Today, we continue with our top trends for 2022 as part of our ongoing series, “Our Top Nine Investment Trends to Watch in 2022”

In this series we are going to cover our top 9 investment ideas:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

If you’re interested in dowload all 9 Trends in one document to read at your leisure, simply enter your email below and have them sent directly to your inbox.

Trend #7 — the influential Is

2022 is likely to be dominated by two influential Is: inflation and interest rates.

Inflation

After a forced absence, inflation is back.

As the Wall Street Journal reported late in 2021:

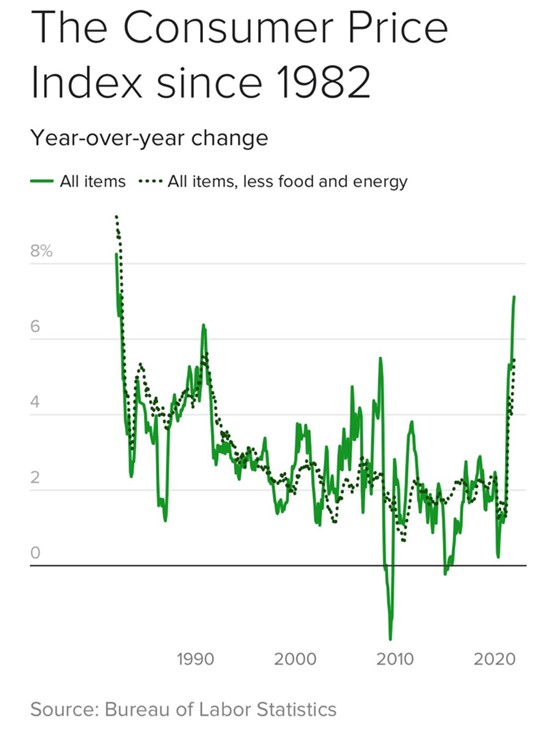

‘Inflation hit an almost four-decade high in November. US Labor Department figures showed that the consumer-price index — which measures what people pay for goods and services — rose 6.8% in November from a year ago. Price pressures have been driven by strong demand and supply-chain woes related to the pandemic, as well as higher energy prices.’

Source: US Bureau of Labor Statistics

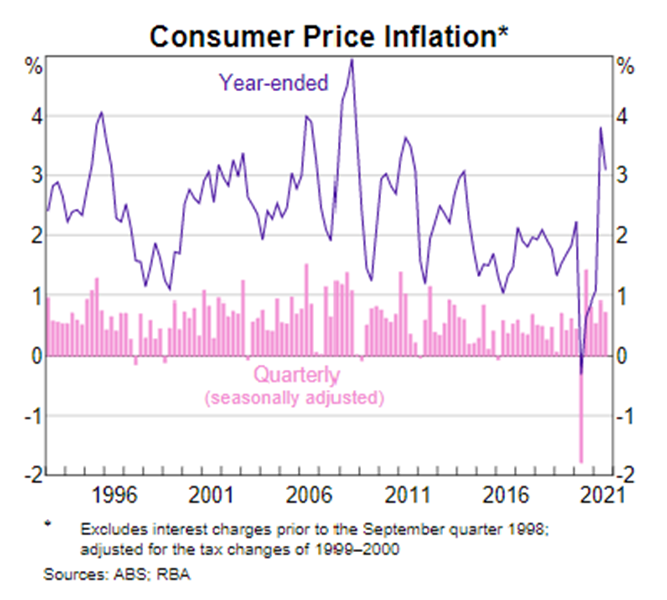

Australia’s inflation is less pronounced, but still elevated.

Source: Reserve Bank of Australia

Inflation is rising fast almost everywhere else too.

Central banks in emerging markets like Brazil, Chile, Colombia, Mexico, and Russia, for instance, are already hiking policy rates in response.

Advanced economies like England, Norway, Korea, and New Zealand have also raised rates.

As market intelligence firm S&P Global pointed out:

‘persistent high inflation requiring an unanticipated policy adjustment is now the main macro risk for 2022.’

S&P Global’s stance was echoed by none other than US Federal Reserve chairman Jerome Powell, who said on 1 December 2021 that ‘the risks of higher inflation have moved up’ and ‘we will use our tools to make sure that this high inflation we’re experiencing is not entrenched’.

Investors are treating rising inflation seriously.

According to figures from the Australian Financial Review, investors poured a record US$70 billion into inflation-protected US bond funds in 2021 in a global rush to shelter from rising consumer prices.

2021 inflows into inflation-protected securities in 2021 were higher than any year tracked by EPFR — going all the way back to 2004.

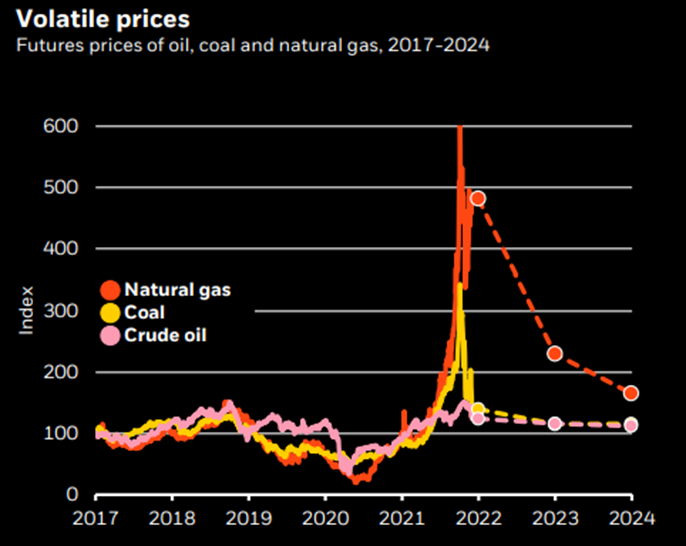

Our earlier discussed trend to watch in 2022, decarbonisation, is also compounding matters.

While noble in its foresight, decarbonisation is straining the world’s supply chains in the short term, impacting inflation.

Giant asset manager BlackRock noted in a 2021 research brief:

‘We view the transition to net zero as a supply shock playing out over decades, helping reinforce persistently higher inflation.

‘A disorderly transition — where policy measures to reduce emissions are imposed suddenly — could result in energy shortages and mismatches across companies and sectors.

‘A smooth transition is even more important to the path of inflation than monetary policy, in our view.

‘The energy crunch in late 2021 has provided a glimpse of a disorderly transition.

‘When weather and geopolitical factors suddenly cut coal and renewable energy supply, other power sources struggled to offset the drop. With governments looking to minimize carbon emissions, natural gas prices surged even more than coal, as the chart shows.’

Interest rates

With inflation rising, the market will nervously monitor what central banks decide to do with interest rates.

The US Federal Reserve, for instance, set the stage for a series of interest rate hikes beginning in 2022. A pivot that showed elevated concern about persistent inflation.

As the Wall Street Journal reported in late 2021, most Fed central bank officials are now pencilling in at least three quarter-percentage-point rate increases in 2022.

Back in September 2021, about half of those officials thought rate increases wouldn’t be warranted until 2023.

Further, Bloomberg reported in 2021 that:

‘Swaps are already suggesting that the central bank’s target will be 88 basis points higher by the end of this year — seen by many as a sign the market is baking in three hikes, plus the possibility of a fourth in 2022 — and momentum is building for the first increase to take place as soon as March.’

And in December 2021, Morgan Stanley’s economics team published a note estimating US interest rates are set to rise as early as September 2022.

Morgan Stanley thinks the September hike will be the first of five over the next two years.

Morgan Stanley wrote:

‘We now expect the FOMC to begin raising interest rates in September next year, two quarters earlier than previously anticipated. After delivering two rate increases in 2022 (in September and December), we expect three hikes in 2023.’

Regarding Australia, ANZ expects RBA to announce the first hike in the first half of 2023, Westpac expects the first hike in February 2023, and NAB predicts one in mid-2023.

Both the Commonwealth Bank and AMP Capital, however, predict an earlier hike, in November 2022.

Why is this important for markets? What effect do interest rate hikes have?

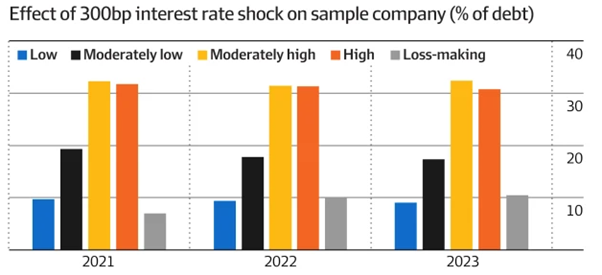

Illustrative insights lie with market intelligence firm S&P Global.

In December 2021, S&P Global ran a few tests to examine how the world would cope with a 3% increase in interest rates and elevated input costs.

As the market intelligence agency reported:

‘Our stress scenario for a 300bp interest rate hike only assumes that rates would return to the levels that prevailed before the global financial crisis. Yet, we find that this increase would significantly alter the financials of corporate issuers. Entities with weak credit metrics may find themselves struggling to access credit markets.’

S&P Global’s test sample included 24,000 corporations, covering US$61 billion of corporate debt. What was the key finding?

‘Higher debt-servicing costs coupled with higher input costs implied by rising inflation will shift more than $US1 trillion of debt on to the balance sheets of loss-making companies.’

‘The share of debt owed by loss-making companies is already running at double the last decade’s average, at 7 per cent. So, a 3 percentage point increase in borrowing costs would lift that to 10 per cent, while the twin shock of both interest rate and input cost increases would lift the ratio to 12 per cent.’

Source: Australian Financial Review

But an interest rate hike will also impact households.

‘A uniform exercise of a 300 basis point interest rate shock would push households back to the debt servicing positions they held in 2008 [during the global financial crisis].’

Households feeling the pinch cut their discretionary spending…a lifeblood for many businesses.

Consumer spending is one of the most important determinants of demand. For instance, consumer spending makes up almost 70% of US GDP.

As for the stock market, rising interest rates often put pressure on high-flying concept or growth stocks yet to reach profitability.

As Princeton University economist Burton Malkiel once pointed out:

‘Since stock returns must rise or fall to be competitive with bond returns, there is a tendency when interest rates go up for prices of both bond and stocks to go down, and as interest rates go down for prices of bonds and stocks to go up.’

Of course, interest rates worldwide are at historically low levels so any increases in 2022 will come from a low base, tampering any effect on equity markets.

But investment bank JPMorgan, featured in Bloomberg’s collation of over 500 investment outlooks for 2022, warned:

‘Increasing interest rates and marginally tighter monetary policy should be a headwind for high-multiple markets such as the Nasdaq.’

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.