Gold’s performance in the last four years is phenomenal. It’s moved well ahead of that of gold mining stocks, which derive their gains from gold’s fortunes, among other things:

| |

| Source: GoldHub Australia |

The more established gold producers, as proxied by the ASX Gold Index [ASX:XGD], have trailed gold significantly. Meanwhile, the smaller gold explorers and developers, reflected by my Speculative Gold Stocks Index, are further behind.

While many wonder whether it’s too late to chase gold, some jump into the leading gold producers as their momentum gains. They’re riding the rising trend. Meanwhile, some buy the explorers and developers at deeply discounted prices, waiting for the buying wave to hit them.

There’s no right or wrong way to do this. But here’s something you can consider to increase your chance of success.

Seek guidance from the right

trends and indicators

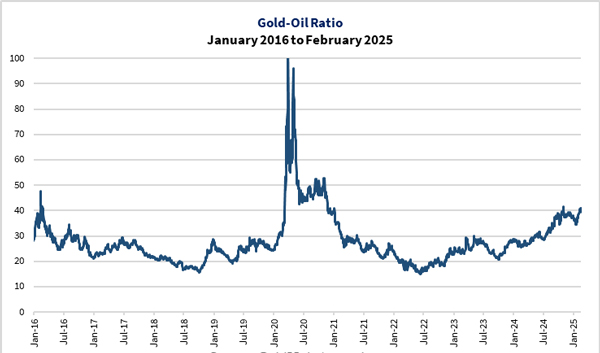

If you want to follow the trend and buy gold producers, pay attention to the gold-oil ratio.

This measures the relative level of the prices of gold and oil. Historically, this ratio can predict the operating margins of gold producers.

A high gold-oil ratio usually leads to gold producers delivering higher margins as they can sell their gold for a higher price relative to their operating expenses.

The trend in the gold-oil ratio is currently at historical highs, as you can see below:

| |

| Source: GoldHub Australia |

Apart from 2020, which was an aberration, this looks to be a golden period for gold mining companies, pun intended.

They collectively delivered a record quarterly performance for the 2024 December quarter, with the average operating margin being over 46%. This comfortably beats the previous record of 43% in the 2020 December quarter.

Having experienced a prolonged period of challenging operating conditions from 2020-23 following the Wuhan virus pandemic, gold producers are hopefully set to catch up to gold’s phenomenal run over the past few years.

Thanks to these great conditions, the ASX Gold Index set a new record in October 2024. Last week, it exceeded that and achieved a new milestone as it surpassed 10,000 points for the first time.

A handful of leading gold producers including Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN], Capricorn Metals [ASX:CMM], Genesis Minerals [ASX:GMD], and Emerald Resources [ASX:EMR] are now trading at record levels.

However, some are only trading a little higher than their 2020 highs as investors are showing signs of hesitation to take prices much higher. Other gold producers, while not trading close to their record levels, are similarly hitting a resistance.

Could there be a catalyst to drive gold producers higher? Possibly. If so, there could be more opportunities to benefit from here!

The missing ingredient to ignite

the gold explorers

Looking at the smaller gold mining companies, they’re almost a world apart. Many are still trading at depressed prices, even making new lows in the past few months.

Though you could see the Speculative Gold Stocks Index trails the ASX Gold Index marginally, the larger constituents have started forging ahead and therefore disguises the true state of most of the smaller companies in this space.

While gold producers sold gold these past few years and generated surpluses in most quarters, explorers and developers were burning cash. They faced a prolonged period of depressed trading and needed to dilute their capital at falling prices to continue.

Those who venture to buy these companies now believe that gold will continue to rise from here. But what could cause a rush into gold is actually its more volatile sibling, silver.

Last year, silver had a great year, breaking above US$30 an ounce for the first time since 2012:

| |

| Source: Refinitiv Eikon |

If not for the correction in November after the confirmation of President Trump’s victory, silver would have outperformed gold last year.

Now why does silver matter? That’s because silver represents the market’s FOMO in precious metals. Silver’s run is more violent than gold in a precious metals bull market.

We’re waiting for silver to break above US$35 an ounce. After that, I expect all cylinders could fire in gold, silver and gold stocks.

That’s why if you’re planning ahead, consider taking positions in the smaller gold stocks now.

But beware, there are always risks when investing in gold stocks, randomly buying these stocks could mean picking up a few duds that will cost you rather than reward you.

A cautionary tale: when gold stocks

retreated in 2021-22

Before I finish this article, I want to remind you that every bull market will end sometime.

It’s hard to work out exactly when, but you could follow the right signs to help you brace for it. This way, you can make a graceful exit and pocket your gains rather than become a victim.

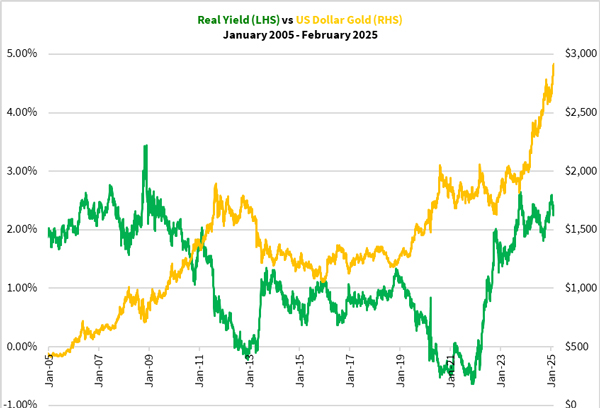

When you look at the gold price cycle in the past, the long-term inflation adjusted yield of US Treasury bonds can influence the price of gold. They often move in opposite directions as you can see below:

| |

| Source: US Treasury, Refinitiv Eikon |

Currently, the real yield is trading in a tight range. The US Federal Reserve is in the midst of cutting rates, which favours gold.

However, that could change depending on how the Trump administration navigates foreign and domestic trade. At this stage, there are fears the tariffs could cause inflation to accelerate, postponing rate cuts. That could cause the price of gold to take a pause.

As for gold stocks, let the gold-oil ratio predict how profitable gold producers will be in the coming three to six months.

What undid many gold and gold stock investors in 2021-22 coming out of the last bull market when gold paused its rally while oil started surging. The gold-oil ratio retreated from almost 40 at the start of 2021 to as low as 15 in mid-2022.

Gold stocks lost their momentum with a falling gold-oil ratio. At the same time, inflation started to accelerate, causing central banks around the world to scramble and raise rates in 2022.

While gold benefits from inflation in theory, central bank intervention to fight inflation held gold back. Oil’s surge constricted gold producers’ margins.

Let this recent history be a word of caution. While you can make friends with the trend or move ahead of the crowd, pay attention to the right indicators to help you navigate the ever-changing markets.

If you want guidance in building your precious metals portfolio to capitalise on this opportunity, check out my service, The Australian Gold Report by clicking here.

I’ve got a game plan for you, plus three gold producers you can act upon right now.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments