In today’s Money Weekend…party on, dudes…uranium spikes…nickel ready to blast off…opportunity brewing in oil stocks…and more…

Now that Fed Chairman Jerome Powell’s Jackson Hole speech is out of the way, and the taper is off the table for now, markets have the green light to keep the party going.

The biggest reaction to the speech has been from the US dollar, which has fallen sharply.

The US dollar has been rallying since May, but that rally seems under threat.

The US Dollar Index has only fallen 1% since the speech, so it’s not in free fall, but the long-term charts are looking more ominous than they have for months.

I have been calling for a stronger US dollar for a while now with a target of 96.00 on the US Dollar Index. I’m going to back off from that call for now due to the moves we have seen since the Jackson Hole speech.

A quick overview of the state of the US dollar is that it is still in a monthly downtrend on the moving averages, but it has been bouncing from strong support which is why I was bullish, looking for a mean reverting move towards 96.00 (the point of control in the chart).

US dollar tipping over

|

|

| Source: Tradingview.com |

If the downtrend that has been in place since early 2020 is going to continue, you would expect to see resistance near the 20-month simple moving average. That’s where prices were rejected from last month. If we then get a monthly close below the 10-month exponential moving average, that will be quite bearish, so I’d prefer to move back to a neutral stance until things are clearer.

The weakness in the US dollar is allowing commodities to come back to life and there have been a few great performers over the past week or so.

Uranium spikes

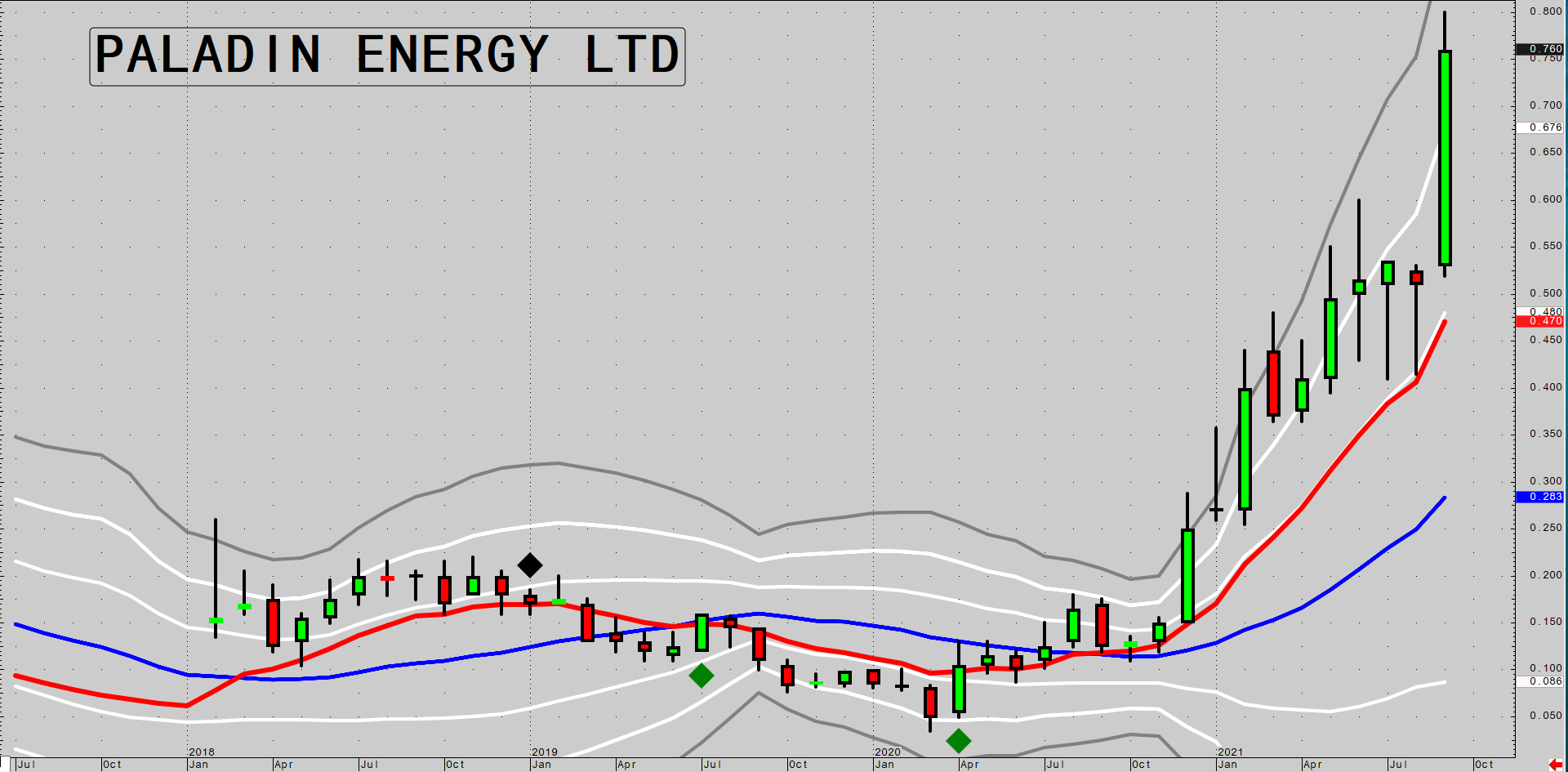

Uranium has bolted higher with uranium stocks flying. September uranium futures hit a five-year high of US$37.20 during the week. Paladin Energy Ltd [ASX:PDN] had an incredibly strong week jumping from 51 cents to a high of 80 cents during Friday’s session.

I tipped Paladin last year at 12 cents for Retirement Trader members, so that’s been an incredible run in the stock over the past year.

Paladin going vertical

|

|

| Source: CQG Integrated Client |

Deep Yellow Ltd [ASX:DYL] has also caught fire over the last year, rallying nearly 1,000% to 95 cents. I reckon the story for uranium is really only getting started after the uranium market spent many years in the wilderness post Fukushima.

This chart of the Global Uranium ETF [NYSE:URA] gives you a sense of how far uranium stocks can run if they come back in favour and the oversupplied situation in uranium markets reverses.

Uranium just getting started

|

|

| Source: Tradingview.com |

Nickel ready to blast off

Nickel is also looking ripe to break out to the upside after consolidating for the past six months.

Nickel itching to move higher

|

|

| Source: Tradingview.com |

LNG prices are continuing to fly with the Japan/Korea Marker (Platts) Futures [NYMEX:JKM] still moving higher at a rapid pace. They had a low of US$5.66 earlier this year but closed at US$20.38 on Thursday.

Opportunity brewing in oil stocks

Oil prices have also rebounded strongly after some weakness early last month. If Brent can bust out above $78.00 (currently $73.00), we should see another leg higher towards $88.00. Who knows if that will make oil stocks rally, because it seems like nothing can make them go up.

Keep your eye on oil prices because if they do keep rallying, there is going to be a big opportunity picking up the beaten-up oil stocks that large investors seem to be leaving in droves.

I want the move towards a greener planet as much as the next person, but there is an undeniable reality that we can’t just switch off our addiction to oil, gas, and coal in the blink of an eye.

If large investors are turning their backs on oil and gas stocks just before oil prices rocket to $100 due to a lack of investment but growing demand, the little guy or girl shouldn’t look a gift horse in the mouth.

The situation in Woodside Petroleum Ltd [ASX:WPL] is interesting. The merger with the oil and gas assets of BHP Group Ltd [ASX:BHP] is causing serious weakness in the stock due to expectations BHP shareholders will be quick to dump their shares once they get them.

That may be true and there might be plenty of downside to come in WPL’s share price. But if oil and gas prices keep rallying, there will be a point where the weakness as a result of the merger will be creating a fantastic buying opportunity for investors who are willing to invest in the space.

Woodside has already been lagging the oil price dramatically for a long time. The whole rally in oil prices this year from US$36.00 to US$73.00 hasn’t been reflected in WPL’s share price at all. The divergence has accelerated after the BHP deal was announced and since the deal won’t be consummated for many months, I’m scratching my head wondering just how wide the divergence can become.

Woodside is a member of the Pivot Trader portfolio. We bought it just before the deal was announced. So perhaps I’m talking my book. But I reckon Woodies will look like a bargain under $20 if oil prices keep running.

Oh, and don’t forget to check out my ‘Closing Bell’ video below, where I show you the commodities and stocks that are taking off after the Jackson Hole speech.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.