- Good news for you, me and everyone else. One of the globe’s most vital asset markets is looking robust indeed!

I’m talking about the US housing market.

This might sound a bit obscure, at least at first.

But there’s potentially money to be made…and worries that can be put to rest.

The team at Bloomberg recently had a housing strategist, James Egan, on their podcast. He was one of the few to call it right last year.

Last year, James said US housing would likely remain stable despite the big fears over interest rates rises, recession, and crumbling confidence.

He’s been bang on. Well done, James!

Bloomberg got him on again. Here are the key points I gleaned from the chat:

- A huge number of existing US homeowners have very low, 30-year fixed rate loans.They have no incentive to sell, and refinance at a (much) higher rate. This is keeping inventory of homes for sale at around 40-year lows.

- New home sales are currently 20% of transactions — and that’s the highest market share since 2006.

- James thinks it’s possible US house prices can still rise this year if the Fed cuts rates and brings mortgage rates down.

- Bank lending since the GFC has been very prudent. A repeat of 2008 is highly unlikely.

- Not only that, but the US baby boomers are sitting on staggering levels of equity. Plus, only around 62% of US homes have a mortgage, nearly 10% lower than 2006.

US housing is a $40 trillion market.

It’s also much more important to US consumer confidence, spending, and net worth than the US stock market.

The American middle class is hitched to housing in a much more powerful way than US shares.

If you’re worried about financial stability for whatever reason, the current strength in US housing should be a weight off your shoulders.

And there’s always potential opportunity about…

There are stocks on the Aussie market with an angle into US housing in one way or another.

Some ideas off the top of my head are Reece, Reliance Worldwide, Beacon Lighting and James Hardie.

James Hardie has been a belter of an idea lately. It’s up around 30% in the last quarter or so.

I’m giving a hat tip to my friend and colleague Greg Canavan for recommending it to his subscribers back in February.

Greg’s timing was impeccable. JHX has been on a steady march higher since.

There looks to be more coming up too.

Greg specialises in ideas like that.

I’m talking about quality companies that represent great value and great potential.

Usually, they’ve hit a temporary glitch or two…and why they come into Greg’s value range.

Greg’s put together his current basket of ideas in a briefing called the Royal Dividend Portfolio.

He only put it out last month, and I can already see two of the stocks are in 52-week highs.

I strongly urge you to check it out here.

- There’s lots of data points flying about as usual. I like to share the most interesting ones I see.

Today’s comes from the team at WaveStone Capital.

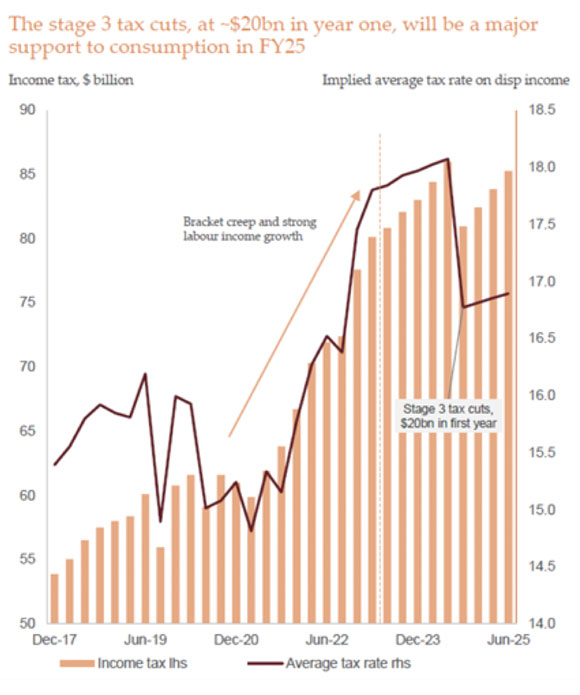

They already have their eye on the Stage 3 tax cuts coming from next financial year (FY25).

Take a look at this chart:

|

|

| Source: WaveStone Capital |

FY25 is a year away. But think about the potential context that surrounds these cuts.

The Federal government is running a budget surplus. Australia will have high migration. RBA cuts will likely be in play too.

We know retailers are taking a hiding at the moment.

However, these factors could combine powerfully to lift them off the floor at some point.

I’d also expected these positive tailwinds to push the retailing focused property trusts forward like Scentre Group, Vicinity Group, and HomeCo Daily Needs REIT.

It’s not something to act on today. But financial markets are forward-looking, probably something to watch for from around January next year.

And, again, the general trends forming now make me positive for the market in general.

- It can be hard sometimes to get across how subdued trading has been in the Aussie market over the last 18 months.

Here’s some data to give you a more concrete example. Volume in Aussie shares is down 20% on last year.

The AFR reports:

‘Average ASX cash equities daily trading volumes were the worst in three years in January, and four years in February, on Coppleson’s numbers. And it has not got much better since, as the recession that was meant to hit in March or April still hasn’t arrived.’

The positive take from this is that there’s so much potential for volume to lift if things play out more positively than expected!

Best wishes,

|

Callum Newman,

Editor, Money Morning