In today’s Money Weekend…the religion of cause and effect…take your pick…the case for technical analysis…and more…

The mad rally in US bonds continues with yields dropping like a stone on the 10-year bond from 1.60% to a low of 1.25% in the last couple of weeks.

There are many theories floating around about the reasons why. There’s one thing I know for sure: not many people actually know the reason why despite their impressive theories.

Our constant habit of thinking in terms of cause and effect means that we are quick to latch onto an idea about why something happened. It makes us feel calm to tell ourselves that we know what’s going on.

But let’s go through a list of the many different ideas out there about why bonds are rallying to get a sense of how confusing it can be to demand a reason every time prices move up or down.

A recent ZeroHedge article stated that US bonds are rallying because:

- Traders have been short treasuries and are short covering.

- Global growth is slowing.

- Inflation expectations have fallen dramatically since March with breakevens in all maturities dropping last week.

- The pivot by the FOMC towards rising rates recently has caused fears that growth will disappoint.

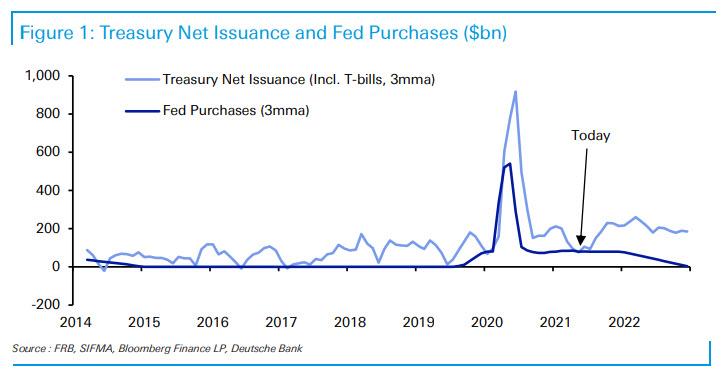

- The US Fed has soaked up the entire net supply of treasuries on a rolling three-month basis.

|

|

- There is strong demand from banks and foreigners.

- The neutral rate of interest is now so low that any hint of rising rates will push the economy into recession.

- There is persistent and rising global excess savings.

- Global fiscal policy is being wound down so future growth will disappoint.

- The Delta variant is resistant to current vaccines so future waves of lockdowns are possible which will affect growth.

- The catch up to normal growth pre-COVID has been done but future growth will be harder to come by. In other words, the ‘V’ has been completed so the easy gains are behind us.

- There are distortions in the reverse repo market resulting in a run on treasuries.

Take your pick

That’s quite a list!

Which one floats your boat?

Now that you’ve attached a reason to the recent move in US bonds, do you feel a bit smarter?

Does it help you formulate a plan of action about what you are going to do next?

What if your guess is completely wrong?

If bonds are rallying due to a short squeeze and you think they are rallying due to slowing growth, you might lower your exposure and then regret it in a few months’ time when growth and bond yields are flying again.

There are multiple analysts on Wall Street that came up with different sections of the list above. If the smartest guys in the room can’t agree why something is happening, why do you think you can read the above list and work out the correct answer?

If every twist and turn in the price of a stock/bond/index ends up with 12 different reasons why it occurred, do you think the goal of investing is to work out exactly why something happened and then make decisions based on whatever reason you chose as the right one?

I think we all suffer from inflated egos thinking that we are smarter than the next guy or girl. But when you are involved in a market that has literally millions of eyes looking at it, I reckon it is foolish to rely on your wits alone to make decisions.

That’s why the first step in my investing process is based on accepting the fact that I don’t actually know the reason why something has moved in the way it has despite my best efforts.

Socrates knew that he knew nothing, and the Delphic Oracle said he was the wisest man of all because of it.

But the dogma of financial journalism is that experts should pronounce with confidence on a daily basis why the S&P 500 went up 30 points or the dollar fell 2%, and the general public is supposed to lap it up.

I still fall for it and write articles sounding impressive about why this or that happened. But the fact is I know the answer just as much as the next person.

My whole philosophy of investing is that I need to accept my ignorance and then go from there. Then I make trading plans that are focused on when I am wrong rather than how much I can make.

I am itching to take part profits quickly so that I can create the no-lose position which ensures my original capital is safe. When you know you don’t know, risk management jumps to the top of the queue of your priorities.

When your ego is involved it needs to be right. It wants to hold onto a losing position because accepting defeat means accepting you were wrong and that hurts.

Accepting your ignorance releases you from your ego. You don’t have anything to protect because you knew you weren’t 100% sure to begin with.

The case for technical analysis

So many people write off technical analysis without ever spending the time to think about what it is. They are told in an article that it is the same as reading tea leaves and they accept the statement and that’s it.

It doesn’t matter how much you try to convince them from that point about the efficacy of technical analysis, they will remain deaf to everything you say.

For me, technical analysis is the risk management tool that I use to make clear objective decisions in a chaotic environment without any rules.

People will make investing decisions based on guessing the truth of one of the 12 answers above about the bond rally, but they will scoff at a decision-making paradigm that is based on analysing the positioning of traders in the market, which is what technical analysis is.

My technical model has been bearish US bonds but will turn bullish on a monthly close in the 10-year bond yield below 1.38%. I don’t really care what the reasons are for the rally because the line in the sand is clear, and I don’t need to overthink it.

Regards,

|

Murray Dawes,

For Money Morning

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.