In today’s Money Morning…a rocky road, but not insurmountable…there is no barrier…the hard part is simply deciding which trend to follow…and more…

When it comes to macroeconomic analysis, bonds have always been the market to watch.

Expert traders and armchair economists alike always love to talk about treasury yields. But they especially like to talk about them when the yield curve inverts…

As for why, well it is because this phenomenon is seen as a precursor to recession.

Out of the 28 times the US treasury yield curve has inverted, 22 instances led to a recession. So with that very curve inverting as we speak, the market alarmists are working themselves into a frenzy.

Here’s the thing, though, while it is always astute to be aware of history and its patterns, it is foolish to always draw the same conclusions. As the data already shows, not every time the yield curve inverts do we have to endure a recession.

Back in 2019, we saw this very scenario play out.

US 10-year yields crumbled and shot below the return of two-year yields. Then, as we’re seeing now, investors got all riled up about an oncoming recession.

Funnily enough, we didn’t see a true US recession, but we did get the COVID market crash. It was an event that was truly unforeseeable in the most literal terms possible. And, as we all know, the markets delivered some of the best returns in the months that followed.

So what sort of outcome should we expect this time around?

A rocky road, but not insurmountable

First of all, before we delve into the possibility of a recession or not, let’s talk about market outcomes. After all, the entire reason I wanted to talk about this today is to shed some positive light for investors like yourself.

I truly do think that the ‘bearish narrative’ has been overblown.

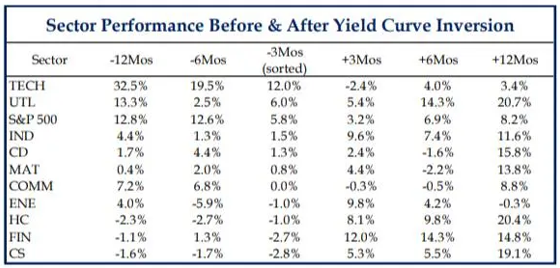

Sure, it’s a volatile market right now, but that doesn’t mean good returns still can’t be found. Take a look at this data showcasing the average returns of US stocks by sector following a yield curve inversion, for instance:

|

|

| Source: Financial Times |

As you can see, almost every sector other than technology stocks performs better in the 12 months following an inversion. It’s proof that investors need to rethink where they invest rather than cash out entirely.

Having said that, no matter what way someone may try to spin it, a recession would be an extreme dampener on these figures. I’m not going to try and sell you a lie.

Like I’ve been saying, though, I don’t think we should count on a recession.

As for why, well, it all has to do with the Fed…as it so often does.

There is no barrier

Going back to the 2019 inversion again, I want to share a quote from former Fed Chair Alan Greenspan.

In an apparent phone interview with Bloomberg, he said the following:

‘There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, beside being a certain level.’

This is the point that matters most in our post-2008 world. Because Greenspan is right, zero has no meaning in an economy that is run by a central bank that is happy to rely on QE.

As one of Bank of America’s economics team posits:

‘The 10-year term premium has averaged about 1.5 per cent over the postwar period. Hence, in the past it took a very tight Fed and high fears of recession to trigger a yield curve inversion. Specifically, the market had to expect the future funds rate to average 150bp below the current funds rate to invert. The Fed only cuts that much in a recession. No wonder inversion was a good predictor of recessions.

‘Today, the long end of the US yield curve is heavily distorted. The Fed has deliberately driven down the long end of the yield curve with its asset buying programme. At the same time, very low bond yields outside the US exert downward pressure on US yields. The upshot is that the term premium has now dropped into negative territory. The yield curve can now invert even if the market expects no rate cuts from the Fed.’

This is precisely why I believe too many Wall Street veterans are placing too much trust in the yield curve. It is no longer a metric that can be trusted.

Like many other tools and instruments, it has been corrupted by the influence of the Fed. An indicator that is now just as reliable as the monetary policy that has influenced it. That is to say, not reliable at all…

For that reason, I wouldn’t worry all that much about the yield curve right now.

Instead, what I would recommend is spending more time thinking about which sectors are flourishing amidst all this. Because while the threat of more volatility is very real, some of the best buying opportunities can be found in times like these.

The hard part is simply deciding which trend to follow.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.