Around this time last year, a former colleague and I made a bet…

…using the most enduring form of currency in Australia — a slab to the winner.

We put our economic forecasting skills on the line over Twitter.

Because, if it didn’t happen on social media, then it didn’t really happen, right?

This bet has been made from opposite sides of the world.

And by its end it will have taken almost 14 months to play out.

So, what’s the bet?

The economic fortunes of Australia.

My call was that Australia’s gross domestic product (GDP) would be negative in either the third or fourth quarter of GDP. Whichever was negative first, the next one would also be negative, triggering acknowledgement of a technical recession.

My mate on the other side of the world said nup, there may be one negative quarter of GDP, but not two back to back.

So far, we’ve both been wrong.

Fourth quarter data comes in March…that means there’s still a couple of months for it to play out.

But things don’t look good…

The retail graveyard

We are 17 days into the New Year, and already seven Australian retailers have entered administration.

Then news came yesterday that electronics retailer Bose was closing its retail stores worldwide.

All this bad news only halfway through January.

Importantly, the retailers tanking isn’t just one type of store. It’s a mash-up of clothing, electronics, wine, and bookshops.

The thing is, this January is similar to the start in January 2019, where three household names went under. Followed by another 10 major brands going broke over the year.1

But then, 2017 and 2018 weren’t great news for retailers either.

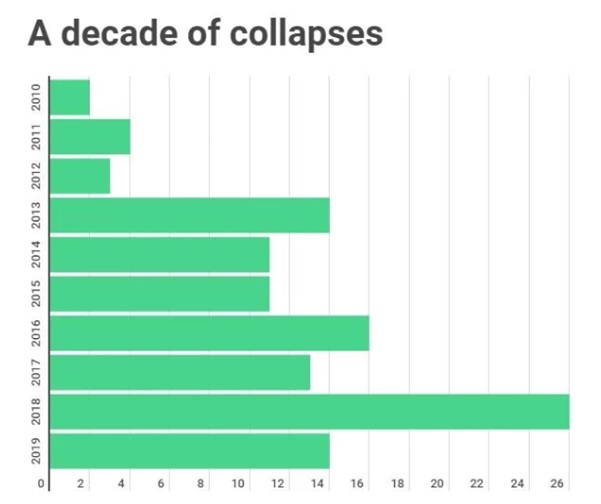

In fact, data from Smart Company shows that more than 100 major Aussie retail brands tanked between 2010 and 2019.

More than 100 brands bankrupt in Australia

|

|

| Source: Smart Company |

Here’s the thing.

The stores above are the brands we know about. Major retailers with some sort of chain store presence in Australia.

None of that data reflects the single store small business type of retailer.

And no, the worst isn’t over yet…

Data to watch

The severity of the decline in the Aussie retail sector doesn’t surprise. I’ve been analysing consumer behaviour for years.

Long-time readers of the Daily Reckoning Australia would know that I call the retail sector my ‘crystal ball’ when it comes to understanding the Aussie economy.

Arguably the stores falling under now are a reflection of shopping habits that showed up five years ago…and only now are we seeing the impact.

Private consumption growth as a proportion of gross domestic product has been falling since 2016.

In 2016 58.9% of all GDP came from private consumption. The most recent quarterly data for 2019 has seen that number fall to 54.8%.2

That’s a slow and steady decline in personal spending.

But this pattern was also evident in Australia’s trade surplus.

There’s a lot of noise made about the trade surplus being a good thing for the Aussie economy. The high amount that the exporting side of Australia is benefiting from higher commodity prices and a weaker Aussie dollar.

Yet, the export side of the Aussie economy only benefits a few. Falling imports means that we as consumers aren’t buying as much. We’ve had a persistent trade surplus since late 2017.

However, monthly trade surpluses began to appear occasionally as far back as October 2016. Watching this play out, coupled with falling private consumption in GDP, pointed to a weaker Aussie retail sector in the long term.

To compound all of this, is the reduction in credit card spending. New data from the Reserve Bank of Australia shows that the total value of credit card transactions in Australia has been falling since 2014.3

One million jobs on the line

The thing is, the years-long pattern of discretionary spending decreasing in Australia is being ignored.

Lazy analysis is blaming the retail woes on all the invasion of ‘foreign’ brands.

That’s nonsense.

Brands like Uniqlo, Zara, and H&M are the scapegoats for the failing Aussie retail industry.

Yet, combined they rake in $700 million from Aussies. A collective 3.6% of the total $19 billion Australians annually spend on clothing.4

International retailers are essentially fighting over the scraps of our business.

But there are structural problems with the retail sector that management has been either too lazy or too arrogant to accept as consumer spending slows.

At the start of last decade, expansion for business growth was the attitude many retailers adopted. That is, increase the footprint of the business (how many stores they have) and then grow the business that way.

But by putting stores in every major shopping centre in Australia, they were canbalising their own business.

This is coupled with the fact that shopping centre rents have been increasing even though in-store sales are falling.

The persistent sale cycle means that retail margins have been falling since 2017.5

Throw in sinking consumer spending, and the inability to adapt quickly to consumers rapidly shifting shopping habits — you see they’ve dug a hole so deep, now they can’t get out.

The thing is, the past five years of slowing spending is only just beginning to be felt.

Consumer spending has been falling for a considerable amount of time and retail stores falling over is a lag effect to the problems the retail industry faces.

More than one million people work in the Australian retail industry. Slightly less than 10% of our entire workforce.

What we are seeing in the collapse of retail is the reflection of the private recession affecting Australians.

Not only that, but the worst is yet to come.

| Until next time, |

| Shae Russell, |

Comments