In today’s Money Weekend…the ASX 200 wobbles…bullish commodities…Sprott cornering uranium…Closing Bell video…and much more…

Dear reader,

The market has been in such a relentless rally for so long that a 168-point fall in the ASX 200 in one day is worth sitting up and taking notice of.

There’s no need to panic yet, but the ears should be pricked up ready to act if the selling continues and a larger correction takes shape.

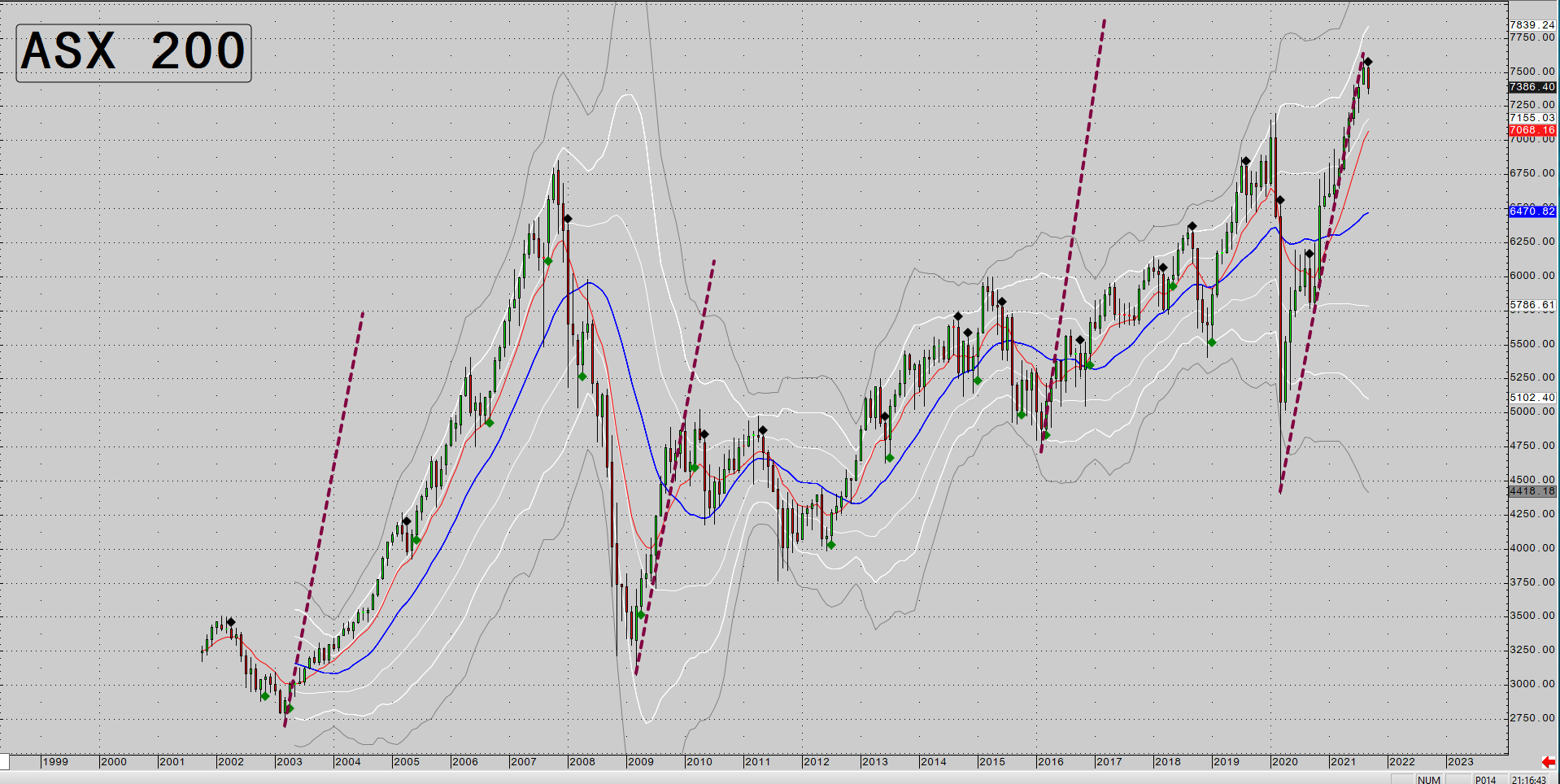

The size and pace of the rally since the COVID crash has been truly impressive. In the chart below I have added lines showing you the current rally from previous lows in the market over the past 20 years.

It gives you a sense of how incredible the current rally has been.

Impressive rally post-COVID

|

|

| Source: CQG Integrated Client |

We shouldn’t be surprised to see a bit of a correction after such a big rally.

Taper is getting closer by the day and there is no doubt volatility will pick up as we head towards that announcement.

I’m not saying the bull market will be over, but a correction to the 20-month simple moving average, which is a fair target on a serious correction, is 12% below where we are trading now. A fall like that could hurt if you are overleveraged.

I’m not doing much selling yet because I’ve already been taking part profits in many positions on the way up, so I want the market to really prove to me that it wants to go down before I will sell any more stocks.

I’ll wait to see how things are looking at the end of this month. If we get a monthly sell pivot confirmed in the ASX 200 (a closing price below 7,415 at the end of September), I may take some more money off the table.

But, until then I must give this current rally the chance to surprise to the upside.

Bullish commodities

There are certainly a few sectors of the market that look bullish. Aluminium and nickel are looking as strong as an ox. I said last week that nickel looked like it was itching to break out to multiyear highs.

That happened this week with the price hitting $18.78 on Thursday evening, our time. A six-year high.

Nickel breaks out

|

|

| Source: Tradingview.com |

For the last few years, a new high has been a precursor to a sell-off. I may be wrong, but my gut feel is that nickel is about to surprise to the upside instead.

Aluminium prices have taken off to the upside with the coup in Guinea possibly disrupting supplies of bauxite.

AWC Ltd [ASX:AWC] has been the beneficiary, jumping 32% over the last couple of weeks to $2.20.

The uranium market remains the most interesting space to watch in my view. It’s a fairly small market (US$6.3 billion), so there is the chance prices can fly around aggressively if market fundamentals change.

Sprott cornering uranium

ZeroHedge reported during the week that since the launch of the Sprott physical uranium trust (SPUT) at-the-market program (ATM) a few weeks ago, it had acquired 2.7 million pounds of uranium. That’s roughly a third of annual production.

An at-the-market offering is described on Wikipedia as:

‘A type of follow-on offering of stock utilized by publicly traded companies in order to raise capital over time. In an ATM offering, exchange-listed companies incrementally sell newly issued shares or shares they already own into the secondary trading market through a designated broker-dealer at prevailing market prices. The broker-dealer sells the issuing company’s shares in the open market and receives cash proceeds from the transaction. The broker-dealer then delivers the proceeds to the issuing company where the cash can be used for a variety of purposes.’

So it looks like investors buy shares in the Sprott fund and they take the money and buy uranium.

In a small illiquid market that is on the edge of shifting from over- to undersupplied, buying from SPUT could have a serious effect on the price of uranium. Especially if a rising trend in uranium prices causes more buying in SPUT which leads to more buying in uranium.

There are also murmurs from Japan that they may be interested in firing up some ‘safe’ nuclear reactors at some stage.

As reported in ZeroHedge:

‘On Wednesday, shares of Japanese utility companies surged after Taro Kono, the administrative reform minister and the most likely candidate to replace Yoshihide Suga as prime minister, said Japan needs to restart nuclear power plants, in order to realize its goal of achieving carbon neutrality by 2050.’

It goes without saying that if those words became a reality, the fundamentals for uranium would become very bullish indeed.

The price of uranium remains well below the levels it needs to get to, to bring new production online, but the conditions are looking ripe for a sustained rally in the uranium price.

We have already seen a strong rally in uranium stocks over the past year, but you should keep your eye on a few of them in case they have a correction that allows you to get in at a fair level.

Boss Energy Ltd [ASX:BOE], Paladin Energy Ltd [ASX:PDN], and Deep Yellow Ltd [ASX:DYL] are the ones to watch in my view.

My trading service Pivot Trader has Paladin Energy Ltd [ASX:PDN] in the portfolio.

Continue below to watch my Closing Bell video where I give you detailed technical analysis of nickel and aluminium and show you a few stocks in each sector to add to your watchlist.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.