Many Australians are familiar with the names Andrew ‘Twiggy’ Forrest, Gina Rinehart, and Chris Ellison. They’re among the richest people in the country, making their fortunes in mining.

People may also have heard of Bill Beament and Jake Klein. They’re well-known gold mining leaders, the former heads of Australia’s two largest gold producers, Northern Star Resources [ASX:NST] and Evolution Mining [ASX:EVN].

Let me test you a little bit to see whether you are really knowledgeable about the gold mining space.

Do you know Raleigh Finlayson?

If you don’t, I suggest you start paying attention. That’s because he’s currently the biggest mover and shaker of the Australian gold mining industry.

He’s not an upstart either. Let me tell you more about him and how he relates to something I call ‘Wildcat Season’.

A company’s destiny transformed

Imagine this: a late-stage exploration company that saw its market value explode in one day. All from an announcement of three men investing into the company and joining the board.

This happened in September 2021. The company was Genesis Minerals [ASX:GMD], a late-stage explorer worth $155 million at the time.

Three men tipped $20.8 million into the company, secured a board seat each. One of them took over as the company’s Chief Executive Officer.

You guessed it, Raleigh Finlayson was the CEO. The other two men were former CEO of iron-ore giant Fortescue Metals Group [ASX:FMG], Nev Power, and an experienced lawyer in the mining sector, Michael Bowen.

The announcement took the company’s share price from around 7 cents to 18 cents, taking its market value to $382 million.

That equated to a change in value of almost $230 million, all in one day.

Raleigh Finlayson invested $7 million into the company but most importantly, he came with a vision. To repeat his feat of turning a mining explorer into a multi-billion dollar gold producer.

And that, friends, is what our ‘Wildcat Season’ event is all about today – get the full story here.

Repeat the feat? What was his first?

The 30-fold growth in 6 years that you might have missed

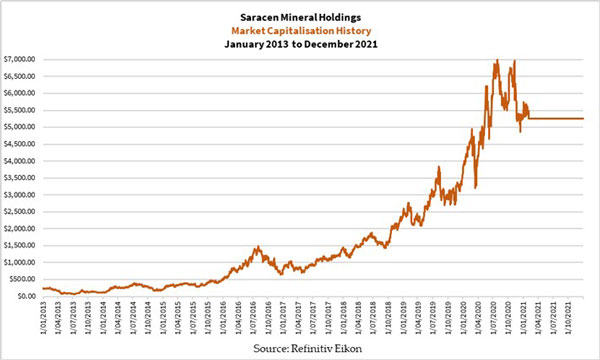

Saracen Mineral Holdings. The company started off as an explorer, then developed and brought into production two gold mines within five years. It survived the brutal gold bear market of 2013-14 and rode the bull market that followed, transforming into a mid-tier producer worth over $1 billion by 2016:

| |

As you can see above, the rate of its growth was amazing. It didn’t stop there. Saracen Mineral Holdings transformed from a $95 million producer in mid-2013 to $3.6 billion at the end of 2019.

If not for Northern Star Resources growing from a $250 million producer to an $8.3 billion giant over the same period, the limelight would have been on Saracen Mineral Holdings and Raleigh Finlayson. Arguably, both companies grew at a similar rate. But size matters, that’s the way it works in business.

The two companies eventually became joint owners of one of the largest gold mines in Western Australia, the Kalgoorlie Super Pit, before merging to form Australia’s next biggest gold miner after Newcrest Mining. When Newcrest Mining merged into Newmont Corporation [ASX:NEM] in October 2023, Northern Star Resources became our largest gold mining company.

You mightn’t know that Raleigh Finlayson succeeded Bill Beament as the Managing Director of Northern Star Resources after the merger. But that may be because he quietly stepped down after a few months.

He had a more ambitious plan, and that was Genesis Minerals.

Finding the next multi-bagger BEFORE it happens

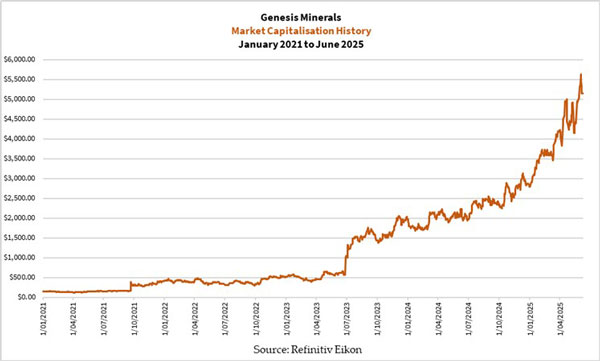

You know the outcome of Raleigh’s plan to pull off another astounding story of growth with Genesis Minerals.

Yes, he has done it again. It rapidly grew to a mid-tier producer with several strategic acquisitions over the last four years, including buying the Gwalia mine, the crown jewel of St Barbara Mines [ASX:SBM] in mid-2023.

Today, Genesis Minerals is worth over $5 billion. All this in just four years, as you can see below:

| |

The point I’m making here isn’t to say you should buy Genesis Minerals shares or back Raleigh Finlayson. I do believe the company has a bright future ahead of it, so you could learn more about it and decide if you want to back him with your cash.

What I want to talk about is how do we find a company like Saracen Mineral Holdings or Genesis Minerals YEARS BEFORE they grow to become a multibillion dollar company.

I do want to toot my horn a bit at this stage, so please excuse me or feel free to click to your next email!

My members bought Genesis Minerals in March 2022, when it was worth $400 million. We rode the gold bear market, saw the company acquire several mine assets in 2023-24, and enjoyed significant gains on the back of gold going parabolic.

I recommended taking profits recently, at around $4.50-5, having taken part profits on the way up. Most members enjoyed a return of 150-200%.

I can’t promise you that the next stock I tip will become the next Genesis Minerals. However, I have refined my research and analytical techniques to increase my chances of doing this.

If you want to take your chances, you’ve come at the right time. The recent breakout in the price of silver above US$35 an ounce has opened the door for investors to rotate their funds into the small-cap gold stocks. (The silver price is a good leading indicator for speculative gold stocks)

I’ve prepared a presentation for you on this topic. If you’re interested in finding the next speculative gold stock that could potential double or triple your investment in the years ahead, you won’t want to miss my presentation.

Go here to watch now and make sure you don’t miss out. I’ll be naming my top pick in the presentation.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments