In today’s Money Weekend…ducks lined up…value stocks to shine…Retirement Trader membership open…and more…

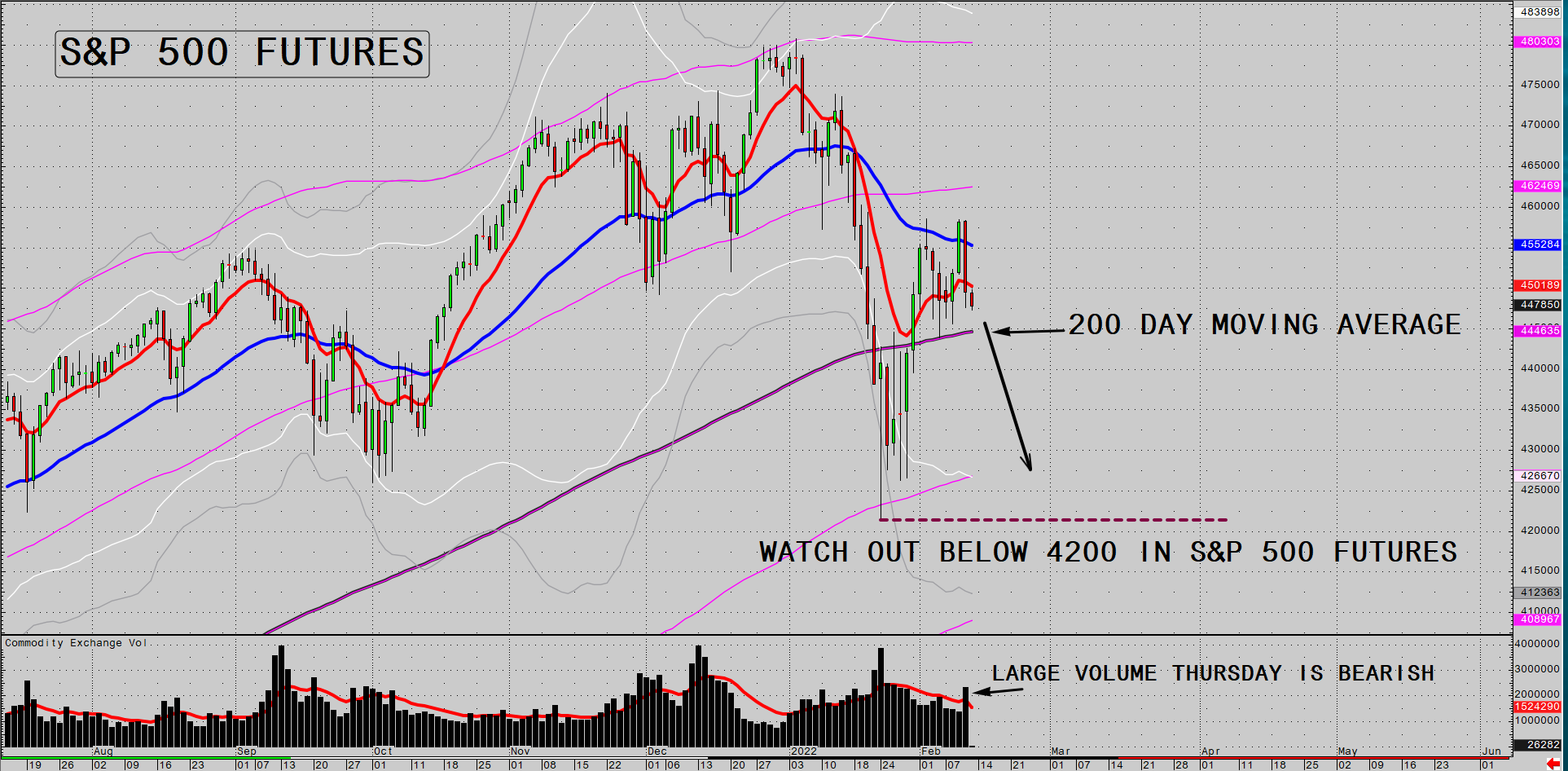

Last week I warned you not to buy the rally because I expected plenty of resistance in the S&P 500 near the 20-week simple moving average now that the trend has turned down on the weekly charts.

The shocking CPI figures released on Thursday evening our time saw bonds sell-off aggressively. I have been warning you that 10-year bond yields would spike higher rapidly once they headed above the 1.8–1.9% region, and that is happening now.

I showed you the weakness in the High Yield Corporate Bond ETF [NYSE:HYG] last week, and the bonds have continued to sell-off further this week.

We now have a technical set-up in equities that is quite dangerous.

The S&P 500 is poised just above its 200-day moving average (on Friday afternoon), having already breached it once recently. Another leg lower could ignite some furious selling pressure that could take the S&P 500 back down to the low reached a couple of weeks ago.

If the selling continues through that low, all hell could break loose.

Dangerous set-up

|

|

|

Source: CQG Integrated Client |

The market rarely moves in a straight line, so we could expect to see further volatility before a major wave to the downside occurs, but enough ducks have lined up to make me wary about what is to come.

The terrible CPI figures have even created the possibility that an emergency rate hike occurs before the FOMC’s scheduled meeting in March.

When a market is caught completely off guard by developments, you can be surprised just how far and fast prices can move before finding some equilibrium again.

My view is that the huge rally we saw post-COVID was due to the fiscal stimulus used to prop up the economy. I also think that is what has ignited inflation, rather than the mainstream view that inflation has been caused by COVID supply chain disruptions.

The path of the US yield curve is still the thing to keep your eyes on. The last time US 10-year bond yields were at 3% in late 2018, equities were 40% lower.

The US 10-year bond yield has just broken out above 2%, so we are a long way from 3%, but as rates keep rising, the effect on equities will become more pronounced. If yields start spiking higher at a fast pace, I expect to see some large moves to the downside in equities.

We haven’t reached that point of panic yet, and it may not arrive for many months. But as inflation marches higher and the Fed prepares to chase it down, the market could be caught flat-footed as the air seeps out of the bubble blown by easy money.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Value stocks to shine

It’s not all doom and gloom. As traders, we want prices to fly all over the place because that usually gives us great trading opportunities while others are panicking.

The rotation from growth to value will probably continue and there are plenty of stocks out there with solid projects that will end up spitting out reliable chunks of cash for many years to come.

That’s the type of stock I have been focusing my attention on for members of my trading service Retirement Trader.

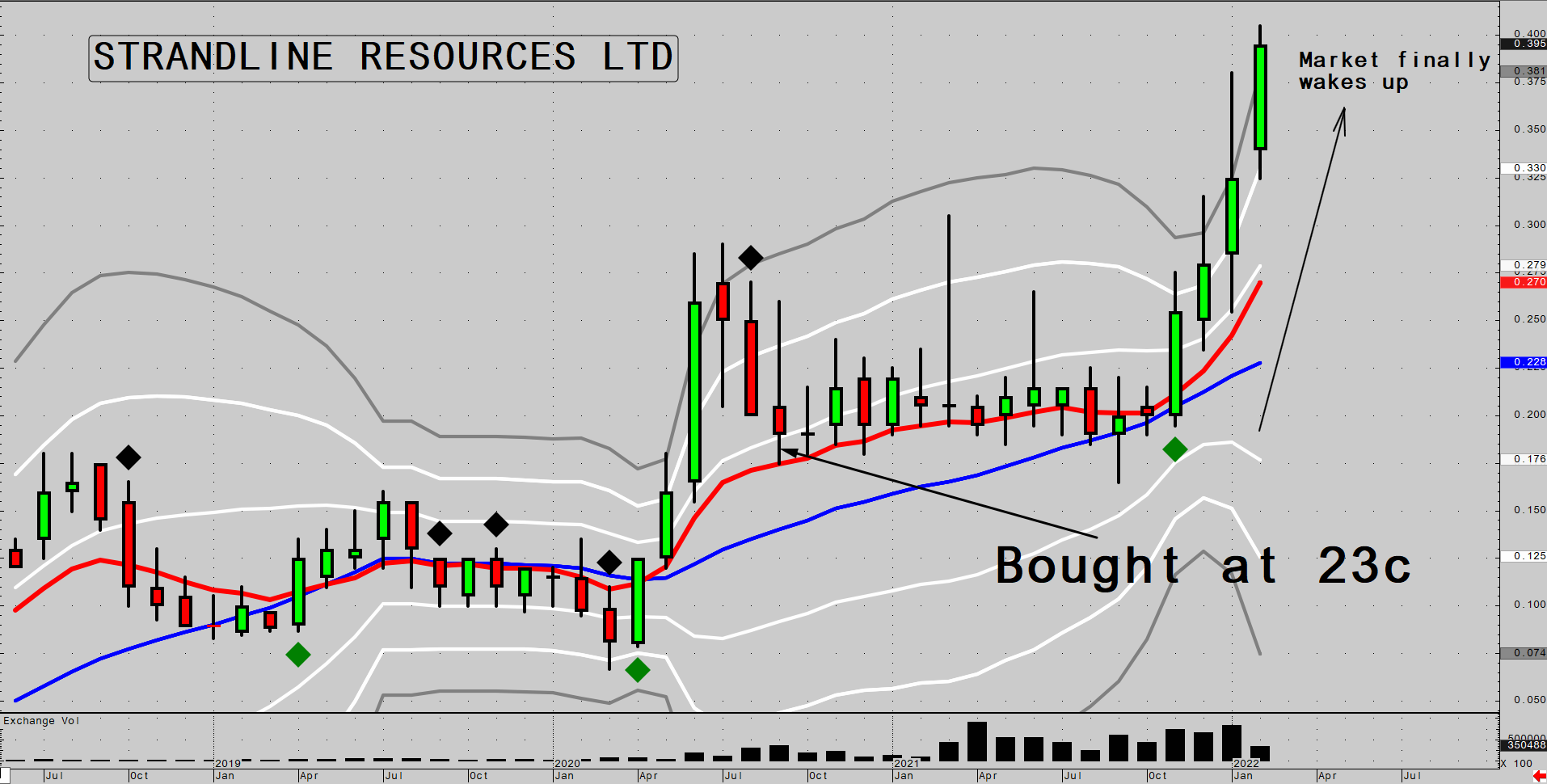

We bought a little-known stock called Strandline Resources Ltd [ASX:STA] in September 2020 at 23 cents. We had to sit on it for ages with the price going nowhere fast.

But now that their mineral sands project is in the construction phase, the market is turning its attention to the great economics of the project and the long mine life that will be churning out an EBITDA of around $105 million for 22 years!

Strandline takes off

|

|

|

Source: CQG Integrated Client |

So even though the general market is looking soggy and could have a lot further to fall, there are pockets of the market still catching a strong bid.

Retirement Trader members have just entered another stock that is in a similar situation to STA a couple of years ago. I reckon the opportunity is even larger. They will have a 30-year mine life and the expected EBITDA at full production is $645 million!

The Net Present Value of the project is $4.5 billion, with an IRR of 42%, and yet the current market cap is just over $300 million.

I can’t tell you the name of the stock because we are still buying and will buy more if the price falls during the coming correction.

Retirement Trader membership open

If you want to find out the name of the stock, all you have to do is join Retirement Trader. Simple.

You get a month to kick the tyres and can get your money back, no questions asked, if you decide not to stay on.

I have put together a video that outlines my strategy in detail so you can understand how I have been able to predict the equity market correction and the jump in bond yields well before they happened.

Please check out the presentation if you have been enjoying my articles and Closing Bell videos. Otherwise continue below to watch my latest ‘Closing Bell’ video where I show you how things could play out as bond yields rise.

Until next week,

|

Murray Dawes,

Editor, Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.