We’re fast approaching the end of 2024.

And what a year it was for precious metals!

| |

| Source: GoldHub Australia |

| |

| Source: Refinitiv Eikon |

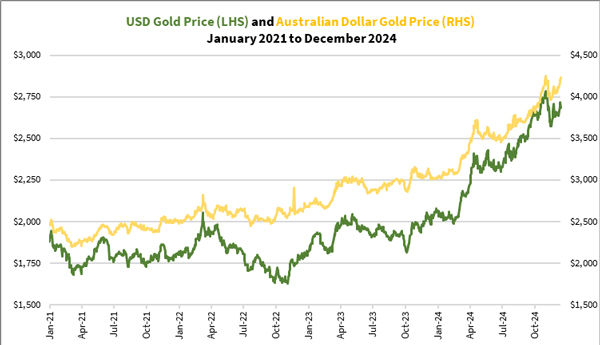

Gold in US dollars rose by some 30% during the year. Silver also rose by the same amount.

In Australian dollar terms, it was even better. Gold’s up by almost 40%, while silver has increased by more than 40%. Our weaker dollar helped Australians who own precious metals become a little wealthier.

Given the impressive performance, can gold and silver have another stellar year going forward?

What about precious metals mining stocks?

Let’s explore this today.

This year has seen mixed outcomes in the global economy. Asset prices have broadly increased, widening the wealth divide.

Many have learnt the hard way that it’s more about investing in the right places than earning a salary/wage that keeps them afloat amidst rising costs of living, job losses, and indebtedness.

Those who invested in precious metals assets experienced some wins. Those who bought gold and silver bullion or exchange-traded funds (ETF) can celebrate. Those who bought certain larger gold producers and established developers also enjoyed significant returns. Meanwhile, the smaller companies remain deeply discounted.

While many think gold dictates the fortunes of gold mining companies, I’ve learnt over a decade ago that there’s more to it than that.

Besides the price of gold, other important drivers include oil, the US Dollar Index [DXY], and silver.

Why’s that?

They all contribute to the success of gold mining companies and the market’s perception of them as investments.

I’ll explain how it works as we delve into the key events to watch for 2025.

All eyes on the ‘America First’ policy

As President Trump’s administration returns on 20 January 2025, expect the ‘America First’ policy to take form. This involves putting the country’s interests ahead of policing the rest of the world and intervening in the affairs of other countries.

Economically, the Trump administration will implement tariffs on some of its trading partners and competitors, bring manufacturing back to the country and cut the government’s bloated departments.

Geopolitically, the US will shift from using its military force to exert influence, opting to act as a key negotiator between countries to manage their regional affairs. This could reduce the burden on its taxpayers and free up funds for domestic development.

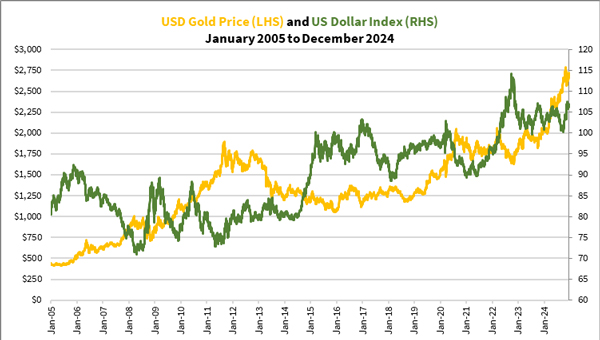

Expectations of an incoming Trump administration have already strengthened the US dollar against most major currencies. The US Dollar Index rose under 5% since President Trump’s victory, causing gold to trade 3-4% lower from its October highs:

| |

| Source: Refinitiv Eikon |

Should the Trump administration succeed in bringing peace to various countries and its economic policy help reduce its deficit and increase productivity, the US dollar could strengthen further. Gold in US dollar terms could retreat.

However, a stronger US dollar could offset the decline in the price of gold for us.

As you may have seen, our dollar has declined in the past month to trade below 65 US cents. This is despite our Reserve Bank of Australia (RBA) holding the 24-hour cash rate.

Should the RBA join other central banks in cutting rates, our dollar could fall further.

While the Trump administration seeks to implement its plans, Congressional members from both parties have indicated they’d try to stifle it. An impasse could exacerbate the government’s deficit and hinder productivity. These can reaccelerate inflation, favouring gold and weakening the US dollar.

Green Agenda out: How will a revival of fossil fuels affect gold assets

The Green Agenda played a key role in driving the global economy into the ground. Shutting down nuclear reactors and coal and oil generators and replacing these with solar panels, wind farms and experimental energy technology have backfired.

Not only has it failed to deliver a cleaner environment, it has also been a catastrophic misallocation of capital.

Countries implementing this agenda have seen higher electricity bills, lower productivity, with many places seeing blackouts and brownouts.

Several governments were voted out for their blunders, yet it may take time for these problems to reverse.

A return to commonsense by restoring fossil fuel use and development may restore global productivity. An increase in oil and gas field development in the US and other Western nations may weaken the OPEC nations’ ability to control the price of oil. This could prevent the price of oil from rising and spur inflation.

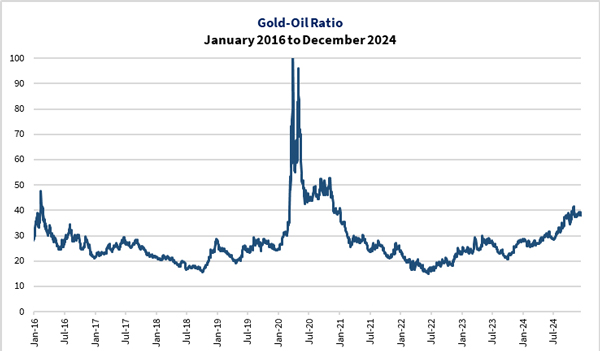

A fall in the price of oil may help improve operating margins for gold mining companies. This is because it affects the gold-oil ratio (how many barrels of oil an ounce of gold can buy).

The current gold-oil ratio is currently 38-39, a level rarely seen in the last decade:

| |

| Source: GoldHub Australia |

Gold producers are currently operating at a sweet spot.

While the price of oil falling can favour the gold-oil ratio, improved global productivity could similarly cause gold to retreat, reducing the ratio. Even if this ratio reduces to 30, gold producers are well-positioned to deliver significant margins to make them an attractive investment.

Can silver spark a gold stock bubble?

Finally, let’s look at silver.

We’ve seen gold stage an extended rally over the past five years, with a pause in 2022 when the Federal Reserve and central banks staged an aggressive rate rise cycle that ended in mid-2023.

Silver’s performance was subdued during 2021-23. It started rallying in May this year. While silver’s gains were impressive, it remains significantly behind gold in the longer term as you can see below:

| |

| Source: GoldHub Australia |

It’s worth noting how silver staged a phenomenal rally in 2010-11 in the last major gold bull cycle.

At the time, gold rallied first. Silver caught up and overtook gold.

This time, gold has moved ahead by more. Silver quickly surged for three months in mid-2020 to close the gap. But this gap has since widened.

Silver is currently trading at US$31 an ounce, around 35% below its record highs in 2011.

However, this is only half the story.

Let’s look at the value of silver after adjusting for the US Dollar Index:

| |

| Source: GoldHub Australia |

The price of silver today is comparable to that in 2011. Moreover, the current setup looks favourable for silver. It rallied twice this year and retreated to build a base.

As to what could spark a silver rally in 2025, gold advancing further to US$3,000 could be just what it needs.

Should silver break out, we might see a major move to gold stocks, especially the explorers and early-stage developers. That rally could deliver you massive gains if you pick the right companies!

At this point, let me wrap up this article.

While the Trump administration may implement economic and foreign policies that brings some sanity into the world, resistance from within and outside the US could cause the world to spiral into chaos.

Such chaos could trigger both gold and silver to rally.

For the well-being of everyone on earth, I hope that won’t happen.

That said, economic and global well-being may still boost the prices of gold or silver. As global debt continues to rise in the foreseeable future, gold and silver will benefit.

They might get to where we’d like them to be, just that it’d need more time.

Finally, I want to thank you all for your support during this year. I tip my hat to you for your comments and feedback, both positive and negative.

Have a safe and blessed Christmas. I continue to seek your good graces in 2025 and beyond.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments