In today’s Money Morning…the boom still isn’t fading…a record-breaking rally…overlooked and undervalued…and more…

By now, it should be pretty obvious that 2022 has been a great year for commodity stocks. And for Aussie investors, that has been a big win for our heavily weighted mining sector.

Because, you see, despite the All Ords being down 2.42% year to date, many miners are way up.

BHP Group [ASX:BHP] and Rio Tinto [ASX:RIO] have delivered a 20.5% and 19.1% return for shareholders, respectively, in the same time frame. And many of the other big names like Fortescue Metals Group [ASX:FMG] aren’t far behind, with 9.57% gains year to date, as well.

When you start delving into some of the smaller miners and explorers, though, things get even wilder.

Lithium, for example, continues to be a popular option. Even with the huge surge in many of these stocks over the past two years, the boom still isn’t fading.

Just take a look at these numbers:

- Calidus Resources [ASX:CAI] — up 48.46% year to date

- Lake Resources NL [ASX:LKE] — up 83% year to date

- Core Lithium [ASX:CXO] — up 105.56% year to date

Investors are reaping a whole heap of reward by jumping on this commodity trend.

Which begs the question, how much longer can the boom last?

How big can this boom really get?

A record-breaking rally

According to JPMorgan strategists, commodities may have a lot further to run.

They’re even suggesting that we could see a further 40% surge in prices in the near future — a move that will result from the growing shift of global capital towards raw materials as an inflationary hedge.

In their own words:

‘In the current juncture, where the need for inflation hedges is more elevated, it is conceivable to see longer-term commodity allocations eventually rising above 1% of total financial assets globally, surpassing the previous highs.’

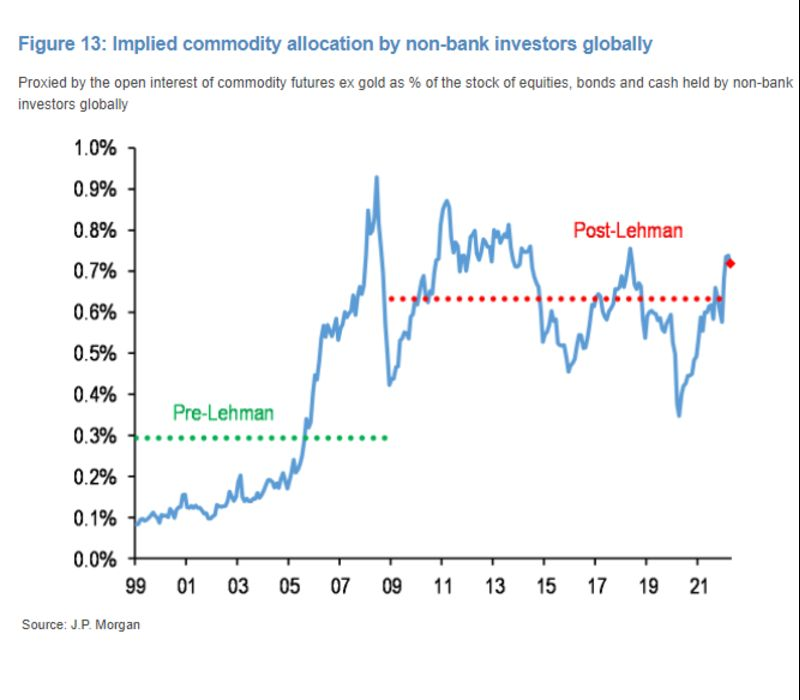

To give you some context as to how meaningful this 1% figure is, check out the following chart:

|

|

| Source: Bloomberg/JPMorgan |

As you can see, this chart shows the implied commodity allocation of investors around the world. And more importantly, it shows just how big the shift toward commodities post-GFC has been.

In order to reach this 1% target, though, the overall market still has a way to go.

Keep in mind that this is purely talking about the raw materials themselves, it is not necessarily a prediction for commodity producers — like mining stocks.

Having said that, if prices rise as a result of this shift, then you can expect many of these producers to rise alongside them. That is on top of the strong narratives already pushing up some minerals — like lithium — thanks to other big trends.

The adoption of electric vehicles and battery energy solutions is still the driving force at play there. This commodities rotation is just the cherry on top that could sweeten the already sensational gains.

You do still have to be somewhat selective, though.

Because as good as the returns are in certain sectors or minerals, it doesn’t mean every stock will be a winner. You still need to do your due diligence before committing your cash to one of these companies.

There will be winners, and there will be losers.

The hard part is making sure you find more of the former than the latter…

Overlooked and undervalued

In my view, with the state of many mining stocks across the ASX, I’d be looking for some niche picks.

Lithium, for example, is red-hot at the moment. And while I’m sure there’s good money still to be made, there are also a lot of bandwagon stocks that will probably peter out too.

You can see this same pattern reoccurring all the time, particularly amongst junior explorers.

These tiny mining firms talk up their potential to uncover the next big deposit, but a lot of the time, they never even make it to the drilling stage. The amount of time and money required often results in many of these hopeful businesses failing — taking down all their investors with them.

I know this because I’ve seen it before.

Back in 2011, when rare earths were in their first big mania bubble, the exact same situation occurred. Tiny miners looking to exploit the favourable market outlook jumped at the opportunity.

As one burned investor humbly conceded during this rare earths bust:

‘A charismatic man with an encyclopedic familiarity with the mining business, Brown told me that rare earths were the new oil — a business whose market is more than 1,200 times the size of rare earths’ — but he also conceded that his new line of work was “a very, very high-risk business.”

‘“Only one in a thousand companies will actually find an economic mineral deposit,” he said, “and you don’t know which one is actually going to find something.” Plenty of people seem willing to bet that his firm will prevail over the long odds: Rare Element Resources is currently worth nearly $500 million.’

Today, that same company — Rare Element Resources — is worth CA$257 million. And as you can see from its chart, investors who jumped on board back in 2010 and 2011 have yet to see a positive return:

|

|

| Source: Google Finance |

Funnily enough, though, rare earths is exactly the sort of sector I’d be looking closely at.

In the frenzy over lithium assets, it seems other crucial minerals in the EV/battery trend have been overlooked. Minerals like copper, cobalt, nickel, and many more are also key materials in a lot of this technology.

And while they certainly don’t capture as many eyeballs as lithium does, commodity investors should be aware of them.

After all, this forecasted boom could be very lucrative for many stocks across the ASX.

Just do yourself a favour and make sure to look beyond the already hot markets like lithium…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.