In today’s Money Weekend…Nearmap collapses…trading psychology…what does losing mean?…don’t overthink it…and more…

I had a rough week this week. Retirement Trader had its first loss of the year.

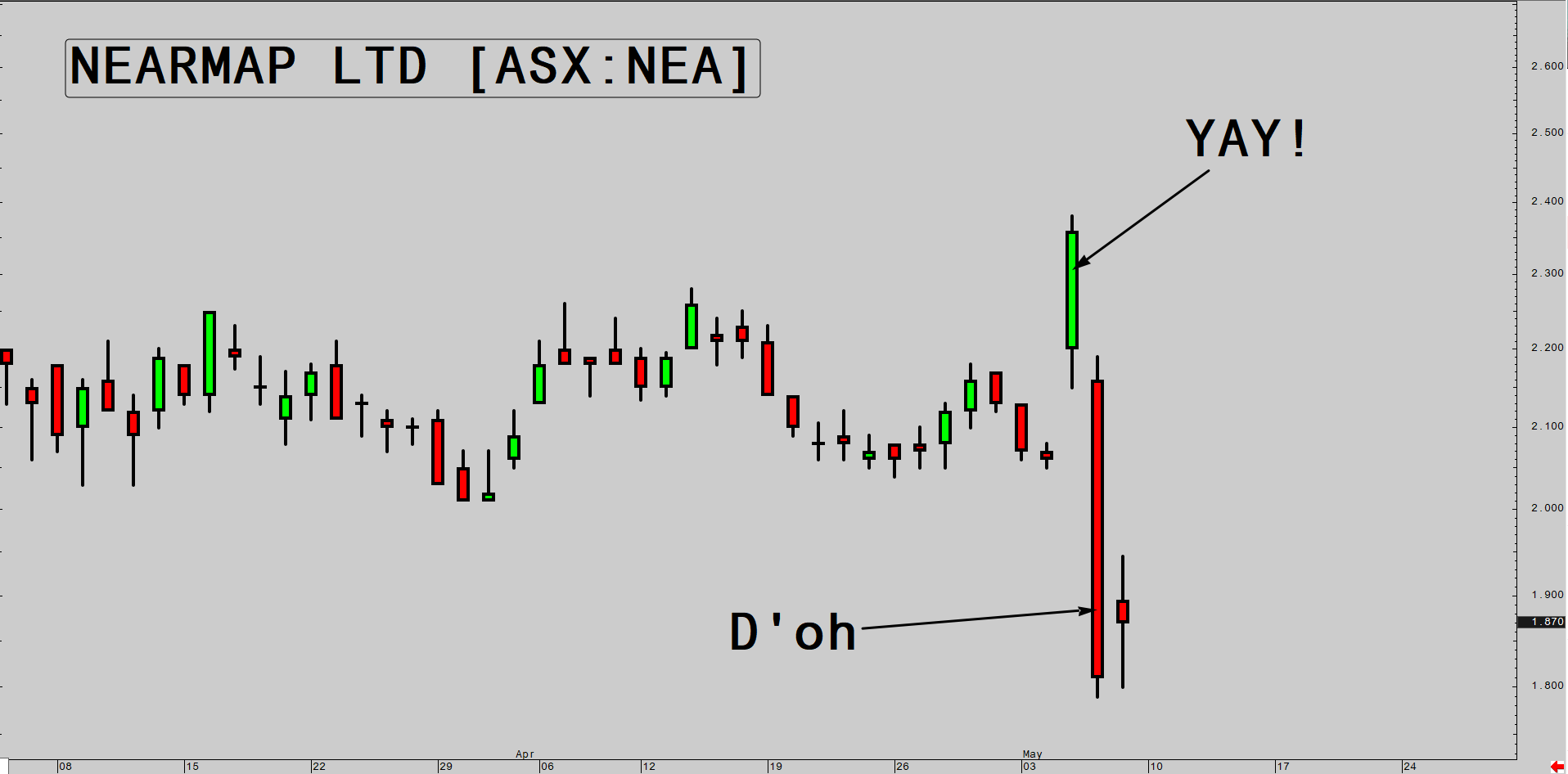

We were long Nearmap Ltd [ASX:NEA] with a $2.00 stop-loss and went through the whiplash of prices taking off after the profit upgrade announcement on Tuesday, and then crashing back to Earth on the announcement about legal proceedings for IP infringement.

After surviving in the trade by 1 cent for weeks, the positive announcement on Tuesday put a spring in my step. Prices bolted out of the blocks on Wednesday and the stock was up 14% to $2.36 by 11:00am.

Then a trading halt around 11:15am and the announcement the next morning about the legal proceedings.

The stock crashed 23% to $1.81. Ouch.

That is the reality of trading right there.

Whiplash in Nearmap

|

|

| Source: CQG Integrated Client |

It doesn’t matter how clever you think you are; you’re going to go through moments like that when trading.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Trading psychology

It got me thinking about the psychology of taking losses.

It’s an incredibly important part of being a trader or investor. We all have to take losses. Whether we hold stocks for five minutes or five years.

No one gets 100% of their trades right.

But it’s not an aspect of investing that is talked about much.

It’s like a dirty secret.

But unless you get a handle on the psychology of taking losses and find your own way to the other side, you will end up paying a heavy price.

My own ego flinches when I take a loss. But I know it shouldn’t.

Thankfully, it doesn’t stop me from pressing the button to get out like it used to, but the feeling remains.

Even after all these years training myself to switch off and keep focused on the big picture of long-term trading stats, it still stings.

Why is that?

I’m sure you could come up with a million reasons why. I reckon we all have some difficulty taking losses in the beginning.

We all hate losing money. But I think there is more going on than just the fear of losing money.

There is the fear of accepting that we made a mistake. Fonzy could never admit that he was wrong.

And he was the coolest guy on Earth.

So, it’s a tough thing to do.

But it is the lynchpin to trading success.

What does losing mean?

The way we internally frame accepting a loss when trading is quite literally the most important thing to get right before consistent performance can be achieved.

If every loss is another chink in your feeble armour of self-worth, the emotional turmoil you’ll experience will be so great that you’ll give up trading long before ever having a shot at making money.

Of course, it’s not much use being great at accepting losses if you are trading with a useless set of trading rules.

Happily accepting loss after loss until your account is drained is not a path to success.

But assuming you have a set of rules that you are willing to follow, and they have at least a smidgeon of a chance of making money at some point; religiously taking losses at the set time will be the difference between winning and losing in the long term.

But it’s so easy to resist the urge when the time comes.

‘What if it bounces back tomorrow? Then I will have sold at the low and I’ll feel like a fool.’

‘Maybe I should lower the stop-loss a bit to give it some more room. I set the wrong level to start with.’

I have described these internal dialogues in past articles and there are many more examples I could give of how adept we are at fooling ourselves into doing the wrong thing.

Overriding the monkey mind and pressing the button anyway is what needs to happen.

Don’t overthink it

There’s no need to fully understand why you are squirming and what it was your daddy said to you when you were little that made you think you should never make mistakes.

You don’t need psychoanalysis; you just need to press the damn button when it’s time to get out despite all of the internal dialogue telling you to hold on.

You have to trust that that is what you’ll do.

It’s like a contract you make with yourself.

Like anything that you practice; in time it gets easier to do.

As you start to see the results from acting when you need to act, your confidence builds that it’s the right thing to do and the internal voices have less hold over you.

You free your mental space to focus on looking for opportunities rather than agonising over the daily gyrations in the stock you should have gotten out of five months ago.

The size of your average losses over time is kept at a reasonable level so there is less pressure on the size of your average winners.

The most important thing to understand is your strike rate and the size of your average winners to average losers.

When you keep track of those figures you start to see the big picture and how you will make money over time.

If you are getting 25% of your trades right but you make three times as much on your winners than you lose on your losers, you will breakeven.

So a 3:1 reward/risk gives you a lot of room for error. But it is much easier said than done.

To get to a 3:1 reward/risk you have to keep your average losses down at a manageable level.

Holding on to a bad trade and dusting 85% when you should only have lost 30% of your money isn’t going to help your cause. It’s going to drag everything down. It makes it much harder to achieve a 3:1 reward/risk.

That’s why it’s imperative to cut losses when you have to and not stick your head in the sand.

Learning how to lose is much more important than learning how to win.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Comments