If you read the news every day you might be forgiven for thinking the end times are upon us.

But it’s the weekend — a time to rest up before going again.

In our pieces this week we have highlighted the companies and assets that could benefit when things hit the proverbial.

That being said, it’s not just about the opportunities on offer — it’s about your psychology as well.

For instance in Thursday’s piece, Sam Volkering came up with a new word to describe what people may be experiencing at the moment.

Hyplegia he called it — where hype paralyses your decision-making faculties.

He rightly followed it up with yesterday’s piece which was about a slew of stocks that could benefit from a trend towards isolated living.

With this in mind, today’s piece is more about how you can handle the current crisis from a personal, psychological perspective.

That is, what you can do to shield yourself from the bombardment of negative headlines.

We think that if you remain clear-headed in this new environment, you will not only feel better, but you will be a smarter investor.

So let’s dig into our three-step system for protecting yourself from the negativity.

Want to learn how to buy crypto? Download this free report for everything you need to know

Step one: Know when to check out

This one is simple, but hard to do.

Stop reading the mainstream news obsessively.

American intellectual Reinhold Niebuhr has some powerful words on the matter, which is drawn from his Serenity Prayer:

‘Give us the grace to accept with serenity the things that cannot be changed, courage to change the things that should be changed, and the wisdom to distinguish the one from the other.’

The prayer was later popularised by Alcoholics Anonymous.

The point of all of this, is to let other people get ‘drunk on negativity’.

Have word-of-mouth information deliver you the news rather than gluing yourself to a screen, absorbing it all in isolation.

Put a bit of internal distance between yourself and something that is clearly beyond your control.

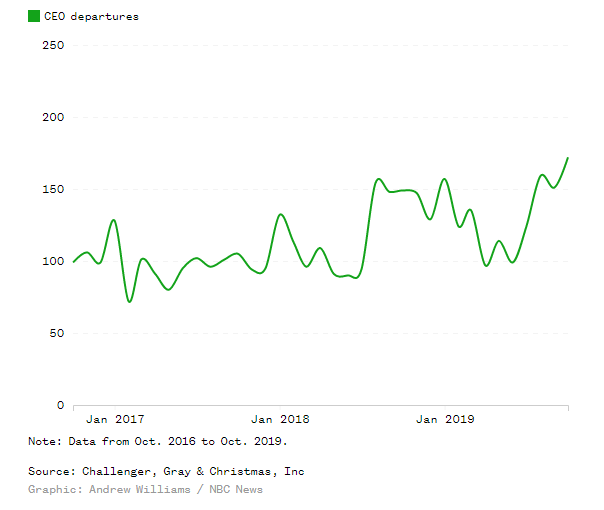

It is telling that in the US, last year saw the highest amount of CEO departures in 17 years.

Last month saw a record 219 departures.

You can see the trend accelerating:

|

|

| Source: NBC News |

Get out while the going’s good it seems.

These CEOs may well be exiting their positions so they can access their company stock at a time when markets could enter a free fall.

It’s going to be hard work running a company in a downturn, so they may as well take a break nice and cashed up!

The same goes for you, the individual investor.

Take a small mental holiday from the news, when appropriate.

Step two: Watch for signs of recovery, but be patient

If this black swan is real, a recovery for markets may take a significant period of time.

Like Sam said in yesterday’s Money Morning, June/July might be when things start to turn.

While I hope this may be the case, the GFC is a useful guide here.

History can be a great teacher.

Let’s pull up the weekly chart of the Dow Jones Industrial Average [DJI] from the six-year period between 2007 and 2013. I’ve provided annotation to remind you of what went down:

|

|

| Source: tradingview.com |

As you can see on the chart there were three false bottoms.

Now in falling markets, picking a bottom is not always going to work.

Investors were burnt not once, but three times.

So we may well see a spate of recovery rallies over the next year or so.

But here is the takeaway — at some point it makes sense to buy again.

If you had bought a big US ETF at the October 2007 high, you would be waiting until early 2013 to see your investment in the green.

And if you had bought the index at the third false bottom on the chart, you would have been back in the green within a year.

However, if you had done the same at the first and second times that the government threw the kitchen sink at the problem, you would be waiting far longer.

So give it some time before you go long and don’t get caught in the fleeting rallies.

What you are looking for is a meaningful trend reversal.

Something that lasts months, not weeks.

You can expect governments to do all they can to halt the economic decay this disease may cause.

That means stimulus.

But what will central banks do?

I expect over the next 6–12 months the Fed will cut rates to at least 1%, if not .75%.

As for the RBA, they have less room to move after juicing things to the max over the last couple years.

I now think we will see 0% before the year is out as well as some form of Quantitative Easing (QE).

These things will take time to flow through the economy and into share prices.

As an investor, watch the ASX 200 [XJO] slide and count the major relief rallies — ones that last more than two weeks.

Slide, rally number one, slide, rally number two — then start to consider your options.

Given a preliminary study published in Lancet places the case-fatality ratio at around 3% — coronavirus probably won’t be the end of the world.

Learn to think like this and wait patiently for an opportunity.

Step three: Put things into context, focus on what matters

I’ve seen the Dalai Lama speak a couple times and at the risk of sounding a bit new age for an investment publication, his thinking is relevant today.

That is, work on the things closest to you.

These are your relationships with family and friends.

By all means protect your investments — and if you think things are just beginning to go down the drain take a long hard look at gold for instance.

Beyond this, context is important.

Don’t let the mainstream headlines bleed into how you get along with the people you care about.

Above all else, stay calm and remain rational.

Regards,

Lachlann Tierney,

For Money Weekend

PS: Bye bye dividends — why income stocks are in the firing line. Download your free report to find out.

Comments