In 1908, Olympic gold medals were made of 100% gold.

Today, an athlete who wins in Paris will find their ‘gold’ medal only has 1% gold in it.

I’m sure this says something about society’s progress over the last century, though I’m not entirely sure what.

| |

| Source: Tuur Demeester |

Perhaps it’s a reflection of the general decline in quality and craftsmanship over the past century of consumerism?

I mean, things used to be made so well that people would pass furniture down through the generations.

Now, everyone goes to Ikea every year or two!

More likely, the gold medals just got too expensive to give out willy nilly.

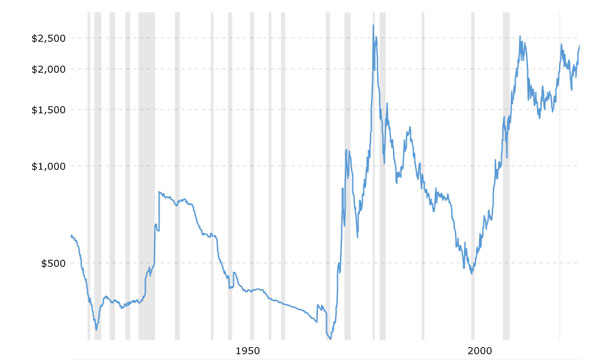

I mean, gold was trading at US$377 100 years ago, and today it’s at US$2,326.

| |

| Source: Macro Trends |

So, for a medal weighing 529 grams, you’re talking US$41,000 per gold medal winner.

[Editor’s note: My mate Brian Chu thinks the price of gold medals (the 1908 ones, anyway!) could be set to soar soon. His family’s private gold fund is set up to make the most of it, and he wants to share his stock selection strategy with you. Go here to find out more…]

That adds up!

Of course, back in 1908, money was also backed by gold, so in a way, a medal was a payment, as well as a trophy.

Things have changed…

Today, athletes earn paper money elsewhere from sponsorships, endorsements, government grants, wages, etc.

And money itself is no longer backed by gold.

There is no intrinsic value to today’s money, and it can be printed at will.

This fact has become all too clear to most over these past two inflation-fuelled years.

The never-ending supply of money is the primary reason everything has got so expensive.

You need to turn your thinking on its head.

As I pointed out last week, what’s really happening is that the value of money has decreased.

But this constant — and now rapid — devaluation in money isn’t just a problem for you and me.

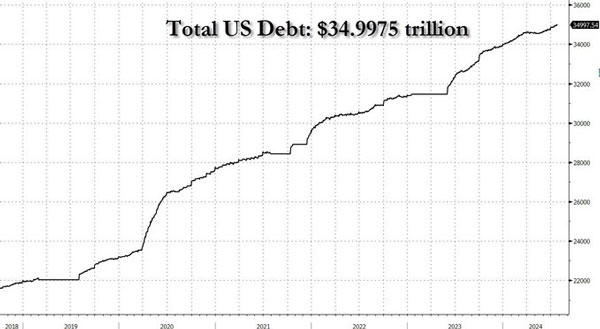

It’s also a huge problem for nation-states who, to be blunt, have debt loads they’ll never be able to get back under control.

| |

| Source: Zero Hedge |

What can they do?

Well, on Saturday in Nashville, a famed dealmaker presented his solution for the US to overcome this massive problem.

It’s a solution you can do yourself now.

And even better, you can front-run the increasing possibility of many other nation-states rushing to buy this asset in 2025.

Let me explain…

Orange man endorses orange coin

Republican Presidential nominee Donald Trump presented at the 2024 Bitcoin Conference in Nashville on Saturday.

He was the second Presidential contender to speak at the three day event.

The first was independent candidate Robert F. Kennedy Jr.

The fact that two serious Presidential hopefuls now feel the need to attend such events shows how large the demographic base behind Bitcoin (and crypto) has become in the US.

But it was what both candidates said that will really get people talking.

First up on Friday was Robert Kennedy.

He pledged four huge things:

- ‘I will sign an executive order directing the US Treasury to purchase 550 Bitcoin daily until the US has built a reserve of at least 4 million Bitcoin’

- ‘I [will] sign an executive order … directing the DOJ and the US Marshals to transfer the approx. 200K Bitcoin held by the US government to the US Treasury, where it will be held as a strategic asset’

- ‘I will sign also an executive order directing the IRS to issue public guidelines that all transactions between Bitcoin and the US Dollar are unreportable transactions. And, by extension, non-taxable’

- ‘I will also sign an executive order directing the IRS to treat Bitcoin as an eligible asset for 1031 exchange into real property’

As a Bitcoiner, you couldn’t really ask for more.

But let’s be honest for a second…

Kennedy hasn’t really got a chance of winning the Presidential race, so such promises are easy to make.

He’ll never have to keep them!

Of more note, was what Trump had to say the following day.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

The Trump speech was a bit more wishy-washy and lighter on specific details.

Some Bitcoiners even called it ‘disappointing’.

But I think that was more a case of people having unrealistic expectations.

When you dig into what he said, there was a lot to like.

He made noises about the US becoming the crypto capital of the world, said he would support the Bitcoin mining industry and would end financial sanctions on banks that take part in the crypto economy.

He also said he thinks Bitcoin will overtake the value of the gold market (14 times higher from here).

And he noted the root cause of the US’s currency problems, saying:

‘The danger to our currency does not come from Bitcoin, it comes from Washington DC.’

But most importantly, he repeated Kennedy’s pledge to set up a strategic Bitcoin reserve.

This is the key point for you to understand today…

Strategic reserve plans gather pace

Cynthia Lummis, the Republican Senator for Wyoming, added the meat to the bones of Trump’s words in a less well attended presentation later in the day.

She presented a proposal she will put before the Senate that will formally establish a national Bitcoin strategic reserve.

She said:

‘Establishing a strategic Bitcoin reserve would firmly secure the dollar’s position as the world’s reserve currency into the 21st century and ensure we remain the world leader in financial innovation.

‘Families across Wyoming and the U.S. are struggling to keep up with soaring inflation rates and record-breaking costs while our national debt reaches unprecedented levels; now more than ever, we need to create a brighter future for generations of Americans by diversifying into Bitcoin and securing our economic future.’

The reserve would look to hold 1 million Bitcoin (or 5% of the total supply) over 5 years.

The implications for such a proposal — if it ever got up — on the price of Bitcoin would be remarkable.

As crypto fund manager Alistair Milne tweeted:

| |

| Source: x.com |

There was a lot more going on behind the scenes at the conference than I have time to go into today.

There were US pension funds adding Bitcoin to their default strategies, there were more companies adding Bitcoin to their balance sheets, and there was even one US state governor saying things like this:

| |

| Source: x.com |

This juggernaut is only gathering steam.

We all know the supply side of Bitcoin is mathematically constrained. So, with new sources of demand coming in from all over the place, the only thing that can react is price.

On that note…

Two price predictions

To finish, I’ll leave you with two financial predictions from the conference.

The first was from the well-known Bitcoin bull, Michael Saylor.

He shared this 21-year forecast:

| |

| Source: Michael Saylor (MicroStrategy) |

His BASE CASE is U$13 million per Bitcoin!

I won’t get into the complexities of his maths, but it’s primarily based on the growth rate of M2 money (which is growing at 9% per annum) and Bitcoin making up a higher percentage of global assets over time.

The other prediction came from large global fund manager Van Eck.

Their base case was a bit more subdued, at a ‘mere’ US$2.9 million per Bitcoin (we’re at US$67,000 as I type) by 2050.

They explained their reasoning:

‘VanEck’s base case scenario posits that Bitcoin could handle 10% of the world’s international trade and 5% of domestic trade by 2050. The firm also predicted that central banks will hold 2.5% of their assets in BTC.

‘This scenario, based on global growth projections and the velocity of money, suggests a potential Bitcoin price of $2.9 million, resulting in a total market capitalization of $61 trillion.’

This was their base case but their more bullish case came back with a staggering prediction of US$52.4 million per Bitcoin!

Interestingly, at the conference, the CEO of Van Eck revealed he personally had more than 30% of his net wealth in Bitcoin:

| |

| Source: x.com |

Whatever happens next, three things are certain…

Number one: The value of the money in your pocket will only go down over time.

Number two: Governments will continue to add to the national debt. The US alone adds US$1 trillion of new debt every 100 days. There’s no stopping the debt spiral the US — and all major countries — are in.

Number three: There will only ever be 21 million Bitcoins. There’s not enough to go around if every millionaire in the world decides they want a whole one each, never mind if nation-states buy in too.

Time is running out for you to set up your own strategic Bitcoin reserve.

And amazingly, you can still front-run the US Government.

Maybe not for long…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

Comments