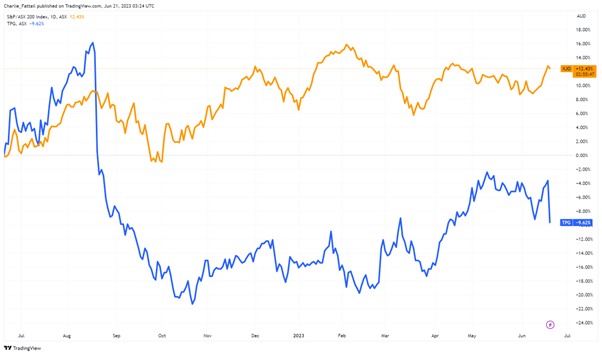

Shares of Telstra Group [ASX:TLS] are up by 0.23%, while TPG Telecom [ASX:TPG] shares plummeted by 7% on market opening today.

TPG shares are now down minus 6.6%, trading at $5.19 per share as of midday.

It has been a tough year for TPG, with shares down by 10% in the last 12 months as the tribunal proceedings have dragged on since the deal was first penned in February 2022.

Today we will look at what happened with TPG shares and the outlook for TPG shares after the Australian Competition & Consumer Commission (ACCC) decision.

Source: TradingView

TPG Shares down by 6.66% after ACCC Tribunal blocks Telstra-TPG deal

This morning, the ACCC Tribunal blocked the proposed multi-operator core network (MOCN) agreement that would have allowed TPG to use approximately 3,700 additional regional mobile sites owned by Telstra.

The $1.8 billion MOCN deal would have seen TPG decommission 725 mobile sites it operates within Telstra’s coverage area. Meanwhile, Telstra would gain access to and deploy infrastructure on up to 169 of TPG’s existing mobile sites, as well as some of its existing 4G and 5G spectrum in regional areas.

The proposed deal would have notably increased TPG’s regional mobile network size by around five times its current coverage.

The basis of the tribunal’s decision was that allowing Telstra to use TPG’s mobile spectrum would reduce the incentive for Optus to invest in its own 5G network — weakening competition.

TPG Telecom Chief Executive, Iñaki Berroeta remarked:

‘This determination entrenches the status quo for mobile coverage in regional Australia. We remain committed to extending the reach and capability of our mobile network to regional Australia and will continue to explore our options to deliver great mobile service and value to our customers.’

Both TPG and Telstra have said they intend to review the Tribunal’s determination before considering a further appeal in the Federal Court.

Singapore-owned Optus cheered the decision today, calling it a ‘win for Australians’ — while Telstra Chief Executive Vicki Brady publicly called for ‘a rethink of policy on spectrum access in light of the ever-increasing demand for mobile data.’

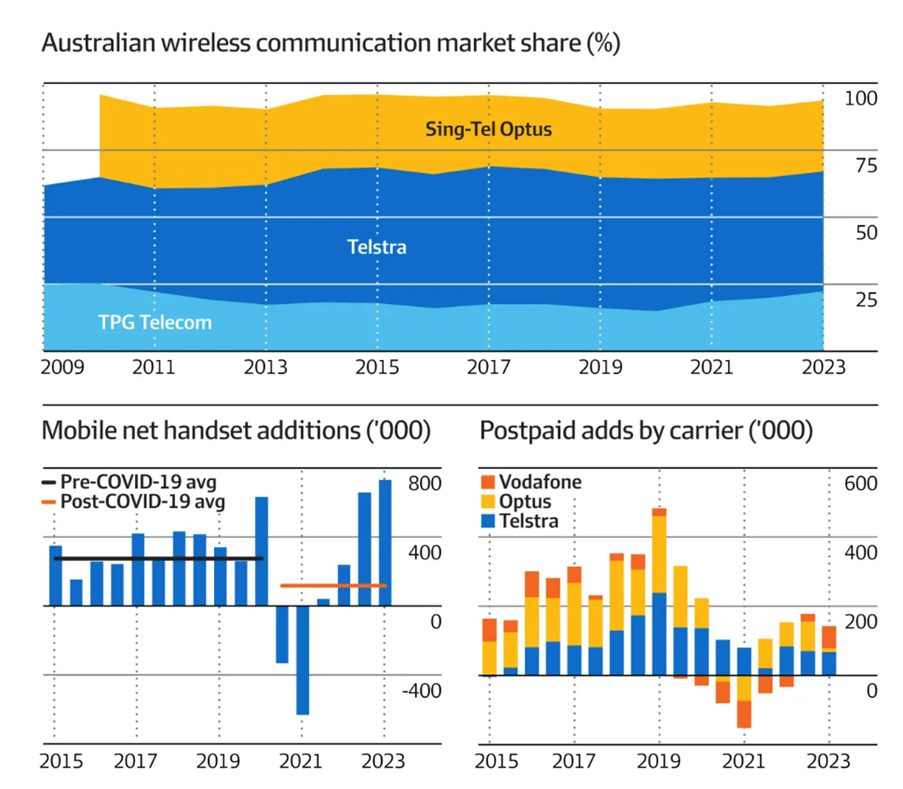

The battle of the big Telcos continues both in and out of the courts as mobile contracts have climbed since the post-COVID lows, and competition remains fierce.

Source: IBISworld

What’s next for TPG

The Tribunal’s decision is a big blow for TPG — who appears caught in the tribunal’s crossfire between giants Telstra and Optus.

The potential loss of this deal could mean TPG faces one-off transaction costs of between $20–25 million.

Despite this, TPG has not changed its earning guidance for FY2023 of between $1.85–1.95 billion.

Mr Berroeta remarked today,

‘Our ability to hold our FY23 guidance range despite these additional costs reflects our resilient service revenue performance and strong operating cost discipline in the first half of FY23 to date.’

Investors remain sceptical as the lack of a deal will mean TPG is pushed into a higher short-term investment at sites within its regional network that would have been decommissioned under the deal.

TPG’s statement today briefly mentioned this possibility, adding that, ‘…if the deal did not ultimately succeed, future capital expenditure plans may need to be adjusted…’

With more appeals on the horizon, the deal may continue to languish for the foreseeable future.

Market headwinds

Global markets are shaky — China’s recovery has stalled.

With cost-of-living and inflation increases, political conflict and the energy crisis taking enough of the attention, you might be thinking…is it worth taking any risks?

But think about this — unassuming small-cap Stem Cell United [ASX:SCU] catapulted 8,284% in two days when it decided it would chase down a medicinal cannabis opportunity.

Cann Group [ASX:CAN] began at 30 cents and ballooned to $4 in a manner of months in another viral explosion.

This is why our experts bring you Tik-Stocks — a cousin to ‘meme stocks’ predicted to be the next big thing — and how to use them.

If you would like to know more about Tik-Stocks, click here.

Regards,

Charlie Ormond,

For Money Morning