still hating!

As Zack Voell noted in this tweet:

| |

| Source: x.com |

In my decade in Bitcoin I’ve seen this reaction many times over.

When crypto is down, these people come out to gloat. But when it’s rising, they can’t contain their anger.

There’s no doubt about it…

The invention and rise of Bitcoin has been a savage blow to most financial ‘experts’ egos.

They resent the fact that this asset class continues to grow despite the antagonism and attacks from all the insiders and cronies that make up their corrupted ranks.

They’re losing control of their money printer.

And they hate it!

Unfortunately for them, Bitcoin doesn’t care.

Over the past 15 years, it has continued to attract new supporters in all manner of places.

And as a resilient, decentralised monetary network it has continued to operate as intended through all market conditions too.

Smart people are starting to realise the fact that Bitcoin is unstoppable.

Countries like Argentina, Suriname and Columbia are now joining the likes of El Salvador and actively exploring ways to integrate Bitcoin into their economies.

Even financial firms like Blackrock and Fidelity have radically changed their tune on Bitcoin.

In June this year, Blackrock shocked the world by announcing they would be applying for a Bitcoin spot ETF (exchange traded fund).

This was a complete 180 from a company whose CEO, Larry Fink, had once called Bitcoin an ‘index of fraud.’

The announcement set the stage for a raft of similar ETF applications from other major money managers.

I reckon it took the bureaucratic class by complete surprise too.

Check out this tweet:

| |

| Source: x.com |

Which brings me to my first key date for Bitcoin…

The first key date

As I type it now looks like 10 January will be a key date to watch.

Why?

Well, according to some, this is the most likely date the SEC will formally approve the first Bitcoin ETF.

Bloomberg analyst, James Seyffart, tweeted this a few weeks back:

‘Okay. This delay on Hashdex all but confirms for me that this was likely a move to line every applicant up for potential (Bitcoin spot ETF) approval by the Jan 10, 2024 deadline.’

He was referring to this document from the SEC:

| |

| Source: SEC |

Basically, this release says that the SEC is delaying a decision on the Hashdex Bitcoin spot ETF.

It’s done this to different applications many times before.

But Seyffart thinks this particular one is setting us up for a ‘mass ETF approval event’ on 10 January, 2024.

This date is when they must make a final decision on one of the leading ETF applications (the one from Ark Invest/21 Shares).

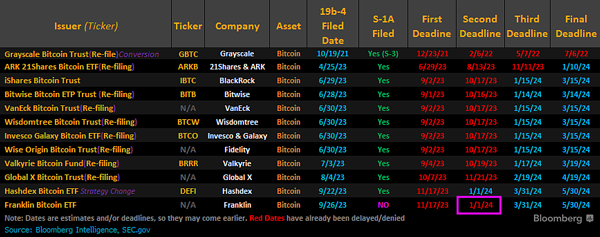

See the key dates in the table here:

| |

| Source: Bloomberg Intelligence |

The thinking here is that the SEC will approve all ETFs at once.

I mean, if they denied Ark’s application, only to approve other ETFs a month or two later, it could cause lawsuits and accusations of incompetence/bias from regulators.

Not that that has ever stopped them making those kinds of ridiculous decisions in the past, mind you.

But I tend to agree with the thinking that all ETFs will be approved at once.

Why is this such a big deal though?

Well, I refer to this date as Bitcoin’s ‘Ascension Day’ — the day Bitcoin finally becomes a legitimate part of the investing industry.

Think about it…

For the first time in Bitcoin’s history, advisors and super funds will be able to allocate funds to Bitcoin through an approved regulatory vehicle (an ETF).

Combine that with the fact there’s a five year low in Bitcoin held on exchange addresses (a good sign of ready supply) and a likely end to interest rate tightening, and you’ve got a recipe for a huge demand/supply imbalance in 2024.

Then there’s this…

The second key date

Around 20 April this year, the supply of new Bitcoin mined falls in half.

Instead of 900 new Bitcoin being added to supply per day, it will fall to 450.

This event is known as the halvening and happens every four years or so (to be exact, every 210,000 blocks).

The last halving event happened on 11 May, 2020.

The price of Bitcoin was around US$9,000.

Post-halving the Bitcoin price shot up to an all time high of US$69,000 in just over 12 months.

You can read about this process in more detail here if you wish.

But in purely investing terms, Bitcoin’s halving events re-enforce the absolute scarcity of Bitcoin, which is why the price tends to rise after them.

And this April’s event is a particularly special one.

You see, after this halving, Bitcoin will become scarcer than gold.

As eToro notes:

‘Bitcoin’s supply halving will cause Bitcoin’s stock to flow ratio, which is a comparison of an assets supply issuance relative to its current circulating supply, above that of gold.

‘This reflects just how scarce Bitcoin is becoming as a decentralised alternative to gold. This chart below from a Fidelity report on Bitcoin shows how Bitcoin will be superior to gold on a stock to flow basis after its upcoming halving.’

| |

| Source: Fidelity |

Do you see what is happening here?

Bitcoin is being legitimised by traditional finance right at the point it becomes the world’s scarcest digital commodity!

Not too late

Amazingly, it’s still not too late to grab your share of Bitcoin.

The price of Bitcoin is still below the last cycle high of US$69,000.

And you’re looking at a price per Bitcoin of around U$700,000 for Bitcoin to match gold’s market cap.

My central theory is that Bitcoin demonetises gold in a big way this cycle.

In fact, this is what the trend says is happening already.

Check out this chart:

| |

| Source: Bloomberg |

The green line shows the price of gold in US dollars and the orange line is gold priced in Bitcoin.

As you can see, gold is actually going down in value when priced in Bitcoin, showing the relative strength of Bitcoin as an alternate store of value asset.

Of course, there’s nothing to say both assets can’t rise as fiat money continues to devalue but at only 1/20th the value of gold, I think Bitcoin will close that gap considerably over the next few years.

Why?

Simply put, it’s better money.

As a recent report Fidelity’s Director of Global Macro, Julien Timmer, noted:

‘In his detailed analysis, Timmer characterized Bitcoin as a “commodity currency” aspiring to be a recognized store of value, offering a hedge against monetary debasement. He compared Bitcoin to “exponential gold,” noting that while gold is a form of money, its practical limitations restrict its use as a medium of exchange. For investors, gold primarily serves as a store of value, a role often paralleled with Bitcoin.’

In his words, Bitcoin is exponential gold!

I’ve always viewed it as such.

If you look back on my record, you’ll see I’ve done a pretty good job at anticipating the ebbs and flows of the crypto markets over the last seven years.

And identifying smart trades…in various coins…that have capitalised on both the ups and the downs. The summers and the winters.

It feels like a new summer is coming.

But with big finance selling it as such — just as their ETF’s are about to come online — well, if you can’t see the opportunity here, I don’t know what to tell you…

I think next year is going to be VERY interesting for crypto.

And the mainstream hasn’t got a clue yet.

Good investing,

|

Ryan Dinse,

Editor, Fat Tail Daily

Comments