You may be thinking of buying an ASX 200 ETF that tracks the overall performance of [XJO] which is the ticker symbol for the index.

This could for example be one like SPDR S&P/ASX 200 Fund [ASX:STW].

So let’s take a look at what the ASX is up to, and where the best investment opportunities could be in the context of recent market moves.

Hint: It may surprise you.

The top 200 or XJO is usually fair indicator of the overall health of the Australian market. The XJO is a top-heavy market with 40% being made up of the Financial and Materials sector.

Third on the list is healthcare — this sector is mostly CSL Ltd [ASX:CSL] with a market cap of over $123 billion, it drags the health sector in line with itself.

In the current climate, the top end of the XJO is heavily affected by the COVID-19 pandemic.

Falling 38.85% from the peak in February 2020 to a low in March of 4,402 points.

Having recovered to trade at 6,023 points at time of writing, this represents a net loss of 16.43%.

Source:Optuma

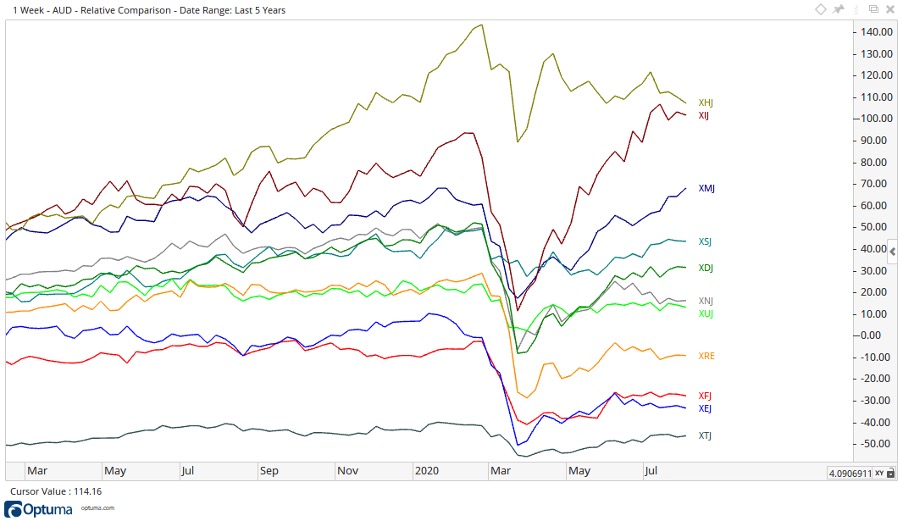

What’s happening in the ASX 200 — sector comparison

We can break this down to sectors and have a look at what’s taking place.

Source:Optuma

Outlined above is the weekly price action over five years for the sectors that make up the ASX 200.

Materials XMJ is inclining slowly (blue line), Healthcare is falling away, which is inline with CSL [ASX:CSL] falling away recently.

While most of the other sectors look reasonably flat.

Where can the growth be found

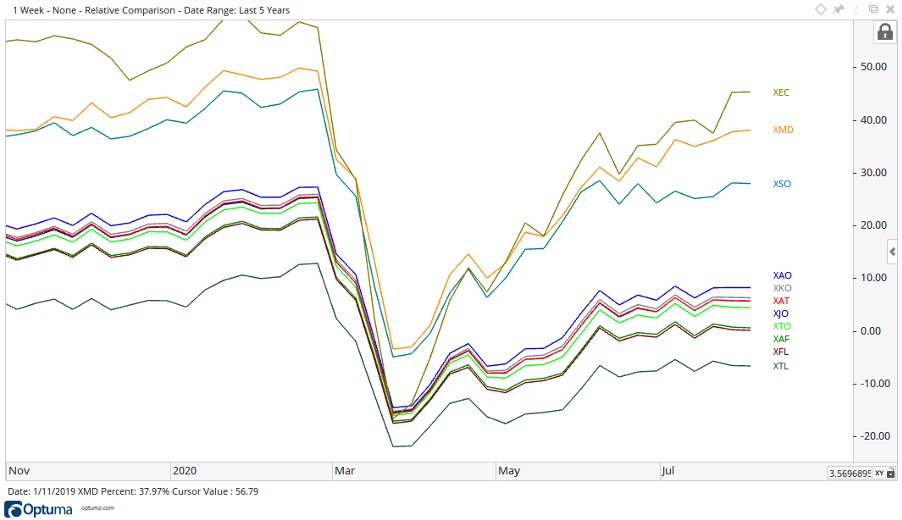

By moving out from the ASX 200 and looking at the overall XAO or top 500 companies a secret can be uncovered.

Source:Optuma

The olive-green line at the top of the chart illustrates the XEC Index, or the Emerging Company Index.

The companies of this sector may not be the big shiny names at the top of the All Ords [XAO] but what they lack in fame they make up for in the ability maybe ward off the macroeconomic headwinds that the big ASX 200 stocks could face.

Particularly if they have a product that is well suited to the lockdown environment.

Source:Optuma

As you can see from the chart above this index is ticking along nicely, moving out from the low in March 2020.

This sector may very well hold more risk then the larger sectors of the market, but if you are willing to do the leg work, and put in the research it may just prove a profitable excursion.

So on that note, I’ve got a great resource for you.

It’s our report on four high value small-caps.

They have been carefully selected for their ability to benefit from lockdown megatrends.

Best of all, it’s free. Get the names and research behind them, here

Regards,

Carl Wittkopp

Comments