In today’s Money Weekend…high risk for high reward…ignorance is bliss…a few stock for your watchlist…and more…

The Australian biotech sector is an often overlooked part of the market that contains some fascinating companies doing great work.

I think many investors are scared of biotechs because it can make your brain do backflips trying to understand what they are up to.

It is a very high-risk end of the market because it takes a long time and plenty of money to bring a new product to market.

The success rate is pretty low, but the rewards are extremely high when they pull it off.

That means their share prices are extremely volatile as good and bad news causes their potential value to fly around.

For example, if a company has a 5% chance of being worth a billion dollars and then some news comes out that doubles their chances to 10%, their stock price can double very quickly.

That is perfect conditions for a trader.

As a trader, you want lots of volatility, so you can use the volatility to set yourself up in no-lose positions.

My method involves taking a third profit after prices move back to the middle of a wave or trading range. I then place a stop-loss for the remainder of the position at a point where I will be breakeven on the whole trade.

I like to make sure that the breakeven stop-loss is below a major support level. That means I will be happy to stop out because there is a chance prices could fall a lot further.

Once the initial profit target has been reached and initial part profit taken, the future outcomes for the trade are to either breakeven or make money.

That’s what you want when trading incredibly volatile stocks such as biotechs.

Then your job is to plant as many of these seeds as possible in various stocks and sit back to see what happens.

Ignorance is bliss

This approach accepts your ignorance about what is going to happen.

You don’t need to spend countless hours trying to work out whether their radioactive-labelled carbon will revolutionise lung imaging. Let’s face it. Who knows!

What you need to do is understand whether the people involved are worth backing and when the key catalysts for the stock are approaching.

The total addressable market for their product and the novelty of their approach is important too.

But as the journey unfolds, there will be many make or break moments for the company, and you want to make sure you are set up in a no-lose situation when they hit.

Then you can leave it up to the gods without fretting that you are about to lose your shirt.

Despite the fact the ASX 200 is at all-time highs, I have found it hard to find many sectors other than large-cap financials and property stocks that are powering higher at the moment.

But the biotech sector is looking solid, and many stocks have strong uptrends.

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

A few biotech stocks for your watchlist

The stocks you could add to your watchlist and research are Actinogen Medical Ltd [ASX:ACW], Anteotech Ltd [ASX:ADO], Cyclopharm Ltd [ASX:CYC], Exopharm Ltd [ASX:EX1], Imugene Ltd [ASX:IMU], Mach 7 Technologies Ltd [ASX:M7T], PYC Therapeutics Ltd [ASX:PYC] and Telix Biopharmaceuticals Ltd [ASX:TLX].

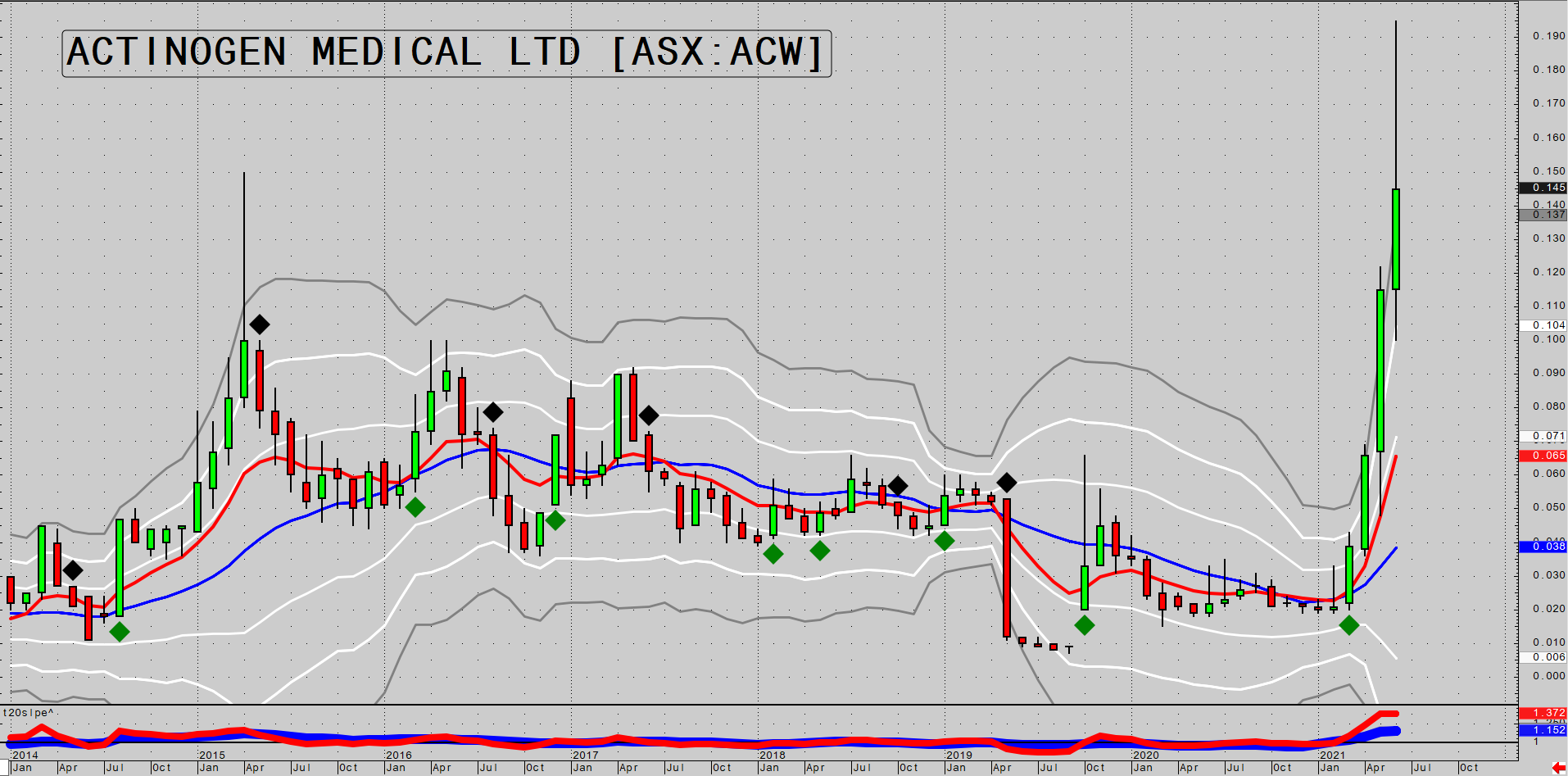

Actinogen Medical Ltd’s lead drug candidate, Xanamem, has been designed to block the production of cortisol — the stress hormone — in the brain. Studies have shown that elderly individuals with high cortisol levels were much more likely to develop Alzheimer’s disease.

Their stock price has shot from 2 cents to a high of 19.5 cents in less than four months.

Actinogen takes off

|

|

|

Source: CQG Integrated Client |

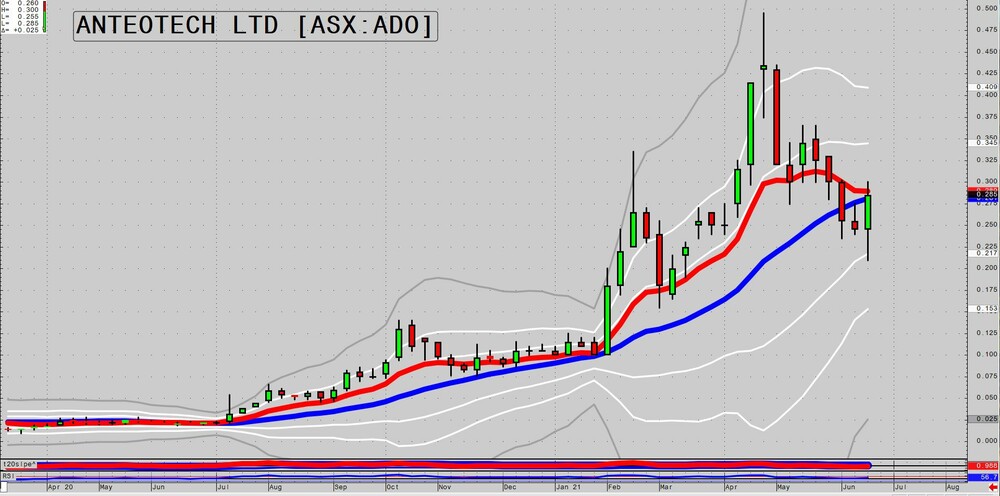

Anteotech Ltd has jumped from 2 cents to a high of 49.5 cents in less than a year. That’s a move of 2,500%!

ADO is developing rapid point of care tests for COVID as well as other antigens. They are also looking at increasing the efficiency of silicon anode batteries. Amazing stuff.

Anteotech continues to fly

|

|

|

Source: CQG Integrated Client |

Cyclopharm Ltd is a radiopharmaceutical company approaching FDA approval for its product Technegas used in functional lung ventilation imaging. They have extremely high margins greater than 80%, and most of their revenue is from consumables.

Cyclopharm about to enter US market

|

|

|

Source: CQG Integrated Client |

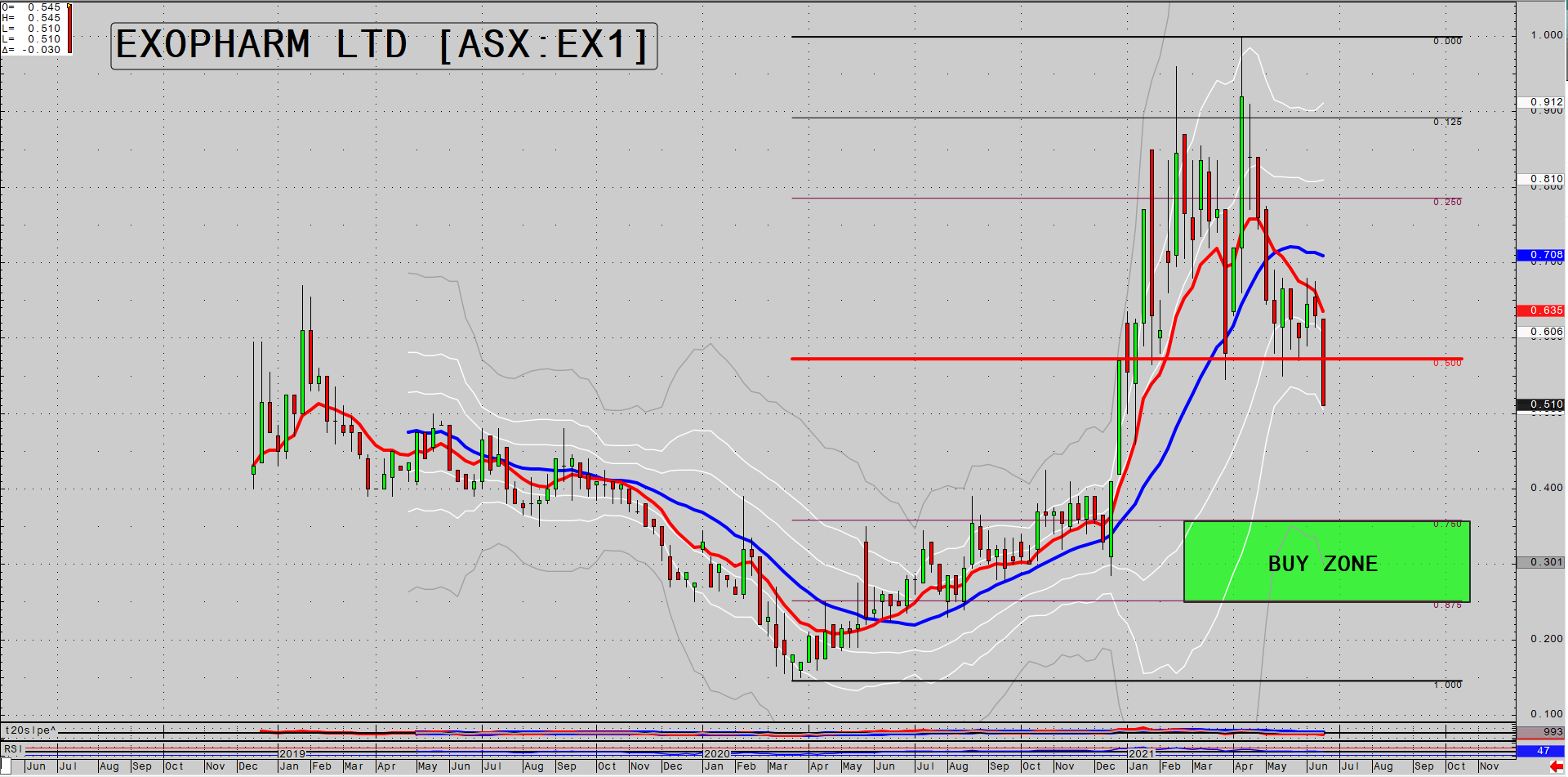

Exopharm Ltd is involved in using exosomes as a novel drug delivery platform. They have technology that can enable the cost-effective production of exosomes for drug delivery, and they have many paths to market.

I was a bit disappointed to see them raise money two days after Pitt Street Research released a company-sponsored bullish report. A company that deliberately uses retail investors as cannon fodder for their plans makes me a bit wary.

The stock price has since collapsed, and there is probably some tax-loss selling affecting it, so it may be setting up a good opportunity at some point.

Exopharm heading towards buy zone

|

|

|

Source: CQG Integrated Client |

You can do your own legwork on the other stocks that I mentioned above. In the interest of full disclosure, Telix Biopharmaceuticals is in the Pivot Trader portfolio.

Hopefully, you get the idea from the above charts that there are some strong uptrends happening in the biotech space.

There’s no need to be afraid of trading them due to their wild volatility and brain-bending business models. You should see the volatility as helpful in creating no-lose positions.

All investors are in the same boat as far as trying to work out whether the business model has legs. Unless you are a scientist (and even then), no one really knows whether its enzyme/exosome/antibody etc, is going to turn into a multibillion-dollar business.

As long as you manage your risk effectively, you can trade them and potentially reap the rewards when they move 1,000%, as some do.

PS: Watch the latest episode of my series ‘Closing Bell’, click the thumbnail below.

Regards,

|

Murray Dawes,

For Money Weekend