In today’s Money Morning…Atomos impresses…Redbubble recovery…Treasury up despite China…Humm humming…and more…

We’re in the thick of earnings season at the moment and stocks are flying all over the place in response to results.

There were a few positive surprises last week with Atomos Ltd [ASX:AMS], Redbubble Ltd [ASX:RBL], Treasury Wine Estates Ltd [ASX:TWE], and Humm Group Ltd [ASX:HUM] all blasting higher after their numbers came out.

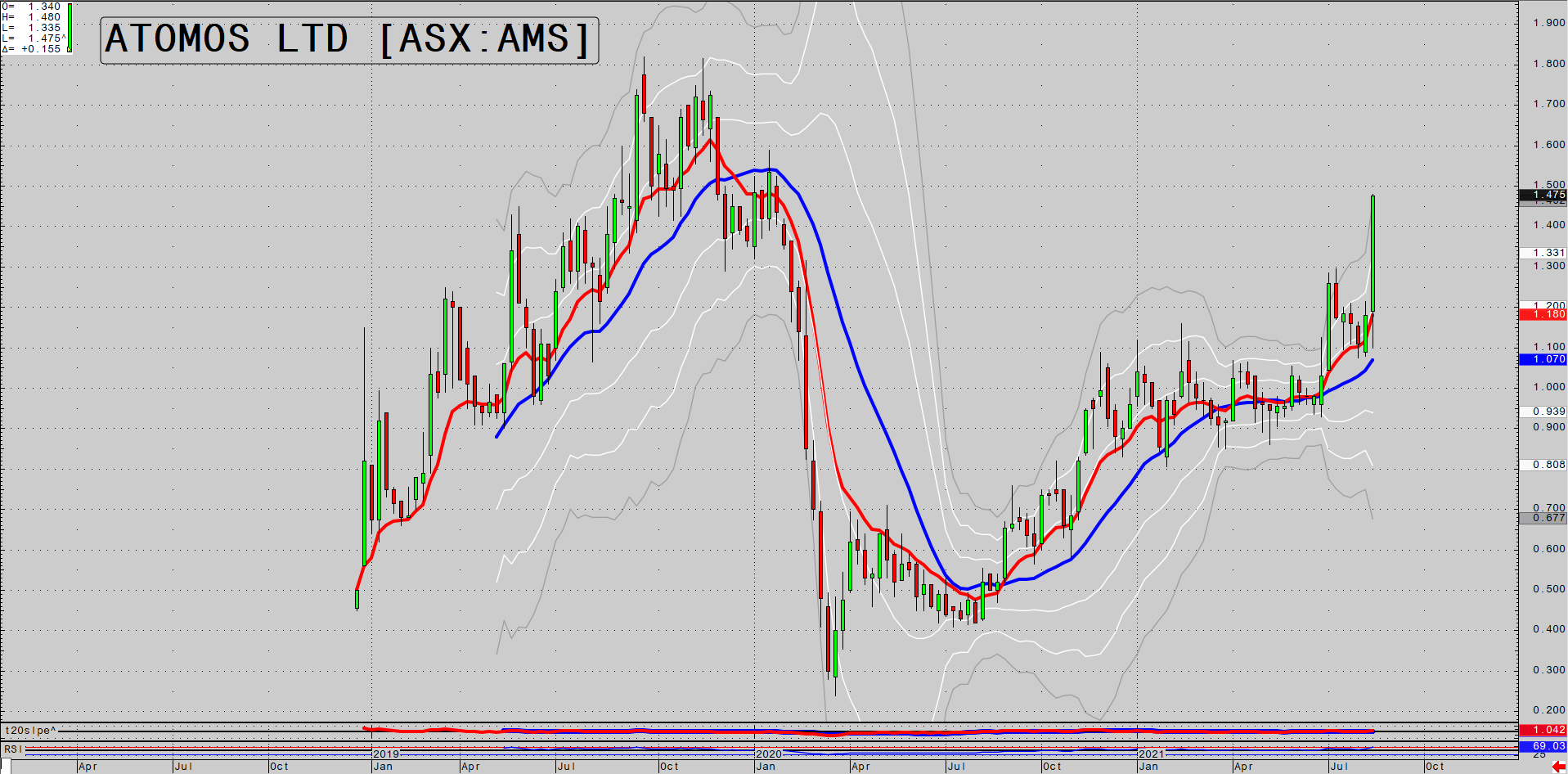

Atomos impresses

Atomos Ltd is a great little company born in Melbourne and taking on the world. They create 4K and HD Apple ProRes monitor-recorders. It’s basically a unit that you attach to your camera that makes production faster, higher quality, and cheaper than the alternatives.

Their products are well respected, and they are used by professionals as well as YouTubers.

Their numbers looked solid with FY21 revenue up 77% to $78.6 million. Gross margins increased to 47.6%, delivering $37.4 million. Net profit hit $4.2 million, which was a huge improvement on the COVID-affected $12.2 million loss last year.

Their stock price has been slowly trending up since the COVID crash but took off after the results, jumping over 30% in the three days since the results were released.

Leap into the Atomosphere

|

|

|

Source: CQG integrated Client |

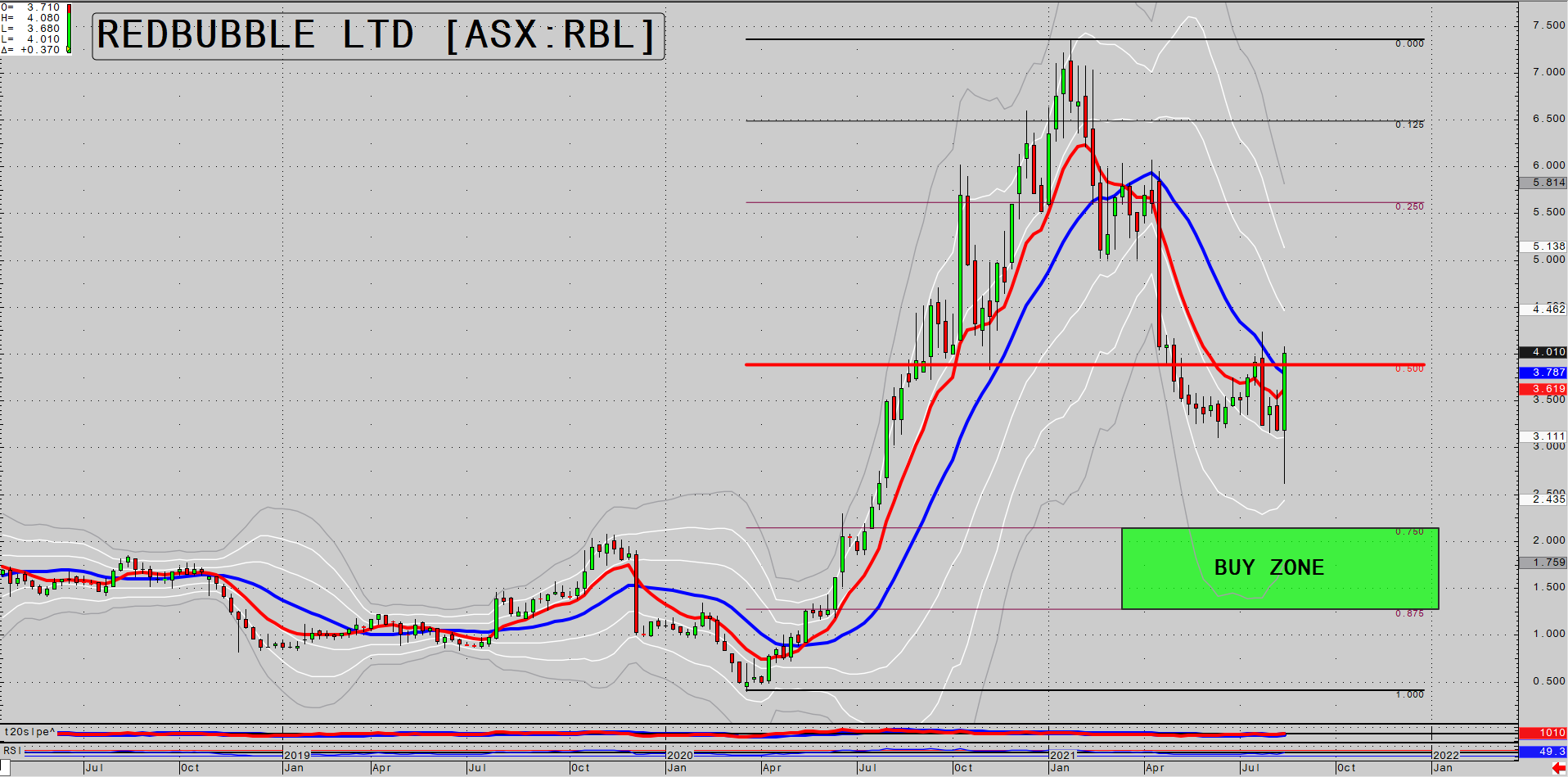

Redbubble recovery

Redbubble Ltd has had a wild ride over the past year, with a 1,300% rally from 50 cents to $7.22 in 10 months due to a leap in sales during the COVID shutdowns. Then as growth reverted to more realistic levels, the price crashed to a low of $2.62 on Thursday last week just after the results were released.

Then the buyers stepped in, the large short position took fright, and the price leapt 58% to a high of $4.14 on Friday!

Redbubble turns a corner

|

|

|

Source: CQG integrated Client |

There are expectations that it will take another six months before there is concrete proof that they have sustained growth post the COVID sales injection, but the chart is looking promising after bouncing so viciously from close to the buy zone of the huge wave higher during 2020.

In the interest of full disclosure, RBL is part of the Pivot Trader portfolio. We picked it up at 95 cents just as the rally was getting going last year and took two-thirds of the profit on the way up.

Treasury up despite China

Treasury Wine Estates Ltd has copped it over the last year as a result of the Australia/China spat. It is a cracking business that should be in a portfolio long term, so I have had my eye on it waiting for the signal that it was ready to rally again.

Despite the China trade dispute headwinds, they managed to shift their attention to other markets and maintain pricing, leading to a 3% lift in NPAT to $309.6 million, which is an EPS of 42.9cps.

That equates to a P/E of 30, which isn’t exactly cheap. But it is a solid business that will be around for generations to come. They have a quality product sought after around the world and the China troubles will probably be sorted within a year or so.

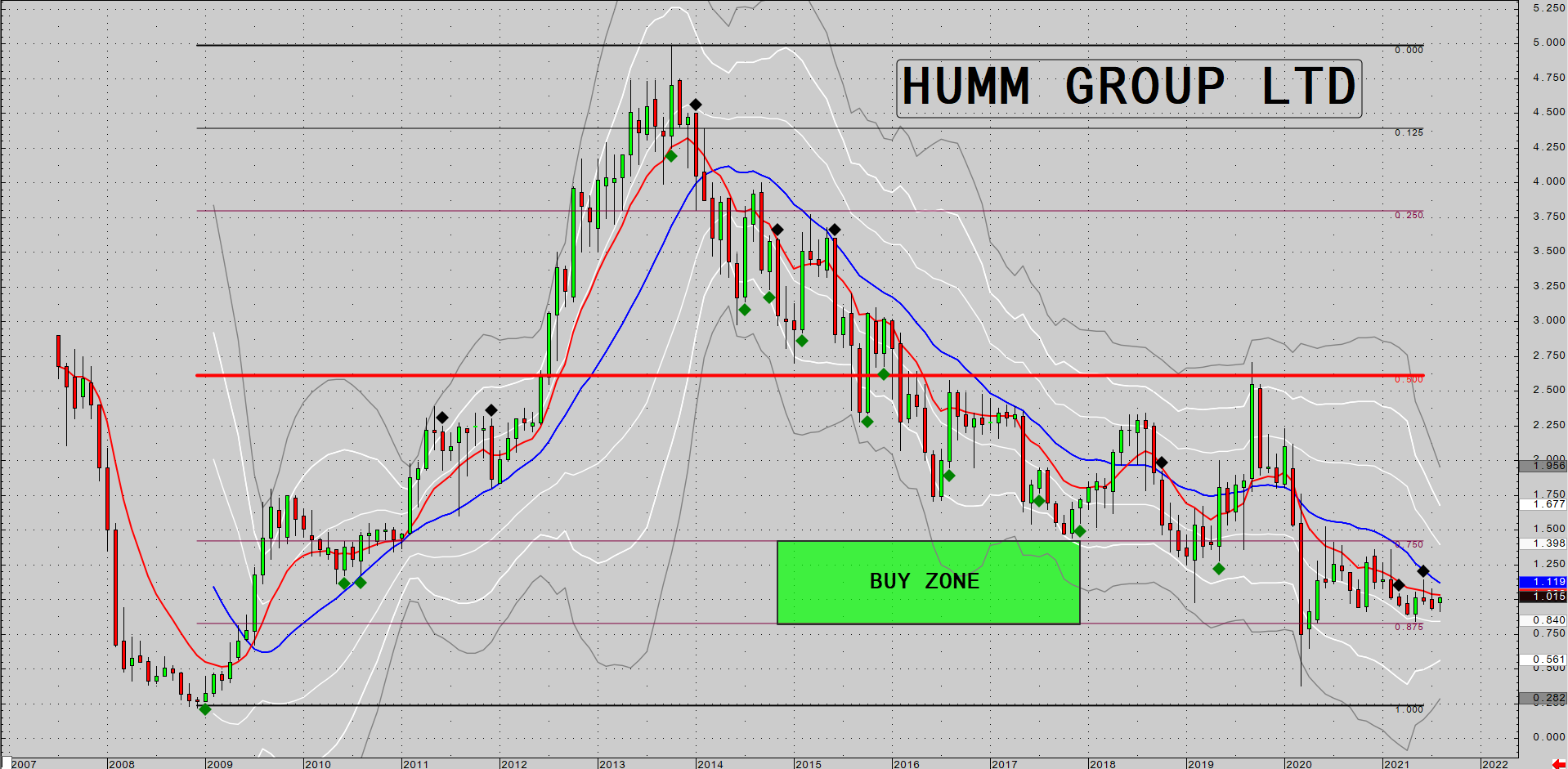

Humm humming

Humm Group Ltd released their results last Thursday and the market seems to like what they see, with the price up 8% since the results were released.

HUM has been a serial underperformer in the ‘Buy now, pay later’ (BNPL) space, but there are signs that they are getting some traction with their offerings.

HUM’s BNPL volume jumped 31% to $1.035 billion. Cash NPAT was up 121% to $68.4 million. Customer numbers were up 20% to 2.7 million. Overall gross income was down 7.3% though, with the company stating that the fall in revenue was due to a decline in cards receivables, margin compression in a competitive environment, lower fees and other income, and the run-off of legacy products.

HUM’s share price has been way underperforming the other BNPL products as the market took a wait-and-see attitude to their late entry into the space. But with solid management, a great balance sheet, plenty of experience in consumer lending, and a niche offering in larger ticket items, I reckon they are one to watch.

HUM on the runway

|

|

|

Source: CQG integrated Client |

As you can see, it was an eventful week last week with a few stocks blasting higher despite the doom and gloom in commodities.

If you’d like to find out about a few of the companies that I have just told members of my investment service, Australian Small-Cap Investigator, to buy, then check out this report that I have put together for you.

They are all companies that, while risky, I think have massive potential over the next few years, disrupting huge industries, and running rings around the incumbents.

I have been writing these ‘Trader’s Corner’ articles to give you a sense of my approach to trading and investing in the markets. If you have been enjoying these articles and the ‘Closing Bell’ videos where I show you some of my technical analysis techniques, then take it a step further to discover what I believe are the seven most-exciting small-caps on the ASX.

Regards,

|

Murray Dawes,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here