In today’s Money Weekend…everything you do has to be mapped out beforehand…fading the false breaks is a powerful strategy…trading the widening distribution…and more…

A trader has to keep their wits about them at all times. The market takes no prisoners.

If you get too cocky you will be brought down to size before long. If you lack confidence in your decisions, you will miss great trades.

If you don’t like facing your problems, your problems in the market will keep growing until you have no choice but to face them.

Trading markets holds up a mirror to yourself. Often we don’t like what we find.

Some people sit on top of a mountain for 10 years to find themselves. My greatest teacher has been the markets.

The only path through the mental battlefield is to remain humble. By remaining humble you remain open to the information that is coming your way.

If you think you know more than you do you will never learn the necessary lessons and will spend your time blaming external events for your results.

‘If the crash didn’t happen I would have made so much money this year.’

‘The high frequency trading algorithms keep stealing money off me.’

‘I’m sure the brokers know where the stop-losses are and hunt for them. You can’t win.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Everything you do has to be mapped out beforehand

Our egos are always fighting for survival and so they will do all they can to protect you from some honest self-assessment.

The state of your P+L is as honest an assessment of your behaviour as you can get.

If you are living in denial the trajectory of your P+L will either be highly volatile, or it will head in one direction. Down.

When you are in the heat of battle you have to accept the fact that your rational self has gone on holiday.

Everything you do has to be mapped out beforehand. And you have to trust your plan so implicitly that you act like an automaton as events unfold.

The only way you get to that point is through trial and error. Once you have made a million mistakes, seen the outcome and written it down in your trading journal (and reviewed your past actions on a regular basis), then you finally cotton on that your trading rules exist to save you from yourself.

My technical analysis theory has one goal in mind: To help me plan trades effectively. I know I’ve said it before but it’s worth repeating; I’m not trying to predict the future.

I’m using technical analysis as a risk management tool.

I want to get to the point where I’m not risking my initial capital as quickly as possible.

That’s the defined goal I have set for myself.

Not to work out what the earnings of the company will be next year and whether management is good enough to execute.

I will have views on all of those issues, and I think fundamental analysis is just as important as technical analysis.

But there is plenty of conjecture in fundamental analysis. Lots of assumptions about the future.

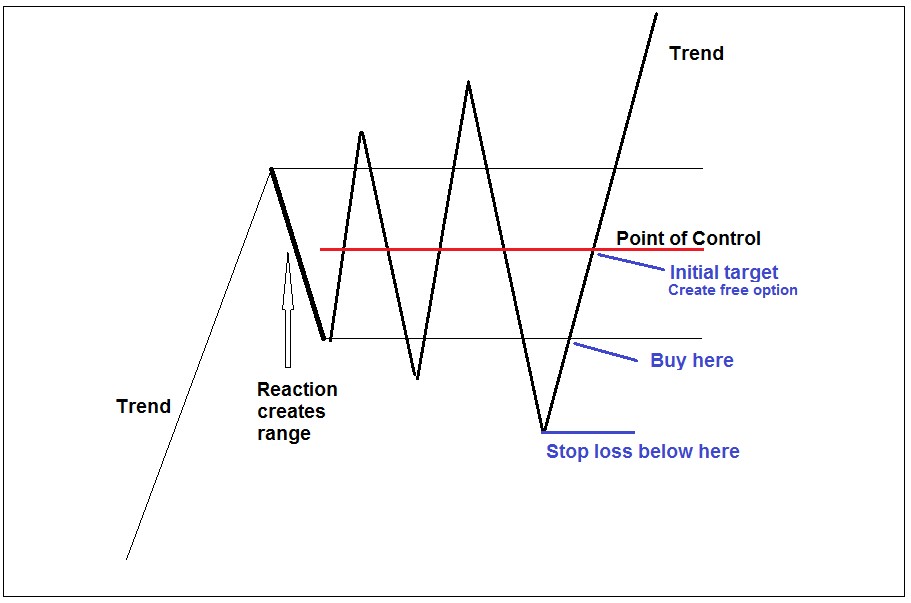

My technical analysis model is black and white. I am proven wrong if X happens. The initial target is the middle of a range and I will sell a third of the position there.

Then I move my stop-loss to a point where I will breakeven on the whole trade and get a free look at what’s coming next.

When I discuss seemingly complex ideas about widening distributions and mean reversion or map out how trends develop, keep in mind that it all revolves around one simple goal…

Reaching the initial target as quickly as possible with a high level of probability.

Fading the false breaks is a powerful strategy

So, let’s move onto another of the key characteristics of widening distributions.

Here is the list again for you and if you want to read my past articles you can find them here:

- Amateurs buy in the top half and sell short in the bottom half

- Amateurs are uncomfortable at the Point of Control (POC)

- The market gravitates back to the POC often to shake out traders

- The size of the false break is related to the size of the initial range

- Once prices hit double the size of the range the distribution is over

- The best entry point is 61.8% outside the range against the trend and 25% outside the range is also useful

- Fading the false breaks is a powerful strategy based on risk/reward

- There are areas within the range that often see reversals to the POC. They are known as buy and sell zones and the calculations are 12.5–25% and 75–87.5% retracements of the initial range

- Calculations for buy and sell zones within a range also work for retracement of waves in a trend

- Prices will revisit the POC for one last time before blasting off in a new trend

- You can use the characteristic of mean reversion to lower your average entry price

- After about five false breaks of the range the probabilities increase that a continuation or reversal of the trend is close

Number seven above says that fading the false breaks is a powerful strategy based on risk/reward.

What do I mean by that?

If a range is being created and the bottom of the range is breached, as I have been saying, there are lots of stop-losses that go off and buyers back off because of the strong selling.

Once the selling is done and traders who want to get short on the break below the level are done, it is quite amazing how quickly prices can bounce and return to the range.

That’s because the selling was finite and the buyers who had backed off return to find there isn’t much on the offer. There is a selling vacuum and prices can move rapidly back towards the POC.

If you act quickly enough you can enter a trade and ride the wave to the POC, where you take part profit.

It looks something like this:

Trading the widening distribution

|

|

|

Source: Port Phillip Publishing |

Once the stop-losses have gone off and prices return to the range or give a clear reversal signal (you’ll be learning about those next week), you can enter a trade with a tight stop-loss.

You know very quickly if you’re wrong and that’s the best thing you can know as a trader.

If prices turn straight back down and bust below the recent low (see picture above) you can exit the trade for a small loss. If prices do gravitate to the POC, you can take part profit and set yourself up in a strong position to see what’s coming next without risking your initial capital.

Then if the previous uptrend does continue you are in the box seat, riding the trend higher.

There are many ways to skin a cat and this example is just one of the ways that you can use my technical theory to enter trades.

I am starting out with simple ideas and giving you a general overview that some of you may have read before. I want to ensure that as I go deeper into the theory that everyone is on the same page or at least has a resource of articles that they can study to get them up to scratch.

Making money in the markets consistently isn’t easy. If you want to understand how I have developed my own approach to trading markets, keep tuning in every Saturday and I will show you things that you can apply to your own trading for better results.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Make Profitable Trades, More Often — I reveal my unique trading strategy designed to help you clock up steady gains in any market, while limiting your downside risks. Click here to learn more.