In today’s Money Weekend…listen to the market…energy crisis erupts…20% in a week…US bonds under pressure…and more…

In last week’s article I gave you an overview of the technical situation in the S&P 500. I said that:

‘We could see the weekly chart flip to positive next week and then the rally will continue. But until then I will reserve my judgment and remain a little wary that more selling could be coming.’

I finished the article by saying:

‘I am responding to the short-term weakness in the weekly charts and taking a few profits off the table in case it is a hint that there is more selling to come.’

It looks like that hint was worth listening to because the selling did return, and we are now in a situation where important technical levels are being breached, which could lead to a sharp correction.

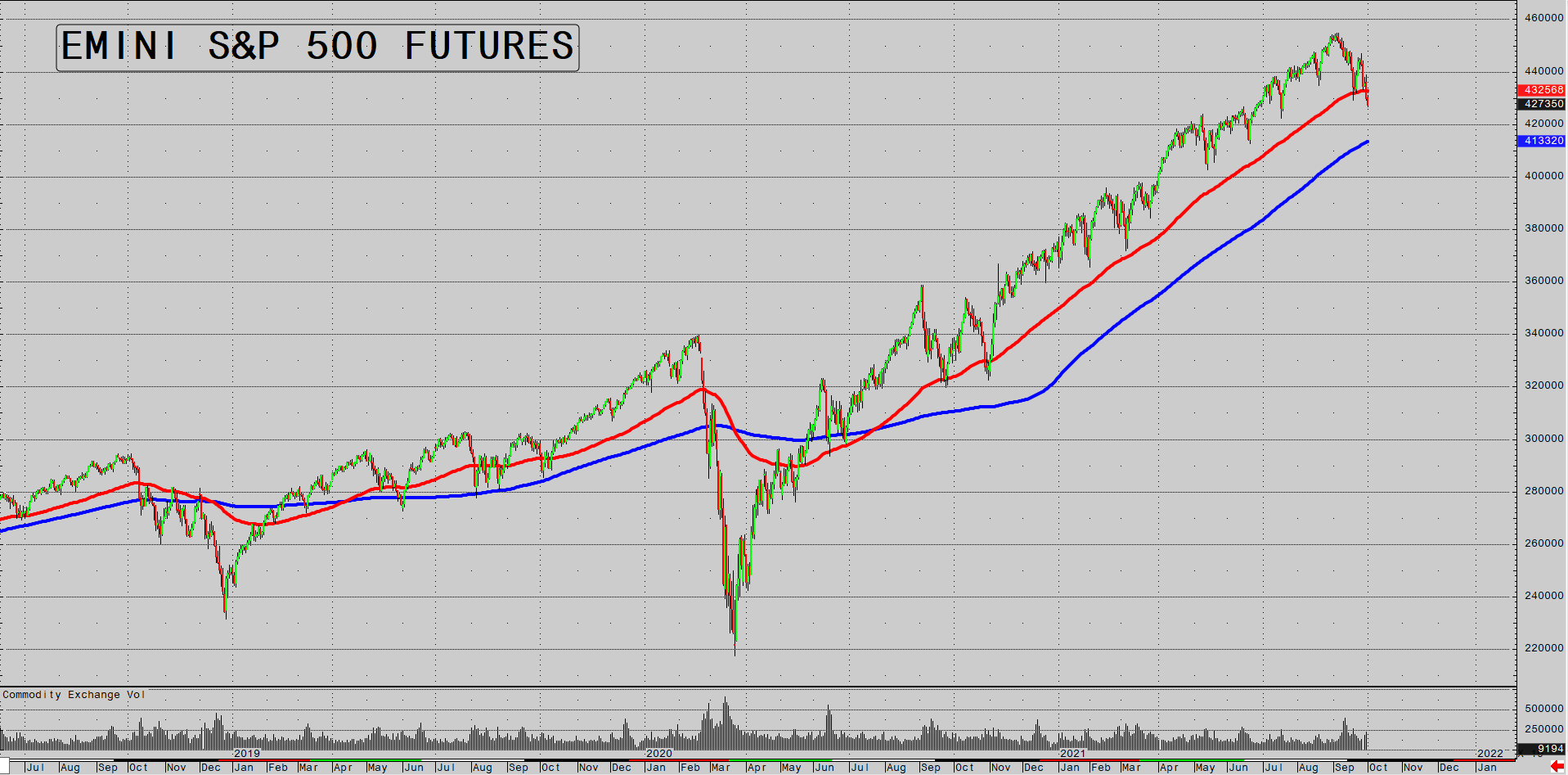

The E-mini S&P 500 futures have cracked below last week’s low of 4,293.75 in the overnight market (I wrote this article on Friday), which is also the current level of the 100-day exponential moving average (EMA).

That has provided support for the rally since the COVID crash.

100-day EMA about to break

|

|

|

Source: CQG Integrated Client |

A fair target on a correction would be to the 200-day simple moving average (SMA). That sits at 4,133, which is 3% below current levels. So we could get there in a matter of days.

The big question is what happens at the 200-day SMA. You can see clearly in the chart above that the 200-day SMA is an important moving average to watch (the blue line). While the market holds above the 200-day SMA, the trend to the upside remains strong.

But when the 200-day SMA gives way, prices can plummet.

I told you last week that the 10-month EMA was an important moving average. That is very similar to the 200-day SMA, since there are five days in a week and about four weeks to a month.

The market is currently way overstretched to the upside due to the relentless money printing from the US Fed. We are heading into the riskiest month of the year, October, and the Fed has said we are getting close to a taper.

Energy crisis erupts

We are also getting daily news about various countries struggling under the pressure of the energy crisis. Gas prices in Europe and Asia continue to skyrocket. Energy retailers are going belly up in the UK. China is experiencing rolling blackouts and the Chinese leadership has instructed energy firms to secure winter supplies at all costs.

The current oil equivalent price of gas in Europe is approaching US$200 a barrel! The price of oil and coal, as substitutes for gas, must start to rise alongside the panic spike in gas prices.

Cheap energy is the lubricant that keeps our civilisation afloat. With growth bouncing back post-COVID and the immense experiment to shift our energy mix towards renewables gathering steam, the risk of a market dislocation in the energy markets is rising.

Even if the current spike in gas prices worldwide dissipates over the next few months, I think it is a canary in the coalmine saying that the transition to renewables won’t be as seamless as people hope it will be.

How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.

20% in a week

I gave you two stocks in my ‘Closing Bell’ video last week that I thought should start to perform well in the current environment. Beach Energy Ltd [ASX:BPT] jumped 20% since that video from $1.20 to $1.45. Not a bad return for one week. Woodside Petroleum Ltd [ASX:WPL] continued its recent stellar run, jumping another 6% since I told you about them.

There isn’t much panic evident yet in the oil markets, with prices still in steep backwardation. Oil for delivery in 2022 and 2023 remains about US$10 below current spot prices.

But as reported in oilprice.com:

‘Many analysts and oil companies see global oil demand returning to the pre-crisis levels of 2019 as early as the start of next year, if not earlier, by the end of 2021.

‘The oil industry is “massively underinvesting” in supply to meet growing demand, which is set to return to pre-COVID levels as soon as the end of 2021 or early 2022, Greg Hill, president of U.S. oil producer Hess Corp, said on Monday.

‘Oil demand worldwide is expected to hit 100 million barrels per day (bpd) by the end of this year or in early 2022, Hill said, adding that demand next year is set to rise to 102 million bpd—exceeding pre-pandemic levels.’

Goldman Sachs came out recently with a US$90 year-end target for WTI crude oil, which is about US$10 above the current price and the way gas prices are spiking, they may get that one right.

Spiking energy prices can’t be a great addition to the already hot levels of inflation that we are seeing.

US bonds under pressure

No wonder US 10-year bond yields have been rising recently. The FOMC meeting last week seems to have been the catalyst for the spike in yields with the US Fed members’ dot plot showing expectations that rates will start to rise at some point next year.

But perhaps there is more behind the rise in yields than that.

The US Fed is about to start tapering. The US government is close to signing off on a multitrillion-dollar stimulus bill that will have to be paid for somehow (ie: selling more bonds) and inflation is remaining stubbornly high, so a 1.5% yield for 10 years is starting to look like a bad bet.

It all sounds like a cocktail for a short, sharp correction in equities to me.

Watch my ‘Closing Bell’ video below where I go into more detail about the current bearish set-up in equities.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.