In today’s Money Weekend…rising from the ashes…rescuing a Damstra in distress…anatomy of a shake-out…remain proactive…and more…

It’s been tough trading conditions out there for a while now, with a few sectors of the market carrying the rest.

The mega-cap financial and resource stocks have been grinding higher while the mid-cap/small-cap end of the market has been drifting aimlessly or trending down on profit taking.

But as the quarterly announcements start coming out, we are seeing a situation where a few stocks are starting to look like good value again and are bouncing hard on positive numbers.

Damstra Holdings Ltd [ASX:DTC] describes itself as:

‘A global leader in enterprise protection software. Its Enterprise Protection Platform (EPP) integrates an extensive range of modules and products that allows organisations to mitigate and reduce unforeseen and unnecessary business risks around people, workplaces, assets, and information.’

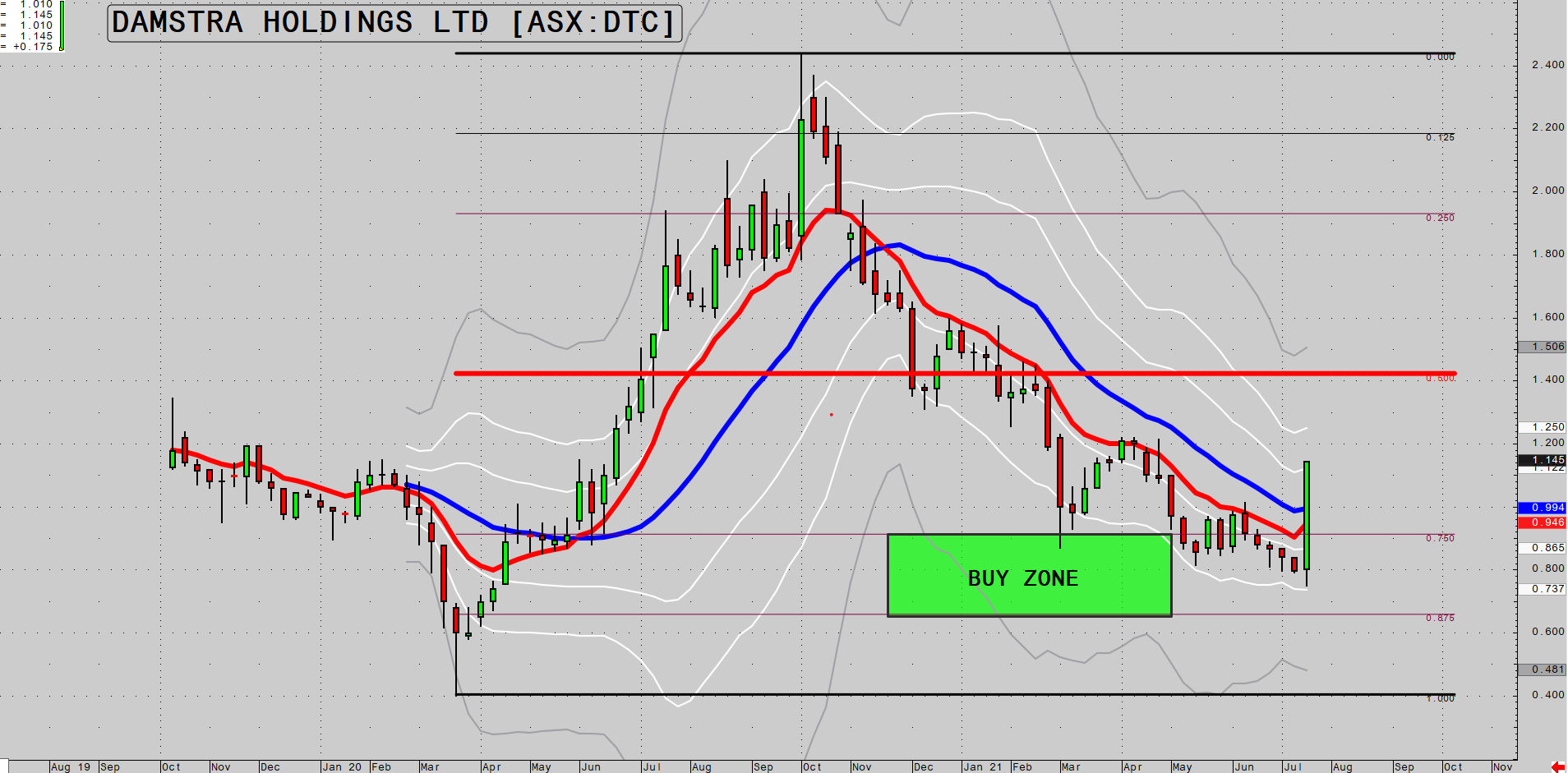

They have copped a beating since late last year, falling from $2.44 to a low of 75 cents. That’s a 70% drop. Ouch.

But their latest quarterly showed a company that is steadily executing in the right direction:

- Record quarterly revenue of $9.1 million, up 75% on prior corresponding period (PCP)

- Strong quarter-on-quarter revenue growth, increasing by 32% from Q3 to Q4

- Record operating cash receipts of $10 million for the quarter, up 80% on PCP

- Continued growth in recurring revenues, with ARR reaching $35 million at 30 June, up 65% on PCP

- Operating leverage drives continued gross margin expansion, which reached 78.4% for FY21

- 55 new clients acquired during Q4, taking new clients to 157 for FY21 and total clients to 724

With the heat taken out of the stock over the past six months, it was setting itself up as a nice buying opportunity — and the last few days’ trading has shown what can happen when momentum takes a stock too far in one direction.

Rescuing a Damstra in distress

|

|

| Source: CQG Integrated Client |

Damstra shot up 44% over the last week as a result of the positive quarterly.

Anatomy of a shake-out

Imagine what happens to a beach ball if you try to push it down into the water. At some point it will leap out of the water and shoot higher. It’s a bit like that with stocks.

The long drawn-out slide from $2.44 would have placed everyone who bought the stock since it listed under pressure.

Last week at 75 cents, everyone in that stock felt despair at the continued grind lower in the price.

Many people would have dumped their position in disgust after riding the wave higher in 2020 and thinking they were on a sure thing.

That’s the reason why I find the 75–87.5% retracement of a wave such a compelling spot to look for trading opportunities.

It is an area where many of the traders who chased the initial wave higher have given up and dumped their position, usually for a loss.

Many traders would know the feeling of joining a strong trend and feeling bulletproof as the stock continues to move higher soon after entry.

The confidence is high, and the dollar signs are flashing, so you don’t take part profit and instead start flicking through car magazines seeing if there are any red Mustangs for sale.

When prices turn down and head back to the entry price it seems wrong to dump the position. We tell ourselves that it would be extremely frustrating to dump the stock at our entry price only to watch in horror as it races off to the upside again.

So we hold on for dear life and endure the mental torture of watching the stock fall a little, day after day.

Everyone has a different breaking point, but I assure you the market will find yours sooner or later.

The combination of time and accumulating losses wears many people down mentally until they just want to end the pain by dumping the stock without any reference to fundamental values.

Disciplined traders who exit their positions if prices return to their entry price would have also been shaken out by the large retracement in DTC.

Remain proactive

The only way to survive such huge volatility is to remain proactive. You must take part profits while the momentum is on your side to put yourself into a strong position.

You also have to ensure your entry point is in a spot where the risk/reward is on your side.

I’d rather wait until a large retracement has occurred, which you know has shaken many traders out of positions. When momentum shifts back to the upside, you are jumping on the beach ball just as it exits the water.

If you look at the chart above again, you can see the red line in the middle of the chart. That is what I call the ‘point of control’ (POC) of the wave up.

I expect mean reversion to occur more often than not.

Mean reversion in DTC would take the price back to the POC at $1.40.

So there is a good chance prices will revisit $1.40 at some point which would give me plenty of time to take part profits and create a no-lose position in the stock.

Prices are constantly going over old ground shaking out weak hands. When you expect it to occur, instead of being a victim of it, you can use it to your advantage.

Continue below to watch my Closing Bell video where I show you a stock that just announced a positive quarterly and looks ready to break out to all-time highs.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.