Happy April Fool’s Day everyone!

If I had told you a year ago that a new killer virus would sweep the world…

That it would change life as we know it…

Kill several thousand and infect hundreds of thousands (so far)…

That it would pretty much shut down air travel, keep kids out of school, and parents would be working from home…

Would you have believed me? Or thought it was all a joke?

To be honest, I wouldn’t have believed it myself.

Maybe, just maybe this is all a really well orchestrated April Fool’s Day joke, and quarantine ends at midnight…

Wishful thinking…

Bringing my experience to you every Wednesday

Anyway, hi, I’m Selva Freigedo.

I joined Port Phillip Publishing’s team as a research analyst in 2016, a rare opportunity that combines my two passions: economics and writing.

Some of you may already know me from Markets & Money, The Rum Rebellion…or from conversations with Shae on Twitter (@shaearussell).

I grew up in Argentina, a country with an unusual economic history to say the least. It gave me firsthand experience on different economic phenomena such as hyperinflation, devaluation, and debt default.

But I have also lived in a few other places throughout my life: Brazil, the US, and Spain.

Back in 2000 I was living in the US as the dotcom bubble popped…

And in 2008 I was in Spain as the property market exploded and then collapsed…

I’ve seen firsthand what happens when bubbles burst.

If my experience has taught me anything, it’s not to hope for the best, but plan for the worst…and to question everything.

For the last five years I have lived in Australia. And let me tell you, Australia is a great place to be. As I see it, it’s one of the few places left in the world that you can still call a ‘land of opportunity’.

And while I love living here, there are a few issues that cause me concern.

Things like the property market, or high household debt.

Today, we are living through a global pandemic that is shutting down the global economy…one that could have repercussions for years to come.

But even before COVID-19, things weren’t hunky-dory.

There was the trade war and tensions between the US and China; Brexit; zombie banks and high debt…among other concerns. We had loss of trust in institutions, misinformation, and unconventional central bank policies.

How do you navigate a scenario where the economic signals and information are reaching us increasingly distorted? How do you grow or — even more importantly — protect your wealth?

This is one of my main interests and something I will follow in my writings at The Daily Reckoning Australia.

In all the grief that the pandemic is causing, there is a silver lining.

You rarely get chances in life like this.

To pause, take a moment and look around. To think and take time to realise priorities. On your future direction and what type of life you want to achieve.

But to also be thankful for the people around us and what we have. To enjoy more time with them.

This is a time when we are realising we can live with less. A chance to think about what’s important in life and what you would like to change.

This is a rare breather. One we are usually too busy to take.

But, on the other hand, this pandemic is giving us a rare taste at the speed things can change and shut down. There is a complete overhaul of the system with government taking on more areas of our lives.

The global economy is contracting

As the outbreak keeps spreading, the global economy is contracting. This time, both supply and demand are taking a hit.

There is unprecedented government and central bank stimulus.

Governments are looking at putting more money into citizens’ pockets to keep liquidity in the system…but also to keep confidence up. If you know anything about our economic system is that it’s all about keeping confidence.

So far though, in Australia, confidence is plummeting.

In the most recent Roy Morgan’s consumer confidence survey, ANZ Head of Australian Economics, David Plank commented (emphasis added):

‘Sentiment took a further hit over the past week, falling to the lowest ever level in the almost 50-year history of the survey. There were some glimmers of hope. “Future finances” were up marginally and inflation expectations rose. In fact, there was a sharp uptick in the weekly reading of inflation expectations, which rose to 4.3%. But we aren’t getting carried away. “Current economic conditions” fell more than 9% and are down close to 50% over two weeks, to the lowest ever level. And most other aspects of the survey are exceptionally weak. The announcement of the largest fiscal package yet may stabilise confidence, but much will depend on the how the pandemic evolves.’

It’s concerning. The economy is at a standstill and this shock has caught Australians quite leveraged.

The main question in my mind is, how will we pay for all of this stimulus once we get to the other side? It may be breathing life into the system, but let me assure you, there will be a bill at the end of this.

It may come in the form of higher taxes, or even high inflation.

Our economic model is broken. Its growth is based on debt, but this debt is eroding our choices and becoming a burden.

It’s decreasing our future purchasing power. It’s unsustainable.

And the pandemic could very well be the trigger for a shift in paradigm.

Before I go, we have something extra for you from Port Phillip Publishing. Following there is an article from The Rum Rebellion’s editor Vern Gowdie.

I’ve had the pleasure of working with Vern many times, not only in The Rum Rebellion, but also collaborating with him in The Gowdie Letter.

Vern has a unique view on how all this could play out, with his main objective being wealth preservation.

It’s why we think that at a crucial time like this, it’s important to give you some insights.

Over to Vern.

Best,

|

[conversion type=”in_post”]

TINA — You’re Simply the WORST

What a difference a decade makes.In 2009, Tina Turner announced her retirement from live performances. This was the year when Wall Street would begin the performance of its life. Back then, Tina Turner was the most famous Tina in the world.

In November 2019, Tina Turner celebrated her 80th birthday. That same month, Wall Street was playing to packed crowds. Another TINA had moved into the spotlight.

As reported in Fortune magazine on 29 November 2019 (emphasis added):

‘Quite simply: TINA, or “There Is No Alternative”— to equities,

-

On Nov. 29, 2019, the S&P 500 closed at 3,140.98.

-

As of Nov. 29, the consensus 12-month forward earnings estimate for the S&P 500 is about $177.

-

Based on this estimate, the forward 12-month P/E ratio for the S&P 500 is 17.7 times, and the corresponding earnings yield (the inverse of the forward P/E) is 5.6%.’

TINA’s followers were in full voice, singing the praises of the performing share market.

‘You’re simply the best, better than all the rest’

They sang it so often and loud enough, it drowned out any competing voices.

The TINA tune stuck in people’s heads…

‘You’re simply the best, better than all the rest’

Over and over and over again it was being played. The lower interest rates went, the higher the volume was turned up. There is no alternative. Simply the best. There is no alternative. Better than all the rest.

On and on it went. It must be true. TINA was the only option.

Which of course was and is utter nonsense. Life is all about choices, some less good than others, but there are always alternatives.

On the surface of it, the Fortune magazine article looks like an ‘open and shut’ case for TINA.

Based on ‘the consensus 12-month forward earnings estimate’, the US share market looked fairly valued.

But let’s just scratch that surface using the faint application of a little homespun wisdom. How many times have you heard or been told, don’t count your chickens before they hatch? We’ve all it heard it during our lives. Good old-fashioned common sense.

Yet, based on unhatched earnings, the chorus rang out…quite simply…There is no alternative.

Hindsight now shows just how flawed the ‘rationale’ for TINA really was. Those consensus 12-month earnings estimates are not worth a cracker.

Consensus is a fancy word for Wall Street groupthink. They all crowd round the same numbers. No one dares buck the system.

In November 2019, when TINA was in full voice, I received this email from a reader:

‘If you [Vern] are going to claim that “It’s official…the US market is over-valued” it would be good if you could substantiate it as opposed to making broad sweeping statements or paraphrasing from someone like the IMF. The 1 year forward P/E on the S&P 500 is 16X, it doesn’t look ridiculous by itself and when valued against bonds it looks screamingly good value.’

My response was published in the 18 November 2019 issue of The Gowdie Letter. This is the shortened version:

‘There are a number of methods used to determine the value of shares.

‘In my opinion, Forward P/E is the least reliable measure.

‘Why?

‘Because it’s an estimate on next year’s earnings.

‘And, a lot can happen in markets and the broader economy from one year to the next.’

Well, a lot has happened in markets and the broader economy since November 2019. And none of it’s been all that good for those forward earnings estimates. In booms and busts, nonsense replaces common sense. It happens all the time.

This is the fourth market crash I’ve gone through…1987, 2000/01, 2008/09, and now. The pattern of mass delusion always repeats itself.

In the midst of booming markets, the irrational somehow passes for the rational. For me, the almost deafening chorus of TINA was actually music to my ears.

The lower interest rates went, the louder the (self-interested and blatantly idiotic) TINA calls became.

‘There is no alternative’.

‘Money in the bank is worthless’.

Investors need to move from cash into higher yielding alternatives. Which ones are they?

Preferably the ones being recommended/sold/managed by those singing the loudest in the TINA choir…stockbrokers/financial planners/institutional economists/fund managers.

Everyone was singing from the same hymn sheet.

‘You’re simply the best, better than all the rest’

The more TINA gained traction, the more obvious it became that people were losing their grip…on reality and their capital. All logic was being abandoned. People forgot they had a choice.

The January 2020 issue of The Gowdie Letter warned readers about the TINA myth:

‘People continue to drive markets higher on little more than the premise of TINA — there is no alternative.

‘What they fail to see is there is an alternative…it’s cash.

‘Investors are focussed on return ON capital, when they should be looking for return OF capital.

‘It’s only when markets crash that there’ll be a change in mindset…investors clamouring to get what’s left OF their capital.’

And as reported by CNBC, on 19 March 2020, there has been an abrupt change of mindset…

‘In the age of coronavirus, cash is indeed king.

‘That’s the view, at least, of many major investors, who are selling everything from stocks to bonds to gold in order to raise cash.’

Where are they clamouring to?

The safety of the warm embrace of US three-month treasury bills…a short-term bond guaranteed by the US Government.

The yield has gone over the cliff…three-month treasury bills are returning next to nothing.

|

|

|

Source: CNBC |

Marvellous how a collapsing market can make you re-evaluate your priorities. Now it’s all about return OF capital (safety) and not return ON capital (interest rate).

Anyone who, in recent times, was taken in by the TINA nonsense has taken a bath.

They must surely be harbouring regrets about the day they chose the alternative.

At what point do you yield?

But what about those who looked for better yielding alternatives several years ago? How are they going?

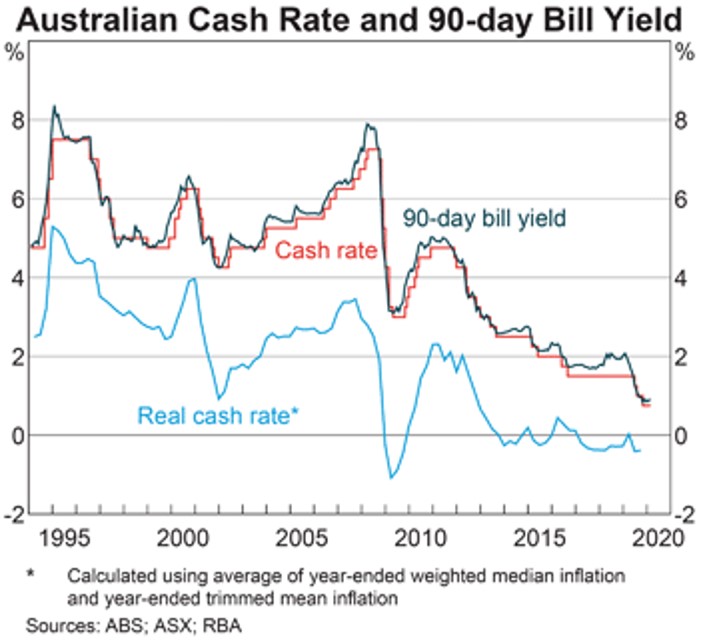

Firstly, let’s look at how the alternative has performed. Cash and term deposits: in 2015, the cash rate was around 2.5%. Term Deposits (TD) were paying around 4% for 12–18 months. Since then, 12-month TD rates have fallen to around 2%.

Let’s assume, money in the bank — on average — has returned around 3% per annum over the past five years.

|

|

|

Source: RBA |

The alternative, the most popular dividend stocks on the Aussie market — the Big Four banks and Telstra — have paid dividends around 8% per annum.

On a yield basis, shareholders have been rewarded with an additional 5% per annum over the past five years…around 25% better than what term deposits have paid over the same period.

However, contrary to what some investors seemed to believe, the market does not give you that extra return for free. There’s always a catch. Now, I know, mentioning that fact may seem rather silly.

However, I can assure you, the TINA mentality did make the irrational seem rational. Anyway, here in graphic detail is the catch.

The following chart illustrates the nonsense in the investment industry’s ‘chasing yield’ fable. Those various coloured lines represent the share price performances of the Big Four and Telstra since 2015.

Here’s a tip for the TINA groupies…performance charts falling from left to right are not good.

|

|

|

Source: Yahoo Finance |

CBA — the blue line — is the best of a bad bunch, with MINUS 20%. The other four (ANZ, NAB, Westpac, and Telstra) are all grouped around the MINUS mid-40% range.

On average — over the past five years — these five dividend paying stocks are down 40% in value. Ouch.

Let’s do the maths. Add back the superior INCOME return of 25% and the yield-chasers are 15% worse off than those who left their money in term deposits.

But, but I know, you were told money in the bank was worthless…there was no alternative.

You know what was worthless…the advice that demonised cash. And for shareholders, you can be assured there’s more bad news to come.

Markets have only just began taking back those ‘free’ lunches. My guess is markets are going (a lot lower) compounding those losses. And, with bad debts bubbling to the surface in the coming weeks, months and years ahead, bank dividends are going to be cut…and cut hard.

Double, triple ouch. TINA. Cash is trash.

These were songs being sung by the investment industry’s Pied Pipers. TINA has taken investors over a cliff…and they are yet to hit the rocks below.

TINA was simply the worst advice people could have listened to. Those with cash in the bank are now quietly humming…

‘You’re simply the best, better than all the rest.’

Regards,

|

| Vern Gowdie, Editor, The Gowdie LetterPS: Exclusive interview from The Daily Reckoning Australia: ‘The New Case for Gold: An interview with bestselling author and Wall Street insider, Jim Rickards’. Click here to learn more. |