In today’s Money Weekend…quiet markets are dangerous…corrections create opportunities…it’s still about the bonds…and more…

The cliché about being a trader is that you are living fast, taking huge risks, and always immersed in the excitement of the markets.

Buy, buy, buy, sell, sell, sell!

Like most things in life, the truth is often far more mundane.

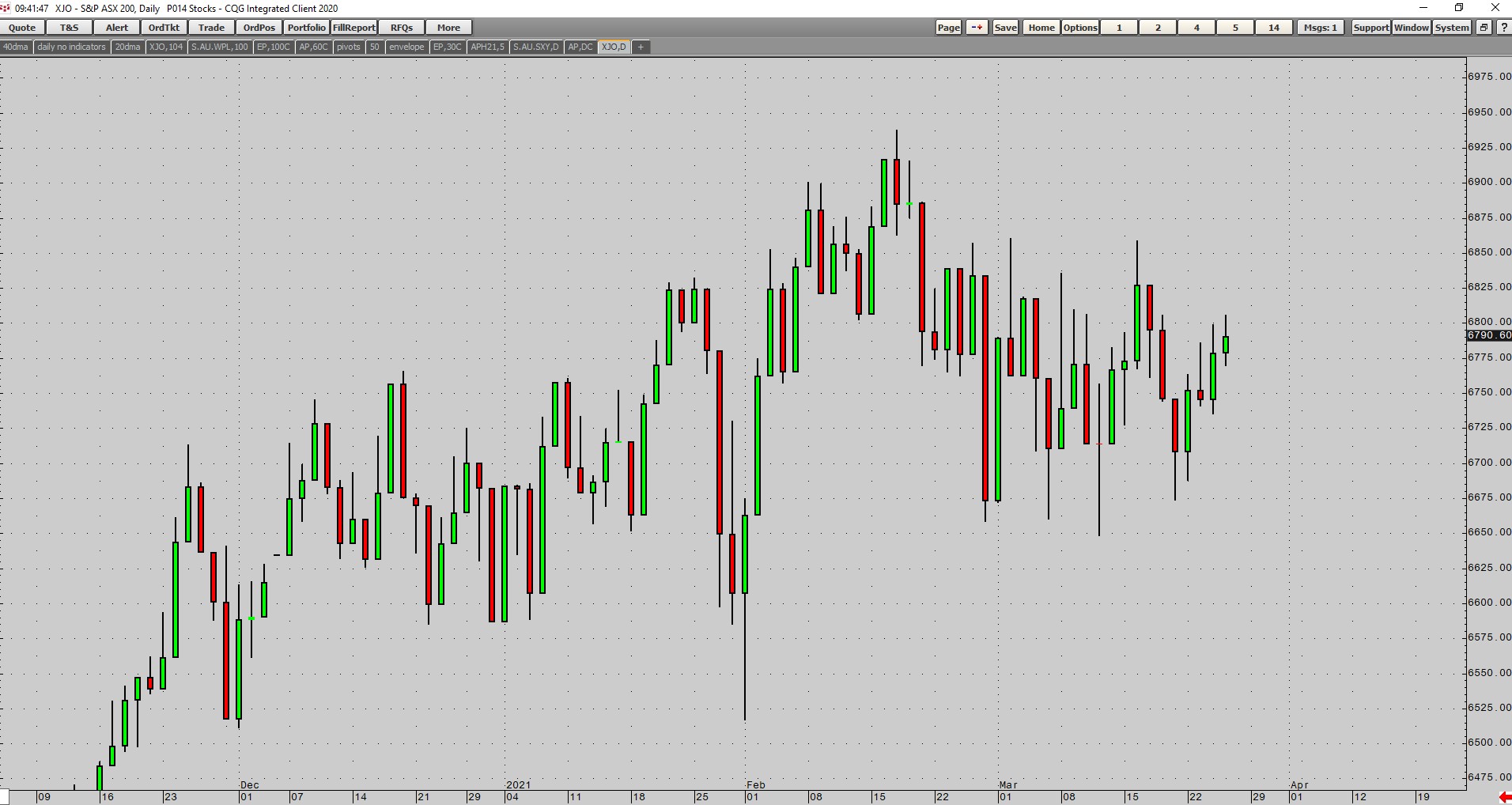

The ASX 200 has spent the last four months within a 6% range and there’s no sign that the range is nearly finished.

Snoozefest

|

|

|

Source: CQG Integrated Client |

It makes a mockery of the daily newsflash about the market. What is the point of telling people that the market was up X points today, when it is down X points the next day and hasn’t budged in months?

As a trader it’s slow markets like this that can be the most dangerous.

We all want to be active and feel like we are busy doing something.

As a slow stock market drags on and on it becomes tempting to take mediocre trades when sitting on your hands is the best option.

Rather than being a source of excitement, watching the markets can slowly wear you down.

It’s the mistakes made during quiet periods that can end up being very costly. There will be some great opportunities once this period is over, but it pays to keep your powder dry while things remain cloudy so that you are ready to pounce when given the chance.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

The ASX 200 may be treading water due to the strength in the big banks, but when you look beneath the surface there are many stocks that are slowly but surely grinding lower, shaking out any weak hands.

Corrections create opportunities

The tech stocks are under pressure and if the correction continues there may be a few bargains to be had. Zip Co Ltd [ASX:Z1P] is trading at $7.57, nearly 50% below its recent high of $14.53.

The buy zone of the most recent wave higher sits between $6.10 to $7.30, so another wave lower and a bounce and it could be worth a stab. I don’t like the look of it below $5.00 though.

In the interests of full disclosure, I have Z1P in the Retirement Trader portfolio. We bought it around $7.00 but have sold two-thirds of the position at an average price of circa $9.25.

Rather than focusing on the stocks that are having a large correction, it can be useful to search for stocks that aren’t seeing much selling pressure.

When the correction in tech stocks is over, it will be the tech stocks that no one was willing to sell during the correction that will probably have the best rally.

The list of tech stocks that are treading water during this correction are Dubber Corporation Ltd [ASX:DUB], Emerchants Ltd [ASX:EML], Money3 Corporation Ltd [ASX:MNY], Codan Ltd [ASX:CDN], and Catapult Group International [ASX:CAT].

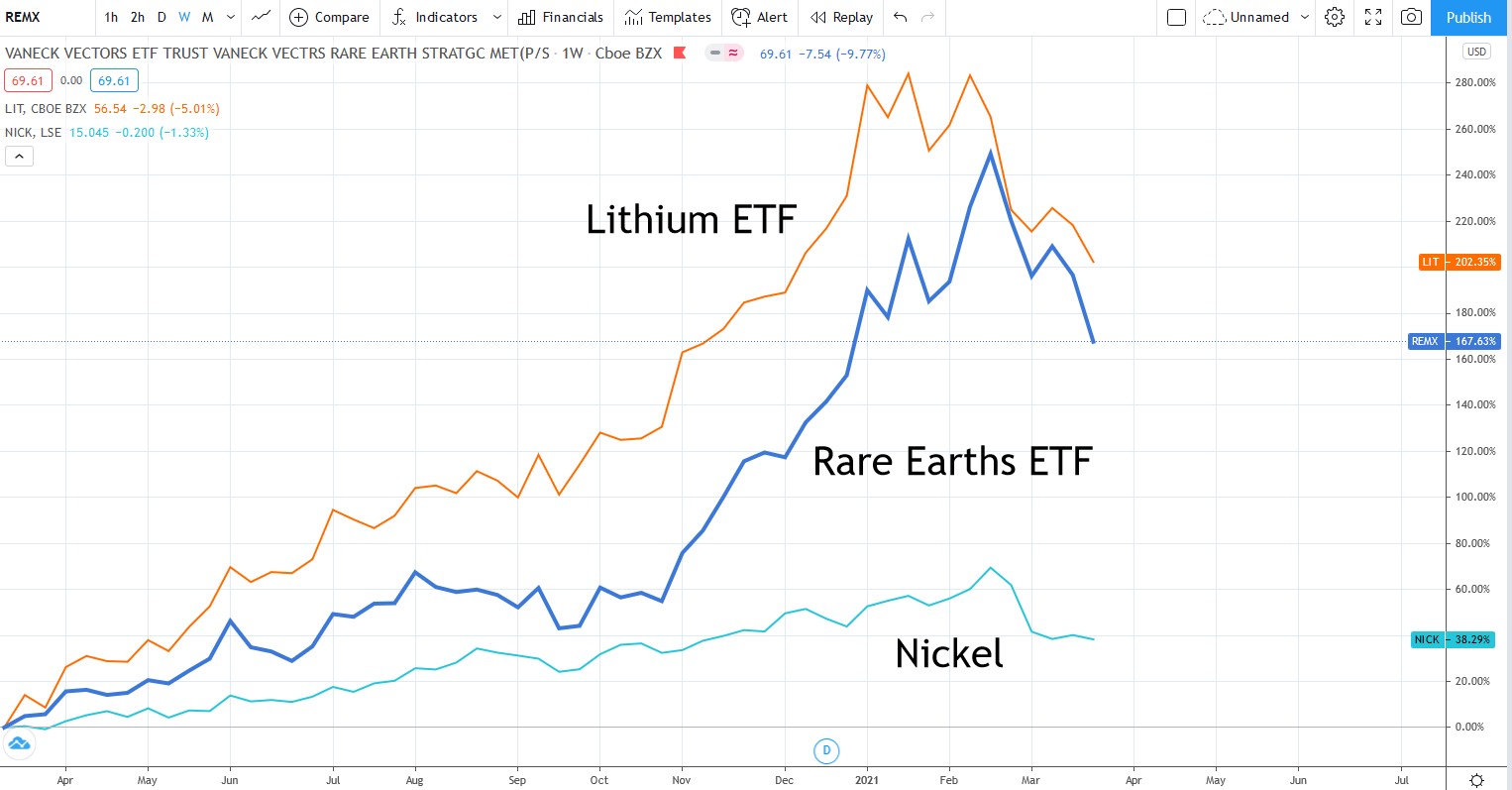

Many of the hot commodities from the past year are also coming off the boil which I think will ultimately be seen as a buying opportunity.

Rare earths, lithium, and nickel are all seeing quite strong selling pressure after a huge rally. If you believe the long-term story for battery metals and think there is a chance that we are in the early stages of a commodity supercycle, you should be cheering this correction on.

The further it falls now the better the opportunity to jump on at good levels.

Battery metals run out of juice

|

|

|

Source: Tradingview.com |

Basically, all of the sectors that have been making people money hand over fist since the crash last year are seeing profit taking.

It’s still about the bonds

The sell-off in US bonds is the culprit and it’s anyone’s guess how far that has to run. The divergence between US rates and those in Europe and Japan are getting to a point where it makes sense for offshore investors to start allocating more money to US bonds on a currency hedged basis.

So, we are seeing signs of buying in the US dollar. It looks like a monthly buy pivot will be confirmed at the end of March in the buy zone of a major wave, so until that is reversed I will be bullish on the US Dollar Index.

US dollar comes alive

|

|

|

Source: Tradingview.com |

The Point of Control (POC) of the range is at 96.00, which is a fair target on a rally from the current price of 92.80.

Commodities may continue to struggle in a strong US dollar environment, but I reckon a rally in the US dollar will only be for a few months rather than a few years.

Gold will respond to the movements in US bonds and the US dollar. It has been trying to bounce after months of selling pressure, but I remain bearish and think my target of US$1,610 is still a possibility during this correction.

If the gold price does continue rallying from current levels I think there will be a wall of selling around US$1,800, and it is not until we see a monthly buy pivot that I will shift my bearish view.

Regards,

|

Murray Dawes,

For Money Weekend

P.S: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.