The Nasdaq hit the magic 10,000-point mark last week as investors continued to pour money into tech.

It was a record high…

Familiar names like Facebook, Microsoft, IBM, Google, and Tesla drove the brunt of the rally.

Incidentally, last week’s move meant Tesla overtook Toyota to become the most valuable automaker in the world.

Which, when you look at the numbers, doesn’t really make sense.

Toyota made $253 billion revenue in 2019 with gross profit margins of 21%. Tesla on the other hand brought in revenues of $21 billion with lower gross profit margins of 17%.

Which company would you rather own for the same price?

But rational or not, it shows you that investors’ appetite for all things tech is soaring high right now.

Don’t get me wrong, I’m a fan of tech innovation too.

Especially in sectors like healthcare which are ripe for major disruption (and I’ve a special report you can read if you want to find out my favourite stocks).

But I also know that, if you want to find the next big thing, you must be willing to start looking where no one else is too.

After all, the big gains come from getting in ahead of the crowd, not in following them.

Even if that means looking silly for a while.

So, it wasn’t the Nasdaq but this record-breaking chart instead that caught my eye last week…

[conversion type=”in_post”]

Never been so cheap

Take a look at this chart:

|

|

|

Source: Long Term Trends |

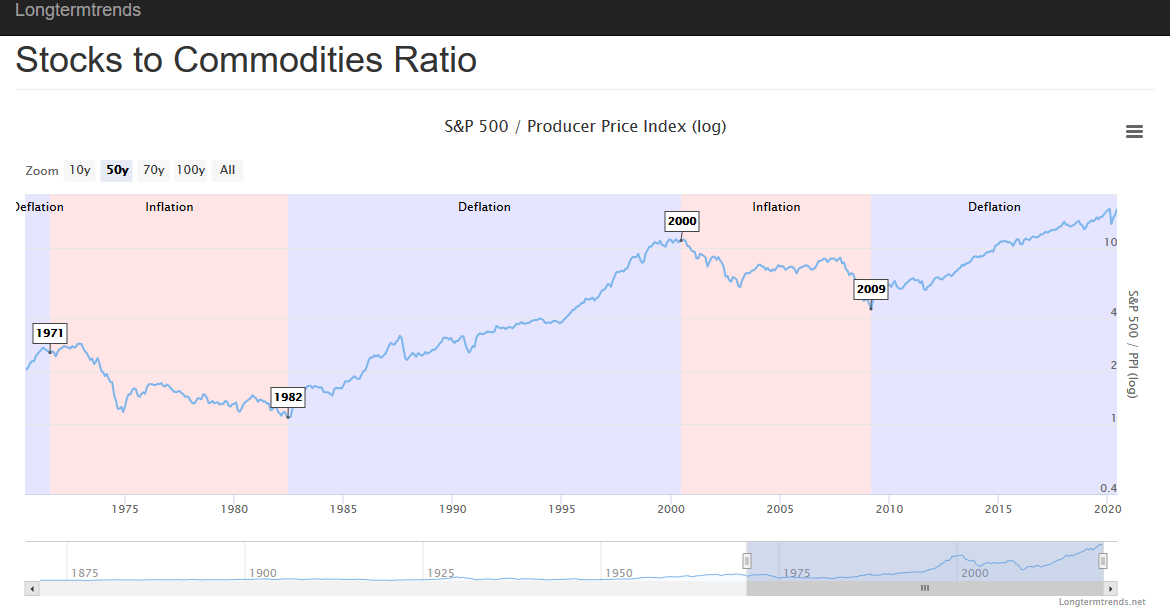

This is a chart of the ratio of the value of the top 500 US stocks to the value of the commodity index.

So, it’s a good barometer of the value of the stock market in terms of the value of commodities like iron ore, copper, oil, etc.

What it is showing is a big deal.

Because it shows that, in terms of commodity prices, the stock market has never been so expensive.

The ratio has even surpassed the 2000 dotcom boom.

But it’s the other side of this coin that interests me.

Because commodity-related companies are now trading at record lows compared to the rest of the market.

Which means one of two things…

Either stocks are far too expensive and will fall soon…

Or, we’re gearing up for a new commodities boom cycle…

You can see in the chart that each cycle is either deflationary — where commodity prices fall; or inflationary — where commodity prices rise.

Although inflation has evaded economists for years, that might be due to change soon.

There’s an unprecedented amount of money being thrown into the system by central bankers right now.

Add to that the trade wars and tariffs — an increase in prices through the addition of further taxes — between China and the US, and I think there’s certainly going to be upwards pressure on prices sometime soon.

Lastly, it’s clear that the fall-back strategy for governments the world over right now is infrastructure and construction spending.

Politically it makes sense as it keeps people working and there’s a tangible benefit at the end of it.

This is as true in Australia as it is in China, the US, and the rest of the world.

Though of course for Australian investors, what happens in China matters more than most.

Which is an interesting dynamic right now.

Despite some outward tensions, we are still seeing rising iron ore prices. Chinese demand for Australian commodities is still ramping up.

The spot iron ore price even rose to over $100 per tonne last week.

As CNBC reported last week, the fact is (like it or not) China needs our iron ore. There’s no viable other option for them.

They quoted Gavin Thompson, vice chairman at commodities consultancy Wood Mackenzie as saying:

‘While it is possible that relations between China and Australia worsen to the point where iron ore, coal and LNG shipments to the East Asian economic giant would be hit, such tactics would also hit China’s growth, said Thompson.

‘“Such a move would also come at a cost to China. Any disruption to its imports of Australian energy and iron ore would have an immediate impact on both price and China’s own supply needs,” he added.’

Taking a closer look

There’s no question when it comes to the biggest investing opportunities on the Australian market, you can’t go past our resources sector.

From small-cap punts to mid-cap explorers, and of course, the big players like BHP and Rio Tinto.

Myself?

I like looking for exponential gains, so I’ll be taking a closer look at the small- and mid-cap miners in the coming months.

These stocks can explode if you get on the right one, at the right time. Not an easy task though, I should add.

But if you’ve the appetite for a speculative investment, I suggest you keep a close eye on the resources sector in the coming months too.

Good investing,

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.