Dear Reader,

Will the economy — and life as we know it — ever return to ‘normal’?

Don’t bet on it, says Jim Rickards.

In today’s edition of The Daily Reckoning Australia, Jim explains why we’re a long way off normal. In fact, he warns things could get worse — far worse — before they get better.

| Until next time, |

| Shae Russell, |

The Great Depression of 2020 Has Just Started

In the US, most people have a sense of where the economy is at. But they have not yet had time to make much sense of it, or consider the implications. Above all, no one knows what happens next.

Will the economy reopen soon? Or will the lockdown drag on, at least in some places? And most importantly, will a ‘second wave’ of COVID-19 strike the country and the world later this year? Will that second wave be even more lethal than the peak wave we’ve just lived through?

That’s exactly what happened in the Spanish flu pandemic of 1918–19. A deadly first wave of infections struck from around March to June 1918. It went around the world and killed millions. But that wave was almost mild compared to the ‘second wave’ that struck in October 1918.

The second wave could be worse

The second wave of Spanish flu was so lethal that dead bodies were piled like cord wood in the streets of major cities. Will we have a second wave of COVID-19 infections? And, even if we don’t, will the economy bounce back in the months ahead?

As for the second wave of COVID-19, almost no one wants to talk about it publicly. Very few even understand what it means. (It’s not exactly the same virus. It’s caused by a mutation that makes the original virus even more lethal.)

History and science say we should expect it, but almost no one is making preparations. Most assume we’ll be past the plague by the end of summer in the Northern Hemisphere. Let’s hope they’re right. It remains to be seen if they are.

As for a rapid economic bounce-back, the White House happy-talk brigade say that all will be well by late summer. They talk about ‘pent-up demand’ that will come roaring back to restore jobs and business profits in a matter of months. They talk about a soaring economy by Election Day.

Don’t bet on it.

Pent-up failure, more like it

In the first place, many of the businesses that closed for the lockdown will never reopen. It’s not a question of lockdown orders. They’re broke and out of business. The owners may start a new business someday, somewhere, but the old business is gone.

Big business is not immune. We’ve already seen bankruptcies by household names like JC Penney, J Crew, Neiman Marcus, Pier 1 Imports, and Hertz. They won’t be the only ones. You can expect at least one major bankruptcy coming from the airline sector. Even giants like Boeing are not immune.

Bankruptcy does not mean the company goes away. Some do (like Pier 1) because they are put into liquidation. But many companies are put into ‘reorganisation’-style bankruptcies.

This generally means equity holders get wiped out, bond holders get a reduced claim (with some equity in lieu of principal), some stores or locations are shut, some assets are sold, leases are broken or renegotiated, and workers are rehired in smaller numbers with reductions in pay and benefits. The company survives, but many landlords, stockholders and employees do not — their claims or jobs are wiped out.

‘Save’ has two definitions, for a reason

Americans may not understand the dynamics of a second wave of infections, but they understand bankruptcy. They may be affected by it directly (if your company went bankrupt or your stock investment went to zero, you understand it all too well).

But, even if not affected directly, Americans know that they may be next. Maybe they’ll lose a job next month or maybe their stock portfolio will take a beating as other companies go under.

So, Americans do what makes most sense under the circumstances. They save more and spend less. If you’re not sure if you’ll have a job soon, or if your portfolio is evaporating in front of your eyes, you want to make sure you have cash to tide you over or preserve what’s left of your wealth.

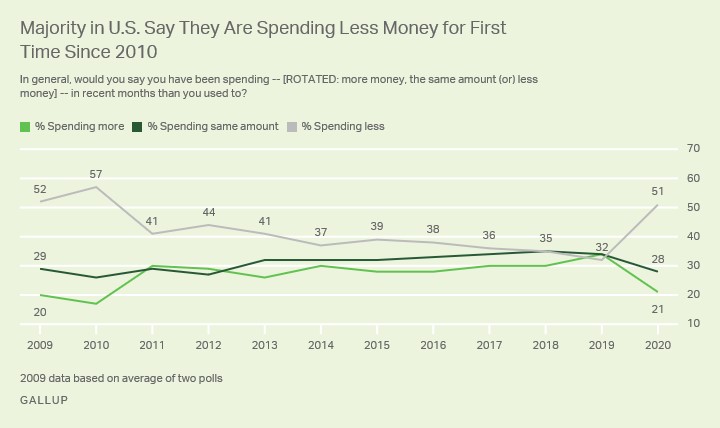

The chart below shows this trend playing out in real time. The grey line shows the number of people who say they are ‘spending less’. That number has jumped from 32% to 51% in just a few months.

The light green line shows the number of people who say they are ‘spending more’. That number has plunged from 32% to 21%. The spread between ‘spending less’ and ‘spending more’ has widened to 30 percentage points, the widest spread since the aftermath of the 2008 crisis.

Americans are spending less and saving more

|

|

| Source: Gallup Polling |

It’s also interesting to note that this trend towards more saving and less spending began in late 2019, even before the pandemic. It’s as if Americans saw it coming. Maybe some of them did.

It’s probably more reflective of the fact that the economy was weak even before the pandemic. What that means is that the spread should widen now. Savings will soar and spending will contract sharply.

Saving may be a smart strategy for individual citizens worried about jobs and their portfolios. But it’s a disaster for economic recovery, at least in the short run.

There will be no sharp, fast bounce back for the economy. Growth will emerge, but it will be slow. The recovery will be long, hard, and painful for affected individuals, entrepreneurs, and jobseekers.

[conversion type=”in_post”]

But depressions are different

The difference between a depression and a recession is not just measured in consecutive quarters of declining GDP. That’s an important measure, but it’s not the whole story.

Recessions involve consecutive quarters of declining GDP. They are generally short in duration (no recession since the Great Depression has lasted more than 18 months; most lasted less than 12 months, although the Great Recession of 2007–09 lasted 18 months).

The first Great Depression (1929–40) lasted 12 years. But it was not a period of continuous declining GDP. There were two technical recessions within the Great Depression (1929–33 and 1937–38). The period from 1933–37 was one of strong growth.

The problem was that the 1929–33 collapse was so severe, and unemployment was so high, that even a period of strong growth did not get the economy back to where it was.

In fact, the stock market did not reach its 1929 level again until 1954. If you were waiting to ‘make your money back’ after 1929, you had to wait 25 years. That’s a depression.

The New Depression

Now we are in the Great Depression of 2020. Some of the initial data is as bad as the first Great Depression. Unemployment in 2020 is set to exceed the 24.9% level reached in 1933.

Between 1929 and 1932, the stock market fell 89.2%. So far in this depression, US stocks fell 27% between 12 February and 23 March, but staged a comeback and are now down just 17% from the 12 February peak.

That’s not unusual. The stock decline from 1929 to 1932 was punctuated with numerous ‘bear market rallies’. It did not go down in a straight line. But it did go down, despite the rallies.

The Great Depression of 2020 has just started. The big-name bankruptcies are popping up almost daily. There’s every reason to believe stocks will end up much lower before all is said and done.

Above all, there is uncertainty. My expectation is that economic growth will grind lower before turning around. When it does turn around, the recovery will be slow and uneven. We may not reach 2019 levels of output again until 2022, or later.

| Regards, |

|

| Jim Rickards, |

Comments