In today’s Money Weekend…doubling down…hedge funds selling…option markets stressed…bearish price action…and much more…

Last week, I made the case that it was time to hang up your trading boots and focus on something else while the risk of a market correction increased.

Fast-forward a week, and my conviction is increasing that we aren’t far away from a sharp sell-off in equities.

No one has a crystal ball, of course. All you can do is keep an eye out for signs of trouble and when the list starts getting long, you take action to lower risk just in case you’re right.

Better to be safe than sorry.

I’ve learnt from past experience that all you can ever ‘see’ is the road directly ahead. You can’t know much more than that.

So perhaps we are in for a short, sharp correction and then once the dust settles, the buyers will move back in and the market will be higher than here in a few months.

The trend has been so relentless in the US that it is a brave person that puts a stake in the ground and calls a market top at this juncture.

I’m not doing that.

I’m just saying that as we head into the end of the year, the risk is to the downside, and there are some lines in the sand beneath the market where I reckon volatility could spike sharply, and the selling could become panicky.

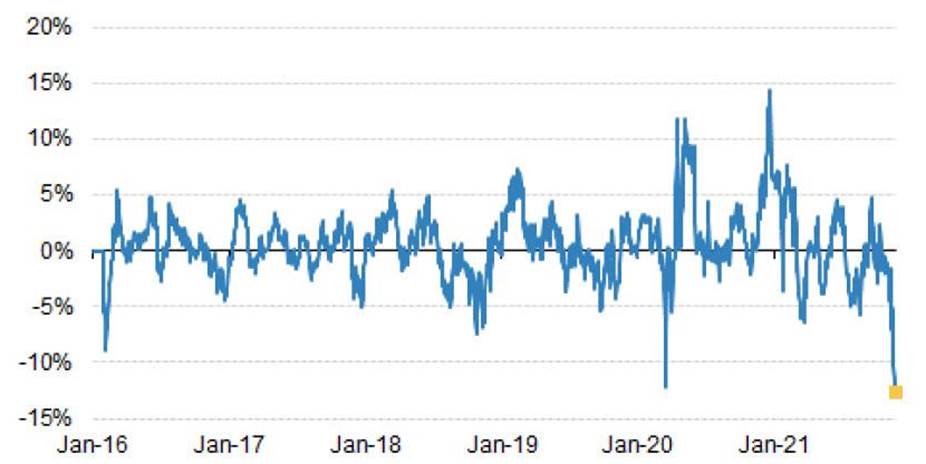

Hedge funds selling

Morgan Stanley’s Quantitative Derivatives Strategy team recently said:

‘The MS Crowded Long basket MSXXCRWD is down 13% vs. the S&P 500 over the last month — the worst rolling one-month relative performance on record (just edging out March 2020).’

Most crowded trades versus S&P 500

|

|

|

Source: Zerohedge.com |

That means despite the fact US equity indices are holding up near their all-time highs, hedge funds have been active sellers of their biggest winners. They are deleveraging.

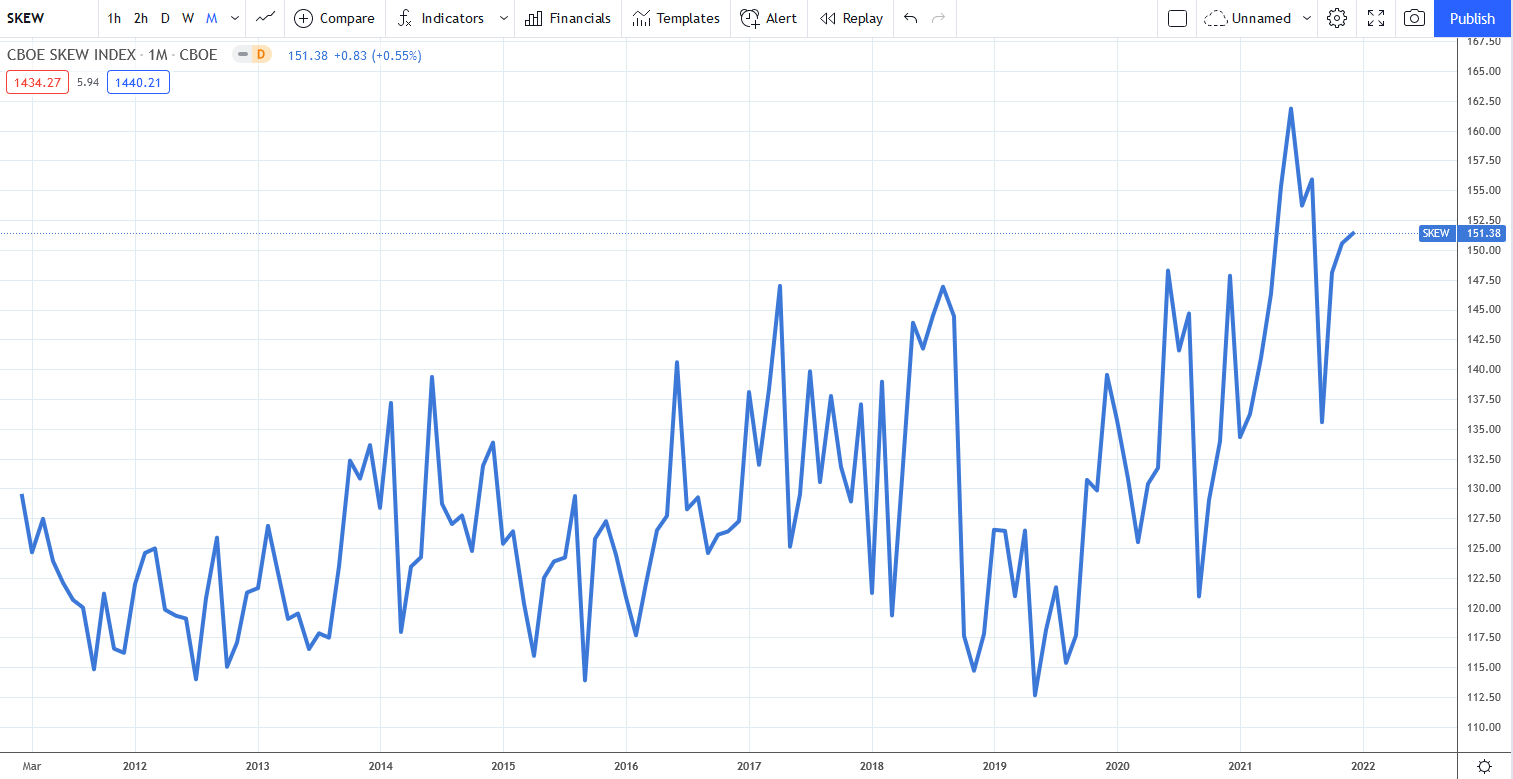

Option markets stressed

Option markets have been under some stress for a while now, but that stress is increasing.

Skew is a measure of the relative demand for downside protection versus upside exposure via calls. If the skew increases dramatically, it is telling you that investors are chasing puts to lower downside risk.

According to Investopedia.com, the CBOE Skew Index [CBOE:SKEW]:

‘Is calculated using S&P 500 options that measure tail risk—returns two or more standard deviations from the mean—in S&P 500 returns over the next 30 days. The primary difference between the VIX and the SKEW is that the VIX is based upon implied volatility round the at-the-money (ATM) strike price while the SKEW considers implied volatility of out-of-the-money (OTM) strikes.

‘SKEW values generally range from 100 to 150 where the higher the rating, the higher the perceived tail risk and chance of a black swan event. A SKEW rating of 100 means the perceived distribution of S&P 500 returns is normal and, therefore, the probability of an outlier return is small.’

The value of SKEW currently sits at 151.

All skewed up

Let’s have a look at a chart of SKEW over the past 10 years:

|

|

|

Source: Tradingview.com |

It is quite clear from the above chart that SKEW is elevated at the moment. That doesn’t mean a sharp drawdown is a given. It just means that the biggest players are currently positioning themselves to either profit from or withstand a sharp correction.

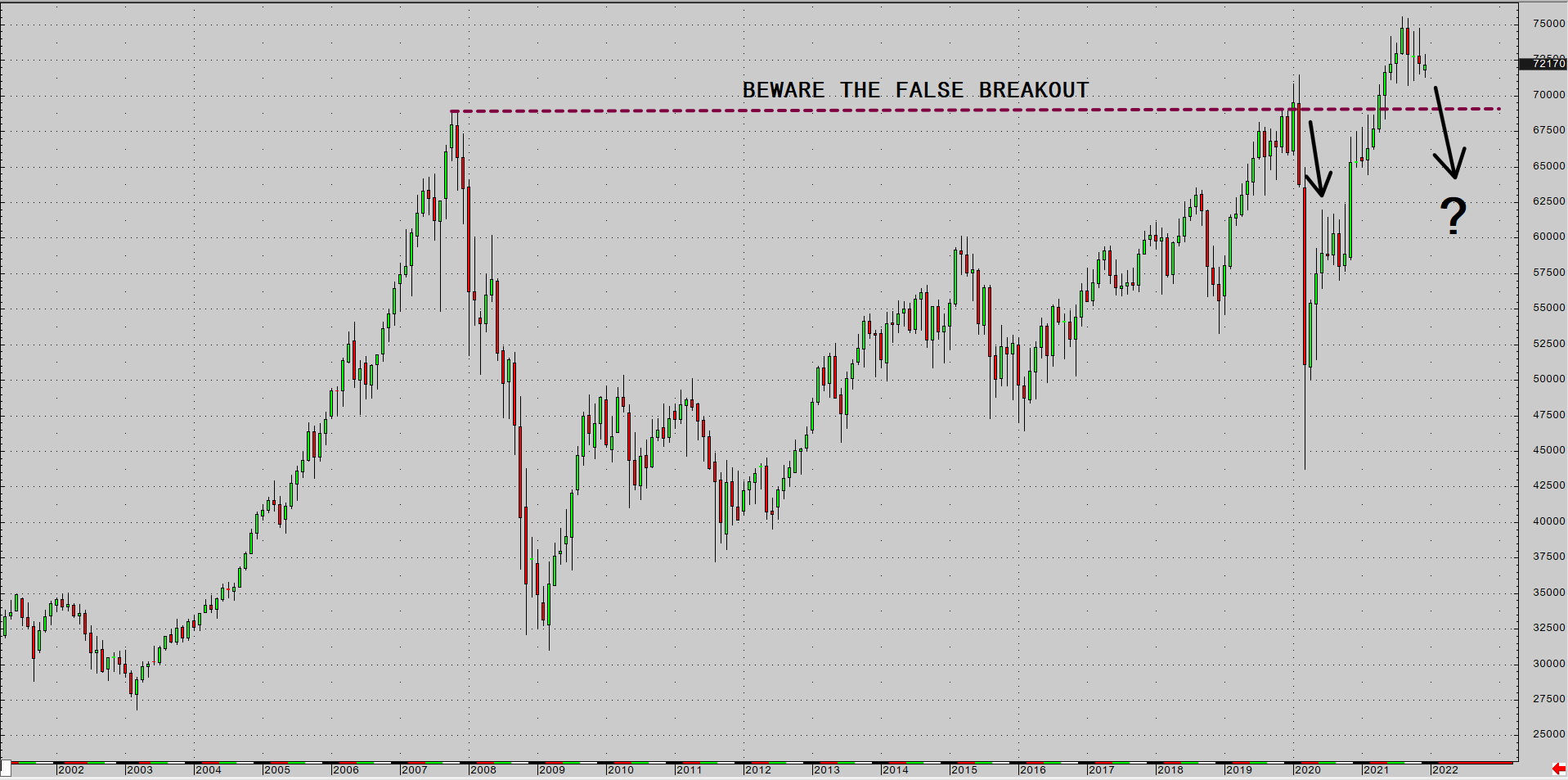

The technicals in the ASX 200 have been deteriorating for a few months now and my view is that the selling pressure could increase dramatically if 7,000 is breached in the ASX 200.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

ASX 200 ripe for a correction

|

|

|

Source: CGG Integrated Client |

You may be surprised to learn that the ASX 200 hasn’t budged in six months. Despite all of the hoopla about the relentless rally since the COVID crash lows, our market has been treading water for quite a while.

The sharp move lower in oil prices after the initial Omicron scare hasn’t been reversed and the Aussie dollar is looking very sick indeed, having busted below the August 2021 low of 71 cents. I don’t see much support for the Aussie until 68 cents, so we could be in for further sharp selling pressure in our currency dead ahead.

Bearish price action

The price action in the E-mini S&P 500 futures over the past week has been interesting to me.

I have seen many corrections occur and even though they are never the same, they do rhyme.

Often when large investors get involved and want to sell stock, they like to do it into a strong market rather than chasing prices lower, and they usually hit the sell button late in the day.

Tuesday’s session in the S&P 500 saw a large 3% range with a 2% rally early in the day turning into a 1% loss by the close of trading.

Last week also saw a 3% range day with prices closing at the low price for the day, so intraday volatility is increasing which is a calling card early in a correction.

You can call me a conspiracy theorist if you like, but I’ve also noticed that when the downtrend starts to develop, the day session may have a bad day with strong selling into the close, but then miraculously the futures trade higher in a straight line in the overnight market.

My guess is that the big sellers in the day session are buyers in the overnight market hoping to spike prices higher on a short squeeze, so they can start selling again into volume at a higher price once the day session resumes.

There comes a point where this game of cat and mouse runs out of steam, and all of a sudden all hell breaks loose.

We aren’t there yet, but a few big down nights in the US and I reckon we will see the selling pressure increase as various hedge funds/investors are forced to sell based on increasing volatility or changes in momentum.

The lack of liquidity that happens as the end of year approaches can either lead to a drifting market or explosive moves. If everyone wants to get out of the door at the same time, but there’s no liquidity, the size of the moves can be exacerbated.

Check out a chart of what happened at the start of the year in 2008 to get a sense of what I mean.

We may not be on the verge of a significant correction like 2008, but there are enough warning signs out there at the moment for me to hit the sell button on a few things so that I’m not sweating it over Christmas.

Check out my Closing Bell video below where I give you a detailed analysis of the current state of play.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.

| https://youtu.be/sCOyLSyXkMA |

|

|