Singaporean company and owner of TPG Telecom and Tuas Solutions broadband business, Tuas [ASX:TUA] has posted results for the first half of the 2023 financial year.

The group’s main highlights included revenue of $39.6 million Singaporean dollars ($44.4 Australian) and earnings of $14.3 million Singaporean ($16 million Aussie dollars).

Tuas said it experienced a 55% increase in revenue performance over the six-month period, which was largely due to growing its subscriber base; however, its net profit after tax remained in the negatives at S$7.5 million ($8.4 million Australian).

The TUA share price had moved up 1.5% by the early afternoon, trading for $1.32 a share at the time of writing.

TUA has improved in stock value in the shorter term, but not so much in the longer term. In the past week, the stock rose 6.5%, and more than 4% in the month.

However, in the past 12 months, TUA has dropped 32%:

Source: TradingView

Tuas posts raising revenue and earnings but struggles for profit

Mother company of TPG Telecom, ASX-listed Singaporean corporation Tuas has presented half-year results for the six months of fiscal 2023, August 2022 through to end of January.

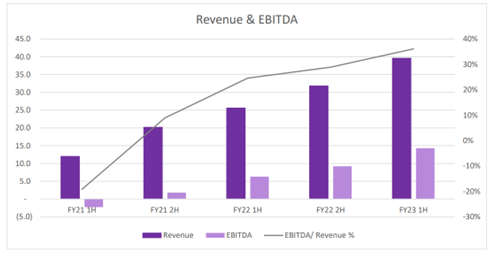

The group reported primary highlights which included revenue of S$39.6 million (AU$44.4 million), which was an improvement on the S$25.6 million pulled at the same time last year, and up on the six months prior (second half 2022) which was then S$31.8 million.

Tuas posted earnings of S$14.3 million Singaporean (AU$16 million), again up from the S$6.3 million on the same time the year before, and the S$9.3 million in earnings from the prior half year.

Unfortunately, higher revenue and earnings were not quite enough to dig the group out of a loss for the half year, with the group taking a -S$7.5 million in reported net profit after tax (-AU$8.4 million Australian).

While the group is struggling to pull itself back into profitability, this is still an improvement in net profit compared with the past two halves, where the group reported -S$13.3 million in 2H FY22 and S$13.4 million in 1H FY22.

Still, Tuas said it enjoyed a 55% increase in revenue performance over the six-month period, which was largely due to growing its subscriber base.

While increased subscribers and operating leverage boosted the group’s performance, average revenue per unit was clocked at $9.38 a month.

Tuas recorded S$43.5 million in customer sales and gained S$17.3 million in operational activities.

However, the group also posted S$22.7 went into plant assets and equipment and S$23.1 million in investments.

The group started the half with around S$49.5 million and ended with S$43.3 million.

Tuas looks forwards to expanding its broadband opptuntiies and says there will be no change to its FY23 CAPEX guidance, which remains at S$45–50 million:

Source: TUA

The next Australian drilling boom

Turning aside from the telecoms and internet sector for a moment, let’s talk about some of the most lucrative sectors for investors.

The universe of booming drillers is making huge bull market-like gains in the face of recession fear, interest rate hikes, and market volatility.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

It’s very possible indeed.

Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

Our commodities expert James Cooper has found six ASX mining stocks that are heading to the top of the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia