In today’s Money Morning…young, dumb, and filthy rich…sticking it to the man…with the biggest loser of all, of course, being the hedge funds…and more…

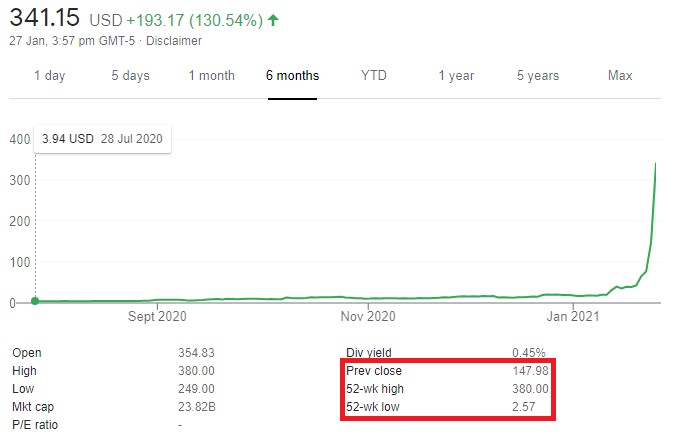

Before I say anything, I want you to look at this chart:

|

|

|

Source: Google Finance |

Because even without knowing what stock it is, you can see the insanity of it. A company that went from trading at US$3.94 just six months ago, to US$341.15 at time of writing.

That’s an 8,558% gain!

And, as you can no doubt see, a lot of that gain has come in just the last week. Practically sending the line vertical.

So, what stock is it?

Well, if you’ve been following US stock market news you may already know. This stock is GameStop Corp [NYSE:GME]. A company that operates retail stores that sell video games and video game consoles primarily.

To provide some context, like many retailers, GameStop was hit hard in 2020. Forced to close stores — both temporarily and for good — while enduring weaker sales than usual.

A sign that led some to believe that it may be headed the way of Blockbuster — a dying business that was being replaced by digital sales channels.

At least, that was the narrative for short sellers, and they piled in on it. Pushing the short interest in this stock to 140.3% at the end of 2020!

A setup for what has become arguably the greatest short squeeze ever.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

Young, dumb, and filthy rich

See, this huge short interest on GameStop attracted the attention of an internet forum.

A group on the website ‘reddit’ known as ‘Wall Street Bets’ picked up on this story. With one user who goes by the name ‘Jeffamazon’ writing about the potential of GameStop back in September. Creating a post that was titled: ‘The REAL Greatest Short Burn of the Century’.

Here is just a sample of what Jeffamazon had to say about the trade:

‘Sup gamblers. Feel bad about missing the gain train on TSLA? Fear not — something much greater and stupider is here.

‘You know Citadel? The MM that took all our money today? Well now we finally won’t be at the mercy of the MMs. Instead, we’re going to temporarily join forces with the Galactic Empire and hijack the death star.

‘Our choice of weapon… $GME.’

What this should immediately highlight is just how speculative, crass, and abrasive Wall Street Bets is. That is, if the name didn’t already give it away…

But, more importantly, most of the users are very much self-aware.

Spend any time looking at some of the posts in the group and you’ll figure that out very quickly. With plenty of posts showcasing individuals’ huge stock losses. Often referred to as ‘loss porn’. Which other users then laugh and comment about.

Occasionally though, some of them will get lucky. With one of their stock market ‘bets’ paying off. Which is the whole point of the group. Especially as it continues to grow.

While Wall Street Bets has been around since 2012, 2020 was a breakout year. With plenty of people finding themselves stuck at home amidst the pandemic. And whether it was out of boredom or curiosity, a lot of them turned to the stock market.

A cohort that quickly joined amidst one of the greatest bull markets we’ve seen in years. Right after a sizeable correction. And once these young traders found Wall Street Bets, things went into overdrive…

Sticking it to the man

From the brief snippet of Jeffamazon’s post, you can see he has a clear disdain for institutional investors. Referring to Citadel — a prominent hedge fund — as the market maker (MM) that took their money.

See, a lot of the hardcore Wall Street Bets userbase believes hedge funds and other ‘market makers’ are rigging the system in their favour. Using their huge sums of capital, as well as the media and other tools to swing trades in their favour.

And while they can certainly get a little extreme in their views, they are right to an extent.

No matter how astute a retail investor may be, large funds or active investors can quickly ruin a stock you may have a position in. Simply by throwing around more capital than your average investor can even dream about.

So, Jeffamazon and the rest of Wall Street Bets — along with an influx of new users — decided to fight back. They went long on GameStop to burn the oversaturated short sellers.

It wasn’t strictly organised, or even necessarily rational, but it has been damn effective. As the chart at the start shows. Burning short sellers for billions. With the biggest loser of all, of course, being the hedge funds.

Melvin Capital, for instance, is down 30% year-to-date. Relying on Steve Cohen of Point72 and Ken Griffin of Citadel to top them up with a fresh round of US$2.75 billion.

In effect, they’re declaring war on Wall Street Bets. Likely looking to hold or possibly even increase their short positions. As of yesterday, the short interest was still at a staggering 139%.

And while no one knows how all of this will end, it is pretty clear that someone is going to lose…badly.

For investors simply watching from the outside though, like you and I, it is a fascinating insight. One that shows just how irrational both retail and institutional investors can be. As well as the absurdity that markets can offer up, if people are stubborn enough.

More importantly though, it is a fantastic reminder as to why you should care about small-cap stocks.

Because unlike mid- or large-cap stocks, you’re rarely going to have to deal with this kind of institutional stranglehold. They can’t afford to devote billions to stocks that only carry market caps in the hundreds or even tens of millions.

Don’t get me wrong, small-caps still have plenty of other risks. But, at the very least you won’t have to take on the ‘market makers’.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.