Editor’s note: In today’s video update I discuss ASX bank stocks relative to resources and the risk that CBDCs pose to traditional banking. I also take a look at what’s happening with gold and the bitcoin price. Click below to watch the video.

‘Nothing endures, but change.’

Heraclitus

Whether it’s by directly holding Big Four bank shares or part of your super — a significant portion of Australians have a piece of the banking oligopoly pie.

And with National Australia Bank Ltd [ASX:NAB] releasing its results on Friday, we got a glimpse of how one pillar of the Australian financial system is faring.

Normally, a 7% fall in profits would be a cause for concern.

However, the results were better than expected.

So, some people on Friday may’ve thought that now is a great time to snap up some bank shares.

Buy and hold for 10 years and you will be laughing, apparently.

I’ll be blunt — I don’t think ASX bank stocks are cheap.

The value argument is based on a static view of the world.

So, here are two opposing arguments on ASX bank stocks.

Free Report: ‘Why Your Bank Dividends Could Be Under Threat’

Argument #1: Relative to resources ASX bank stocks look cheap

Diversity of opinion is a good thing and there are two camps amongst our editors.

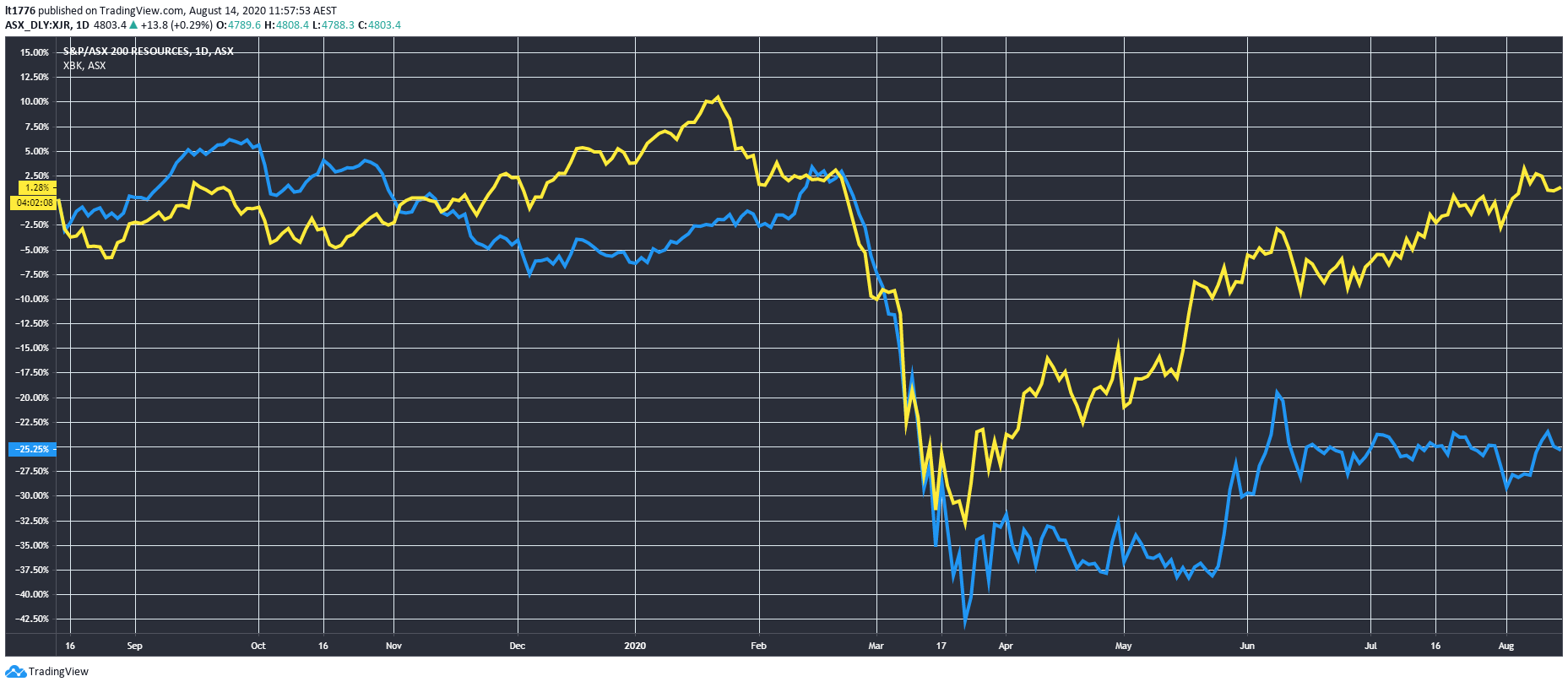

One camp makes a good point by highlighting the chart below:

|

|

|

Source: tradingview.com |

The blue line is the S&P/ASX 200 Banks Index [XBK] and the yellow line is the S&P/ASX 200 Resources Index [XJR].

You can see the banks clearly lagging behind resources.

This is because the banks are a catchment for macroeconomic sentiment which is depressed at the moment.

The negative headlines seem endless.

The reasoning here is that this discrepancy between the two sectors will eventually correct.

Australia has always relied on a combination of mining and banks.

And eventually the banks will pick up as we extricate ourselves from the pandemic.

Meanwhile, the risks emanating from China could hurt resources in the long run.

Now if I wasn’t aware of the huge undercurrents of change in our monetary system, I’d be tempted to agree with this view.

So, here’s the way I see things.

Argument #2: Technology is coming for traditional banking

Whether it’s an old technology like gold or a new technology like bitcoin, both are signalling that things can’t remain the same.

The two are flying up the charts and this points to the decay of trust in fiat.

And I think there is a third technology to consider — a central bank-backed digital currency (CBDC).

This from CoinDesk on Thursday:

‘Federal Reserve Board Governor Lael Brainard said the U.S. central bank has been testing [distributed ledger technology] DLT over the past several years to study what a digital currency might do to the existing payments ecosystem, monetary policy, financial stability and the banking sector…’

Continuing:

‘To enhance the Federal Reserve’s understanding of digital currencies, the Federal Reserve Bank of Boston is collaborating with researchers at the Massachusetts Institute of Technology in a multiyear effort to build and test a hypothetical digital currency oriented to central bank uses.’

Brainard also pointed out:

‘China has moved ahead rapidly on its version of a CBDC.’

So, there’s a race on at the moment to push this technology forward.

And how would things look if a CBDC were rolled out?

Well, the current fiat system relies on banks middle-manning funds.

The government issues money and the banks take a clip as they distribute it to citizens.

A CBDC could conceivably end this relationship.

A government bank account would strip the banks of their power.

At the same time, I don’t think people would take kindly to this new arrangement.

People don’t like banks, but distrust government even more.

Which means whether it’s the no-counterparty gold or the trust machine that is crypto, the demand for stores of value that cannot be manipulated is only set to grow.

How long will the Big Four Banks survive for?

So, for your buy and hold strategy on ASX bank stocks to work — the banks need to still exist in 10 years.

It sounds like a bold claim, but I don’t think the Big Four are going to survive the next decade.

I believe we will go from four big banks to say 50 smaller fintech-style banks…to eventually none.

The Big Four could evolve into crypto-wealth managers or consultancy firms, or even a sort of techno-auditing service.

But whichever way things play out — decentralisation is coming.

And as result, ASX banks stocks are only cheap if you ignore the writing on the wall for traditional banking.

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: Four Well-Positioned Small-Cap Stocks – These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.