In today’s Money Weekend…you heard it here first…the power of technical analysis…what next?…and more…

Two weeks ago, before the selling started, I wrote an article called ‘Batten Down the Hatches’. Then last week’s instalment was ‘Shaking Up the Coke Bottle’.

In each, I made the case that the conditions were ripe for a sharp sell-off that would catch people off guard.

On 15 January in ‘Batten Down the Hatches’, I wrote:

‘When a market has been going sideways for many months, the odds increase that when the range does snap, the move can be quite explosive.

‘It’s like shaking up a Coke bottle. The longer you sit there shaking it up, the more Coke you’re going to wear on your face when you finally take the lid off.

‘The fact that the long period of sideways motion has occurred just above two incredibly important technical levels (2007 and 2020 highs) increases the odds even further that if the breakout of the range is to the downside, the selling pressure could increase dramatically.’

With the ASX 200 down nearly 9% in the two weeks since I wrote that, I’m going to claim it as a nailed call.

I’ve actually been warning about the possibility that the ASX 200 could see stiff selling pressure after a false break of the highs from 2007 and 2020 for a few months.

The power of technical analysis

Many people think technical analysis is a bunch of hocus-pocus. You can talk till you’re blue in the face trying to convince them of the efficacy of the method, but it usually falls on deaf ears.

My approach is to write these articles and shoot the ‘Closing Bell’ videos where I can go into detail about what’s happening in the charts and then you can follow along and make up your own mind whether I’m full of it or not.

Maybe I don’t need to blow my own trumpet and you already know that I nailed the call because you’ve been watching the videos. If you’ve been following along and even took evasive action prior to the sell-off, I’d love to hear from you, so I know I’m not spending my time talking to myself in these articles.

Just write to support@fattail.com.au. I’ll definitely write back to everyone that makes contact and I’d love to hear if my videos have been useful for your trading.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

What next?

The big question now, as always, is ‘What next?’.

I will go into detail about that in the ‘Closing Bell’ video below, but the main point is that momentum has changed, and rallies are probably selling opportunities from here.

But the short squeezes can be vicious, and they can go on for so long that many get convinced the market is heading up again and jump on at just the wrong moment.

So beware the bull traps.

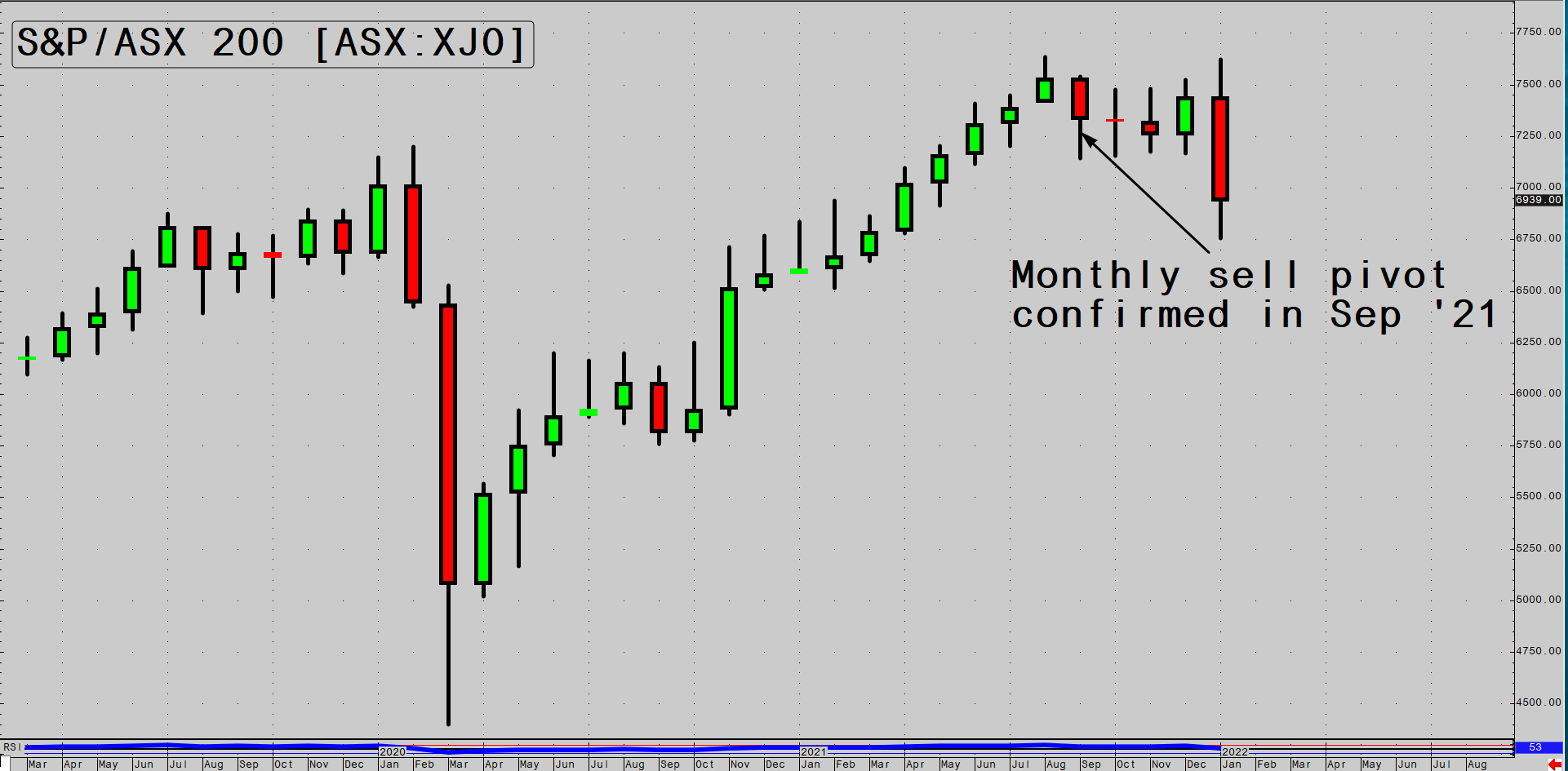

The ASX 200 confirmed a monthly sell pivot all the way back in September last year. That’s why I’ve been telling you to tread carefully since then. The market held up remarkably well over the past few months, but the monthly sell pivot was never negated, so I had to remain on high alert.

Warning signs

|

|

|

Source: CQG Integrated Client |

I whittled down the Pivot Trader portfolio from about 25 stocks to 15 and haven’t been very active in trading for many months.

But that doesn’t mean I haven’t made mistakes! Because I have.

I hate it when market commentators act like they can do no wrong. It’s baloney. Trading isn’t about being perfect. It’s about knowing your limitations and doing everything in your power to remain on the front foot no matter what’s happening.

US dollar up, gold down

I went into a few gold stocks in October thinking they would be a good hedge on any weakness in the market. I thought the correction in gold stocks was nearly over and that they were looking like good value.

With inflation taking off and my expectations that the Fed would drag their feet chasing inflation down, I thought gold was a no-brainer.

So far, I’ve been wrong on that call.

The Fed is sounding far more hawkish than I or others expected, and short rates are blasting higher as the market tries to gauge what the Fed will do this year.

That has seen the US dollar take off like a rocket, which is hurting gold.

But the fact is the Aussie dollar gold price is holding in there remarkably well.

But that didn’t stop the nervous Nellie’s from smashing gold stocks along with everything else during the panic.

There were also a few poor quarterlies from Evolution Mining Ltd [ASX:EVN], Silver Lake Resources Ltd [ASX:SLR], and Newcrest Mining Ltd [ASX:NCM] released that has added to the weakness in gold stocks.

I reckon we’re nearing a point where the bad news is priced into gold stocks, and they will start holding their ground and eventually heading back up. But for now, they’re a thorn in my side.

As I was writing this article, the ASX 200 has done a U-turn and is heading north at a rate of knots after heavy selling in the morning that was probably margin call related.

We may be getting close to a nice short squeeze that is tradeable.

Check out my ‘Closing Bell’ video below where I give you a detailed look at the current state of play after a wild couple of weeks trading.

Regards,

|

Murray Dawes,

Editor, Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here