In today’s Money Morning…hot or overheating?…Pilbara Minerals running hard…beware the false outbreak…a live trade…and more…

Hot or overheating?

There is plenty of action in certain sectors of the market at the moment. The battery metal/green energy theme has gone into overdrive with punters chasing anything with a shade of green.

Many other sectors have been drifting on light volume as you would expect just after Christmas.

If you haven’t been participating in the rally you are probably starting to feel a bit of FOMO (fear of missing out).

If there’s any advice I could give you right now, it’s that it rarely pays off to chase stocks that have already doubled or tripled in a few months.

Pilbara Minerals running hard

The lithium stocks are now pricing in a lithium price well above where it is currently trading. Things are starting to look a bit hot.

PLS looking stretched

|

|

|

Source: CQG Integrated Client |

The trading model I have been teaching you about in these ‘Trader’s Corner’ articles is based on waiting until traders and investors have been shaken out of positions and then jumping on as soon as momentum turns.

Pilbara Minerals Ltd [ASX:PLS] is a great example of the types of trades I look for. The green box above is just the 75–87.5% retracement of the whole wave higher in PLS from listing in 2014 to the high reached in late 2017 (labelled ‘2’ in the chart above).

That’s what I call the ‘buy zone’ of the wave because it’s the point where most traders have given up hope and exited positions that they entered during the rally phase. If you see a shift in momentum from that zone, there’s a higher probability that it could turn into something bigger than a short-term rally.

The sell-off in PLS took two years to complete and prices fell from $1.25 down to a low of 13.5 cents. That is quite a fall.

If you had bought the stock at say 50 cents in 2016 and ridden the price up to $1.25 and then watched it sell-off slowly for two years to 13.5 cents, I’m guessing you would have given up in disgust and dumped the stock at some point.

That cyclical process of traders being tempted into positions on large rallies and then shaken out goes on all the time.

Would you like to buy PLS near the buy zone in the chart above or buy it now as it breaks out to new all-time highs?

[conversion type=”in_post”]

Beware the false breakout

The other thing I have been teaching you in these articles is that prices have far more false breaks than breakouts. Amateurs are well known for chasing breakouts. They’re cannon fodder for professional traders.

Look again at the chart above and imagine how prices looked as they broke out above the high reached at ‘1’ and rallied towards ‘2’ (the arrow in the chart above). That’s when amateurs were falling over themselves buying the stock.

Then the music stopped and a false break of the high at ‘1’ occurred and a new downtrend developed, slowly shaking out all the traders who had paid too much for the stock.

We’re in a similar position now with prices having spiked through the old all-time high at ‘2’ ($1.25), after rallying 300% in three months.

If you know that false breaks happen more often than not, what do you think the chances are that PLS sails through the old all-time high and keeps rallying?

Even if prices are ultimately heading higher, it should be odds on that we’re close to seeing a correction of the immense rally which will shake out loose hands.

If you are feeling a bit of FOMO because you aren’t riding the hot sectors, don’t jump out of the frying pan and into the fire by chasing stocks that may be close to a correction.

A live trade

It’s all well and good to show you a chart and tell you where you should have bought the stock. We can all do that. Harry Hindsight is the best trader in the world after all.

So, I will show you an actual trade sent to members of my trading service Pivot Trader.

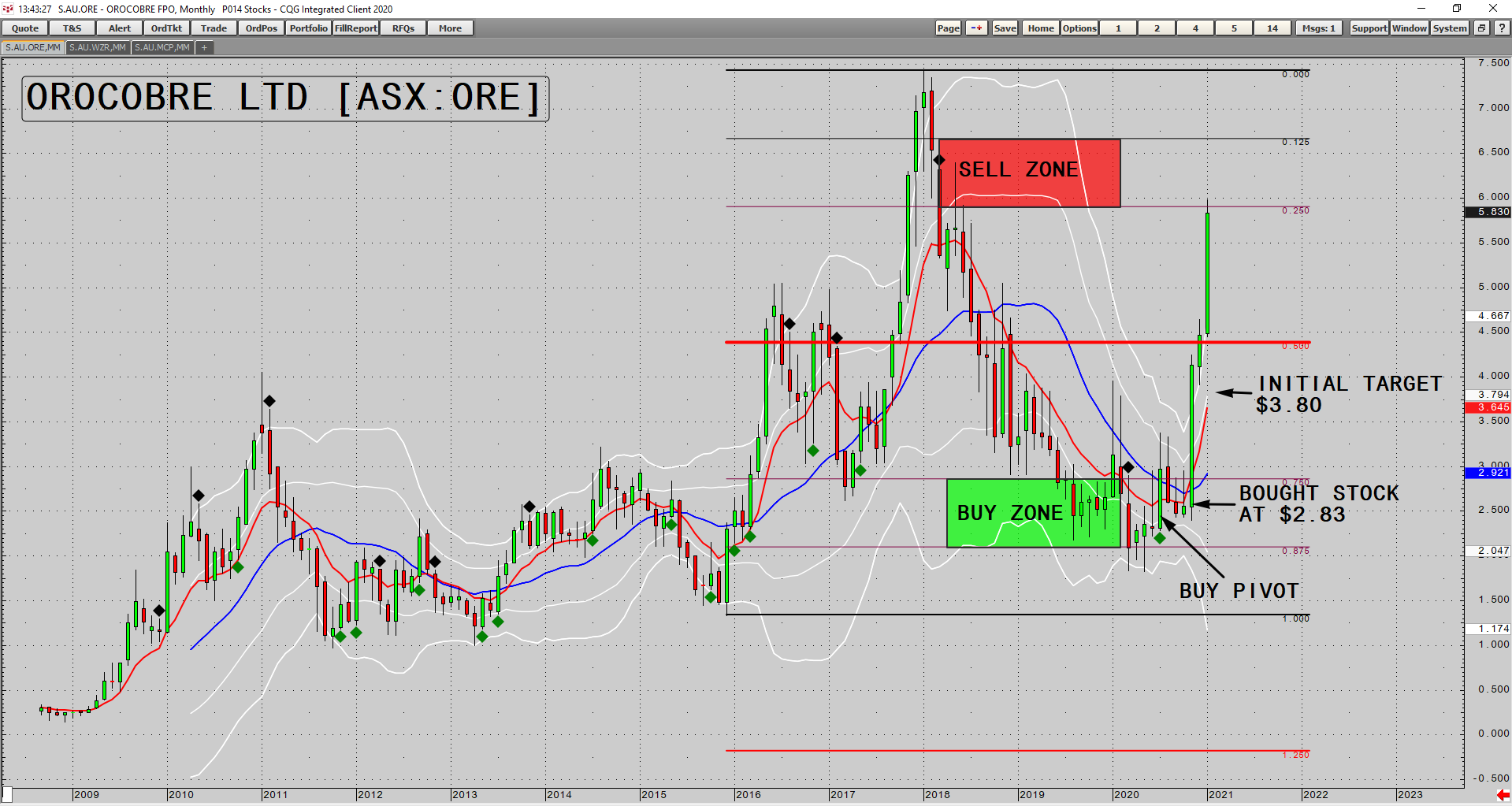

We managed to jump on another lithium stock Orocobre Ltd [ASX:ORE] before the huge rally started.

A live trade

|

|

|

Source: CQG Integrated Client |

The set up was similar to PLS in that a large correction had taken prices right back into the buy zone of a major up wave.

I waited until I saw confirmation of a monthly buy pivot to give me a sign that momentum was shifting, and then I made another calculation which gave me the exact entry price and we jumped on at $2.83.

We actually spent nearly two months slightly underwater on the position but then the fireworks began, and prices launched into orbit.

We then sold a third of the position at the initial target of $3.80 and remain long the rest.

Blindly chasing stocks higher is the easy path. Delving a bit deeper into the mechanics of price action and the logic behind it can get you set well before the hoards have cottoned on. And then you are taking profits just as the frenzy starts.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Make Profitable Trades, More Often — Trading expert Murray Dawes reveals his unique trading strategy designed to help you clock up steady gains in any market, while limiting your downside risks. Click here to learn more.