Last week, copper futures on the New York COMEX exchange swelled 11%.

So, you’d expect copper miners to follow, right?

In some instances, they’ve done okay…

A copper developer in the portfolio for my paid readership group was up over 10% last week, which aligns with the broader move in the futures market.

But one of our producers was down 4%.

Meanwhile, copper miners broadly, tracked by the Copper Miners ETF [ASX: WIRE], were down around 1.3% last week.

Broadly speaking, it means copper stocks aren’t playing ball with the futures market.

So, should investors be concerned?

Mining Memo’s Take

There’s no denying it: tariffs are having a direct impact on copper prices.

Evidence began earlier this year, when copper futures surged to near all-time highs during the first round of Trump’s tariff jingle.

And that’s happening again after Trump imposed a 50% tariff hike on copper imports last week.

So, will this price surge be temporary? Or is there something more ‘fundamental’ underpinning copper prices?

To answer that, it’s essential to understand that copper prices are tracked on different markets (or exchanges).

By looking at markets that aren’t impacted (as much) by tariffs, we can reveal whether this is the only story underpinning copper.

First up, the New York COMEX.

This is the benchmark exchange for copper trading and is what most news outlets use to quote copper prices.

However, given its location in the US, it’s also the exchange most impacted by Trump’s tariff agenda.

As traders ‘front-run’ tariff deadlines, copper imports into the US surge.

That pushes up the local price of copper compared to other important markets, such as those in London or Shanghai.

To show you what I mean…

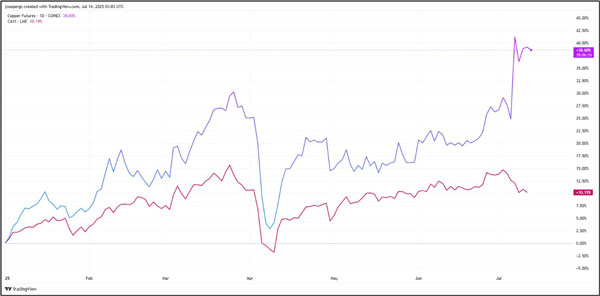

Year-to-date, copper futures on the COMEX are up 38%, as shown in purple below. Meanwhile, the London Metal Exchange (LME), shown as red, is only up 10%:

| |

| Source: Trading View |

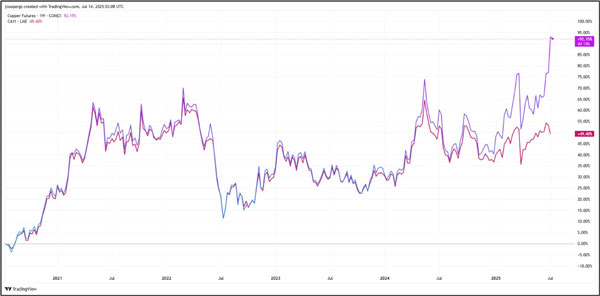

But as you can see below, it was only since the issue of tariffs began to emerge (late last year) that the two exchanges began to diverge:

| |

| Source: Trading View |

So, what’s the key takeaway here?

Copper miners appear to be more aligned with what’s happening on the LME, an exchange that’s less impacted by the ‘tariff effect.’

Should Investors be bracing for copper falls once tariff deadlines hit?

This is the all-important question!

Once tariffs come into place, traders will stop front-running imports of copper.

That will slow purchases and, of course, pressure local prices on the COMEX exchange.

However, while it has underperformed, copper’s price action on the LME remains bullish.

Today, LME copper prices are trading just below $10,000 per tonne.

Copper on the LME reached just over $9,800, around the levels from the peak of the last mining cycle, in 2011.

Given that the price action is still strong on the LME, I think there’s more to the copper story than tariffs.

Fundamental drivers that could drive copper prices higher beyond the ‘Trump tariff effect.’

I’ve delved into these many times at Mining Memo:

Falling head grades at the world’s largest copper mines, especially in Chile.

As well as falling production among the world’s largest copper mines due to strikes, drought, and mine nationalisation, forcing mine closures.

But a lack of investment in new supply, in things like exploration and new mine development is probably going to be the most important factor.

So, whether you’re looking at the COMEX, the LME, or copper producers directly…

The price action remains bullish. And that supports the fundamental view, too.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments