In today’s Money Weekend…Meta crashes…don’t buy the retest…junk bonds nosedive…Pivot Trader presentation…and more…

After eight months of twiddling my thumbs and getting monumentally bored by the price action in equity markets, we are finally out the other side and witnessing explosive moves.

On Thursday night, US markets got belted all day long and the S&P 500 was down 4% on the back of the weak Meta Platforms Inc [NASDAQ:FB] (formerly Facebook) results.

I’m sure you already know that Meta was down 26% on the day, which was an immense move for such a huge stock.

Then in the aftermarket, Amazon.com, Inc [NASDAQ:AMZN] released good results and the stock leapt 18%!

Stocks rallied in a straight line from there.

It’s a washing machine out there, and as a trader, you have to keep your wits about you.

We are now in a phase where the market behaves as if it is in fast-forward. Moves that would usually take weeks to take shape can happen overnight.

Daily volatility is far higher than normal so it can be easy to get fooled by large moves.

Just because the market is up 2% doesn’t mean it won’t turn around and drop 4% in the blink of an eye.

The main point I would like to get across in a market like this is that momentum has turned down in the short term and there could be more to come, so beware the bull traps.

There are still plenty of ‘buy the dippers’ who think the market is going to shoot back up straight away (it could). There are also plenty of traders trying to get short.

That can lead to explosive short squeezes that get traders bullish and shake the shorts out of their positions.

The thing to watch is how markets behave once they have rallied back to the main moving averages.

Don’t buy the retest

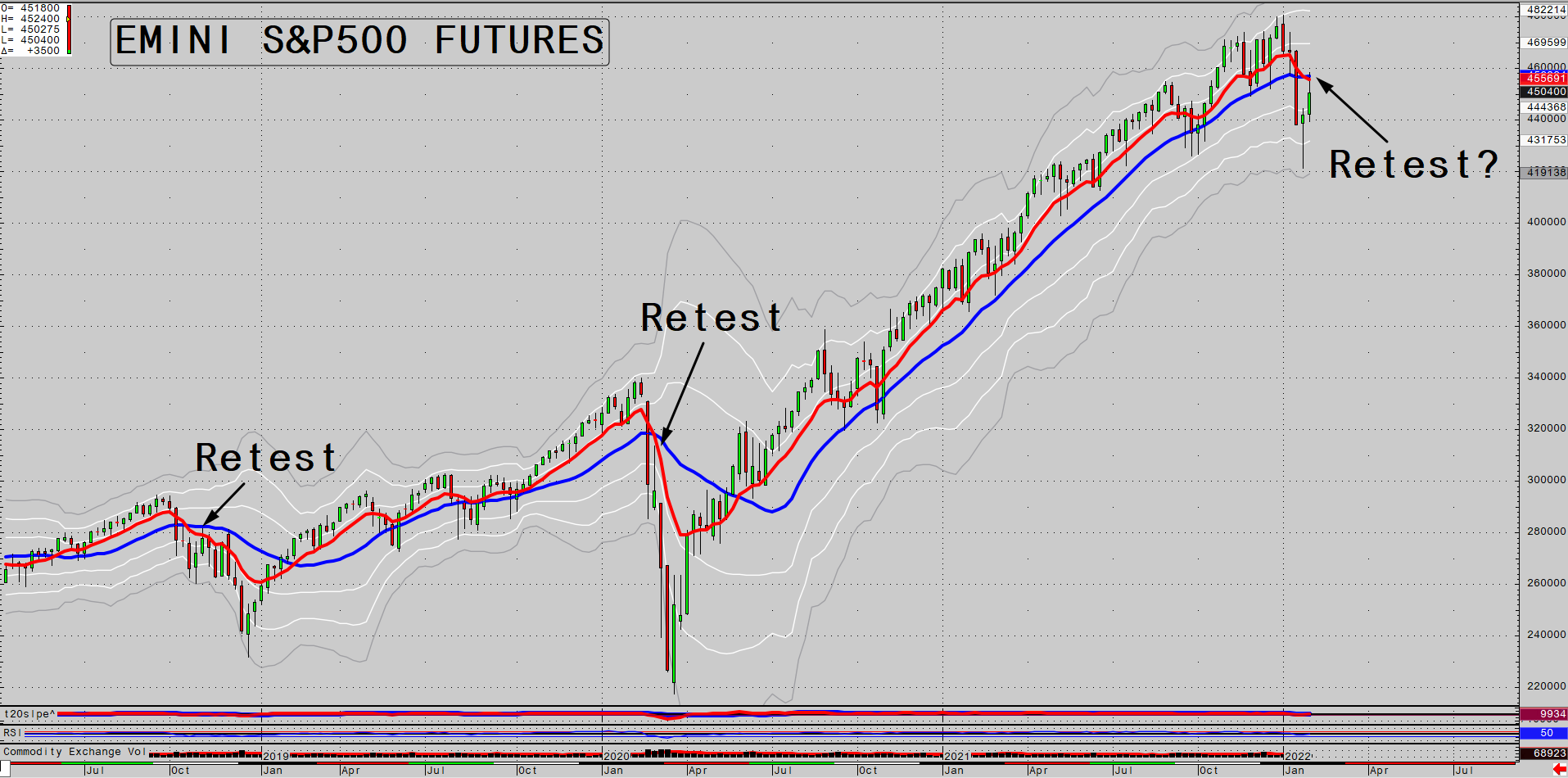

I currently have my eye on the weekly charts because the weekly trend has finally turned down after spending 20 months in an uptrend.

I use the 10-week exponential moving average (MA) and the 20-week simple MA to gauge the weekly trend.

After an initial impulsive sell-off that has broken the back of the uptrend, you usually see a rally back towards the 20-week MA. If the selling returns from there, things can go pear-shaped quite quickly.

Third time unlucky?

|

|

| Source: CQG Integrated Client |

The chart above shows you the last couple of times the weekly trend turned down in the S&P 500. Look at what happened after prices went back to retest the major moving averages after the trend had turned down.

The 200-day moving average is just below current prices (it’s midday Friday currently), so there are some pretty serious dominoes lined up beneath the market that could cascade into a large fall.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Perhaps the Amazon results are enough to ease the bloodletting for now and we will see continued consolidation, but I reckon there are a few signs saying that a few good results aren’t going to be enough to stop the exodus out of way overpriced tech stocks.

The Bank of England (BOE) raised rates 25bps on Thursday and the ECB is making noises that they are concerned about inflation and will be raising rates this year.

German 10-year bond yields finally jumped back into positive territory and Italian and Spanish bond yields spiked higher.

High-yield bonds are also selling off. The iShares High Yield Corporate Bond ETF [NYSE:HYG] is looking very sick indeed.

Junk bonds nosedive

|

|

| Source: Tradingview.com |

I’m not sure what happened on Friday night in the US, but if stocks turned back down again and sold off below the previous night’s low, I reckon the fall could have been big.

I have been offloading a bunch of stocks personally in case things do turn back down.

Pivot Trader presentation

I will be giving a presentation next Thursday outlining the nuts and bolts of my methodology for you. If you have been enjoying my articles and the ‘Closing Bell’ videos that I send you every Saturday, I’d love it if you could spare the time to check it out. I wanted to give regular readers of ‘Trader’s Corner’ the opportunity to sign up for it.

The presentation includes the latest trade recommendation I just sent out to members of my service Pivot Trader. And you can get that trade for free no matter what. All you have to do is watch the presentation next Thursday.

You don’t have to spend any money to get it. There’s no smoke and mirrors.

I send out trade alerts with a three-star conviction rating so members can gauge how much I like the trade. I rarely give three stars for a trade as I reserve them for the very best opportunities. I only sent two three-star conviction trades last year.

The trade I just sent out was a three-star conviction trade in a little company that I reckon will be multiples higher within a couple of years.

So I really hope you’ll join me next Thursday to understand more about how I help members of my service make successful trades.

If you’ve been reading my articles for a while, you should know that I’ve been warning you about the correction for months before it happened. That’s valuable info.

The presentation will give you some insights into how I predicted the correction before it happened.

You can register for the presentation here and then we will remind you before it gets started next Thursday at 11:00am AEDT.

Check out my Closing Bell video below where I go into more detail about the current bearish set-up and show you what to expect as the correction unfolds.

Until next week,

|

Murray Dawes,

Editor, Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here